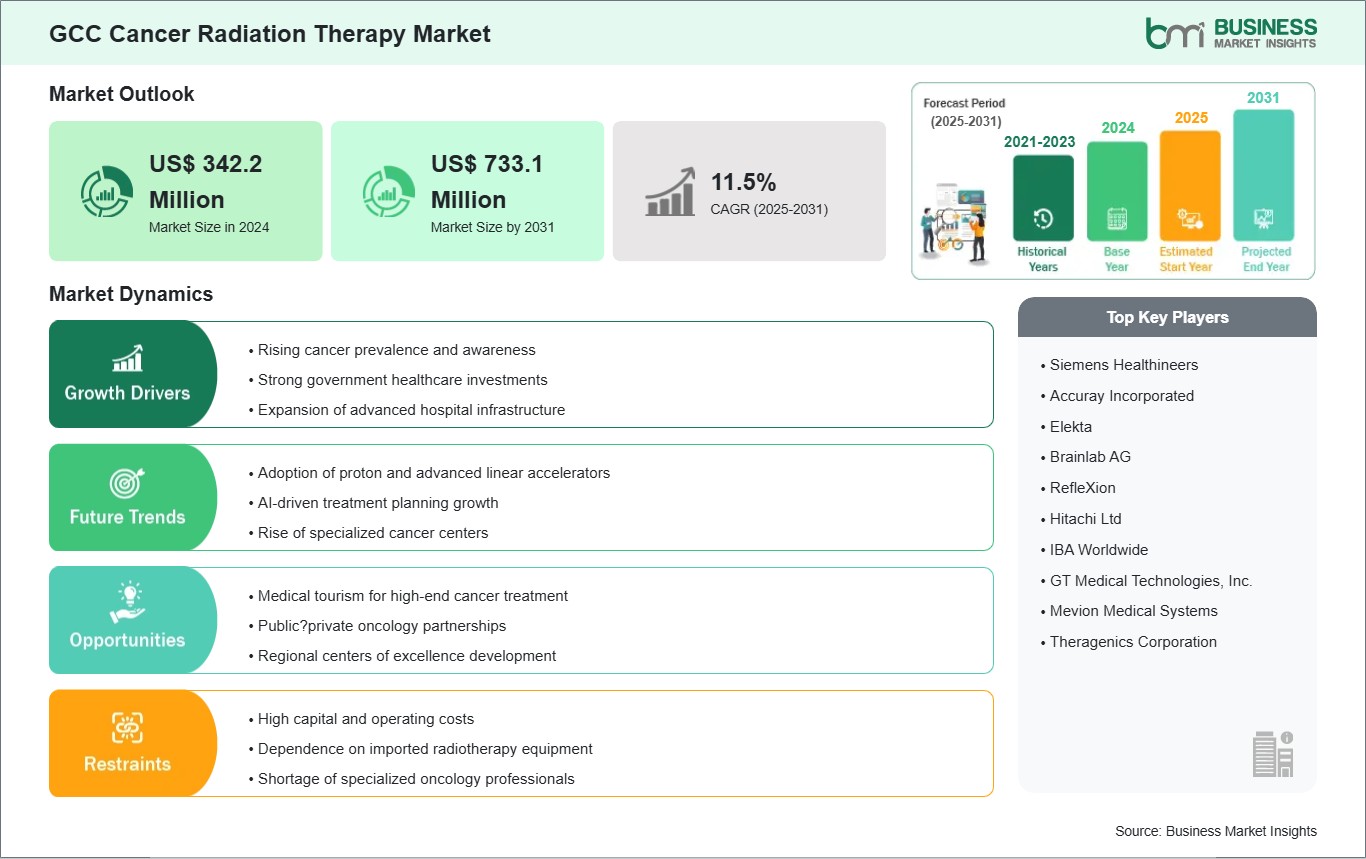

The GCC cancer radiation therapy market size is expected to reach US$ 733.1 million by 2031 from US$ 342.2 million in 2024. The market is estimated to record a CAGR of 11.5% from 2025 to 2031.

The cancer radiation therapy market in the GCC is evolving rapidly, supported by large‑scale healthcare transformation programs and strong government initiatives aimed at expanding specialized oncology services. Countries such as Saudi Arabia, the UAE, and Qatar are investing heavily in modern radiotherapy infrastructure, integrating advanced treatment technologies, and strengthening multidisciplinary cancer care pathways. These investments are aligned with national health visions that emphasize early diagnosis, improved patient navigation, and the establishment of comprehensive cancer centers capable of handling complex cases. The region's growing focus on medical tourism, especially for high‑technology oncology procedures, reinforces the demand for precision‑based radiotherapy.

Despite this momentum, several structural restraints remain. Dependence on expatriate clinical talent, limited regional training pipelines, and fragmented access outside major metropolitan hubs create disparities in care availability. Procurement cycles can be lengthy due to regulatory and budgeting complexities, slowing the adoption of next‑generation systems. Nonetheless, the GCC presents substantial opportunities for long‑term growth. Artificial intelligence tools, adaptive therapy platforms, cloud‑enabled planning ecosystems, and fully digitalized oncology workflows can help optimize throughput, standardize protocols, and reduce reliance on external expertise. As GCC countries continue reshaping their healthcare systems toward advanced, technology‑driven oncology models, radiotherapy is set to become a central pillar of modern cancer treatment strategies across the region.

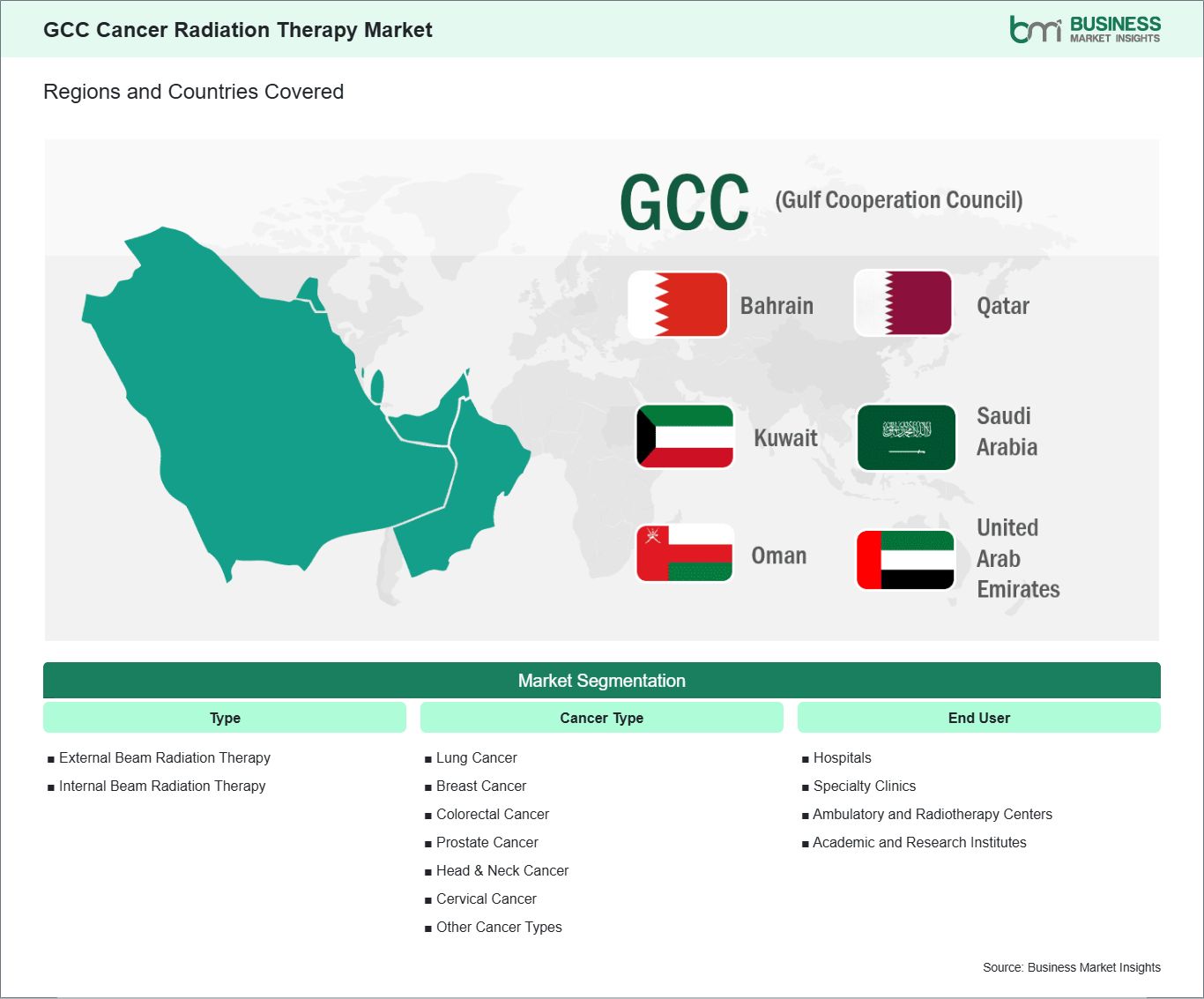

Key segments that contributed to the derivation of the GCC cancer radiation therapy market analysis are type, cancer type, and end user.

Cancer incidence in the GCC (Gulf Cooperation Council) countries including Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, and Oman is rising due to aging populations, urbanization, and lifestyle-related risk factors such as obesity, diabetes, and smoking. Breast, colorectal, and thyroid cancers are among the most commonly diagnosed, with prostate and lung cancers also showing increasing trends. Early detection programs are improving, leading to higher numbers of patients eligible for radiation therapy.

Healthcare systems in the GCC are heavily investing in oncology infrastructure, with advanced cancer centers established in major cities such as Riyadh, Dubai, and Doha. External beam radiation therapy is widely available and is used to treat solid tumors such as breast and colorectal cancers, while internal beam therapy is adopted for prostate and gynecological cancers. These expansions are aimed at addressing the growing cancer burden and ensuring comprehensive care.

Government initiatives and private-sector investments are boosting diagnostic capabilities and treatment capacity across the region. Referral networks are strengthening, enabling timely access to radiation therapy for both early- and late-stage cancer patients. The increasing prevalence of cancer remains a key driver for the GCC cancer radiation therapy market, fueling demand for both infrastructure and advanced treatment technologies.

Personalized medicine is emerging as a significant focus in the GCC, driven by patient demand for tailored treatment and government support for advanced healthcare technologies. Radiation therapy is delivered based on individual tumor characteristics, location, and patient-specific factors, improving treatment outcomes while minimizing side effects. Hospitals in the region are adopting image-guided and intensity-modulated radiation therapy to enhance precision.

External beam radiation therapy is customized using advanced planning tools, while internal beam therapy, particularly for prostate and gynecological cancers, is delivered with patient-specific dosing. The integration of AI-driven software and modern imaging is allowing clinicians to optimize treatment schedules and achieve better outcomes. These technologies are being implemented in leading cancer centers in the UAE, Saudi Arabia, and Qatar.

Collaboration with international research institutes and technology providers is helping the GCC region build expertise in personalized oncology care. Patients are becoming more aware of treatment options and are actively seeking therapies with reduced side effects and higher efficacy. This rising demand for personalized medicine presents substantial opportunities for equipment manufacturers, software providers, and healthcare service companies in the GCC cancer radiation therapy market.

The GCC cancer radiation therapy market demonstrates steady growth, with size and share analysis highlighting evolving trends and competitive dynamics among key players. The report further examines subsegments categorized within type, cancer type, and end user, offering insights into their contribution to overall market performance.

By type, the external beam radiation therapy subsegment dominated the market in 2024. Due to its widespread availability, precision targeting, noninvasive nature, and effectiveness in treating diverse cancers, it is the preferred choice across global oncology practices.

Based on cancer type, the lung cancer subsegment dominated the market in 2024. Due to its high incidence, strong link with smoking and pollution, late‑stage diagnoses, and reliance on advanced radiation techniques, it is the most treated cancer type globally.

In terms of end user, the hospitals subsegment dominated the market in 2024. Hospitals dominated the market since they provide comprehensive cancer care, advanced radiation infrastructure, skilled oncologists, and integrated treatment pathways, making them the primary setting for delivering radiation therapy services.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 342.2 Million |

| Market Size by 2031 | US$ 733.1 Million |

| CAGR (2025 - 2031) | 11.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered | By Type

|

| Regions and Countries Covered | GCC

|

| Market leaders and key company profiles |

|

The "GCC Cancer Radiation Therapy Market Size and Forecast (2021 - 2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the GCC Cancer Radiation Therapy market report is divided into: Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, and Oman. Saudi Arabia held the largest share in 2024.

Saudi Arabia dominates the GCC cancer radiation therapy market due to its extensive healthcare transformation agenda, significant infrastructure investments, and rapidly expanding network of specialized cancer centers. The Kingdom has prioritized oncology within its national health vision, enabling the deployment of advanced radiotherapy technologies across major hospitals and dedicated cancer institutes. These facilities incorporate sophisticated treatment‑planning platforms, high‑precision imaging workflows, and modern linear accelerator technologies that support complex, protocol‑driven radiotherapy techniques. A defining strength of Saudi Arabia's leadership is its systematic approach to building a resilient oncology ecosystem. Large-scale government initiatives focus on enhancing clinical pathways, strengthening physics oversight, and integrating multidisciplinary tumor boards to ensure consistent, evidence‑based care. The Kingdom is also expanding its training capacity through partnerships with global academic institutions and medical technology companies, enabling local clinicians, physicists, and radiotherapy technologists to gain expertise in advanced workflows. Additionally, the country's strategic investment in digital health—ranging from integrated oncology records to AI-assisted planning and automated quality systems—positions it at the forefront of tech‑driven radiotherapy modernization in the region. As Saudi Arabia continues advancing its oncology capabilities, it stands as the key anchor shaping radiotherapy standards and innovation within the GCC.

The GCC Cancer Radiation Therapy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the GCC cancer radiation therapy market are:

The GCC Cancer Radiation Therapy Market is valued at US$ 342.2 Million in 2024, it is projected to reach US$ 733.1 Million by 2031.

As per our report GCC Cancer Radiation Therapy Market, the market size is valued at US$ 342.2 Million in 2024, projecting it to reach US$ 733.1 Million by 2031. This translates to a CAGR of approximately 11.5% during the forecast period.

The GCC Cancer Radiation Therapy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the GCC Cancer Radiation Therapy Market report:

The GCC Cancer Radiation Therapy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The GCC Cancer Radiation Therapy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the GCC Cancer Radiation Therapy Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)