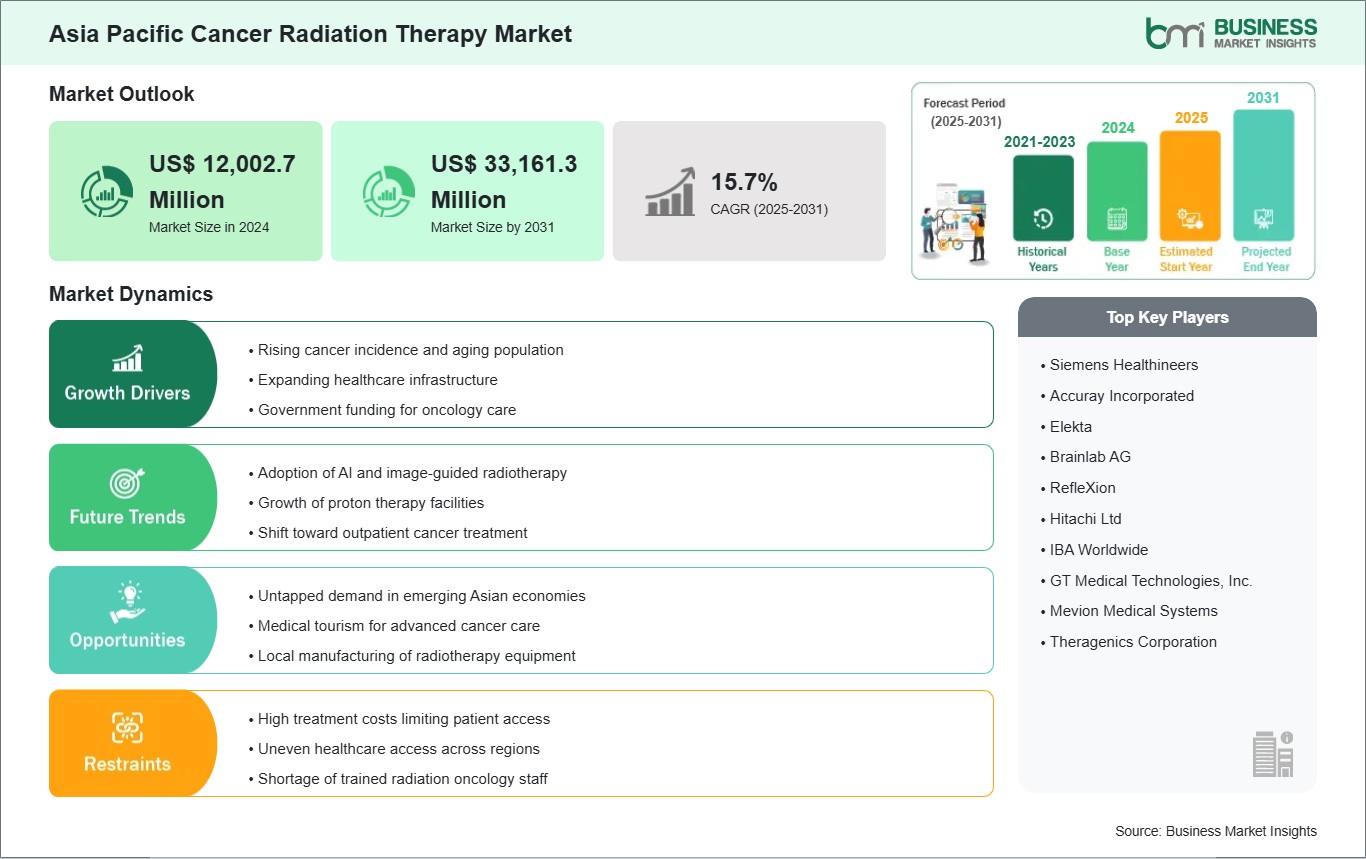

The Asia Pacific cancer radiation therapy market size is expected to reach US$ 33,161.3 million by 2031 from US$ 12,002.7 million in 2024. The market is estimated to record a CAGR of 15.7% from 2025 to 2031.

The cancer radiation therapy market in Asia Pacific is advancing rapidly as healthcare systems modernize and governments prioritize oncology capacity-building across both developed and emerging economies. Growth is driven by expanding cancer incidence, rising investment in clinical infrastructure, and increasing adoption of advanced treatment modalities across large markets such as China, Japan, India, Australia, and South Korea. Several countries are upgrading radiotherapy departments with image-guided systems, motion-management capabilities, and data-driven planning tools to support more precise and efficient treatments. Expanding medical tourism corridors, especially in East and Southeast Asia, also contribute to procedural demand as cross-border patients seek comprehensive, technology-intensive cancer care.

Despite this momentum, the region faces structural constraints. Uneven distribution of radiotherapy centers, particularly between urban hubs and remote areas, continues to limit access for large segments of the population. Workforce shortages—especially of medical physicists and dosimetrists—challenge uniform adoption of advanced techniques. In some markets, procurement complexity and lengthy reimbursement processes can delay technology refresh cycles. However, a compelling opportunity lies in the region's accelerating shift toward digital oncology. AI-based contouring, cloud-enabled planning, adaptive workflows, and remote QA solutions can help scale high-quality treatments even in resource-limited settings. As Asia Pacific continues investing in integrated, multidisciplinary cancer care, radiotherapy is positioned to play a central role in treatment expansion and technological innovation.

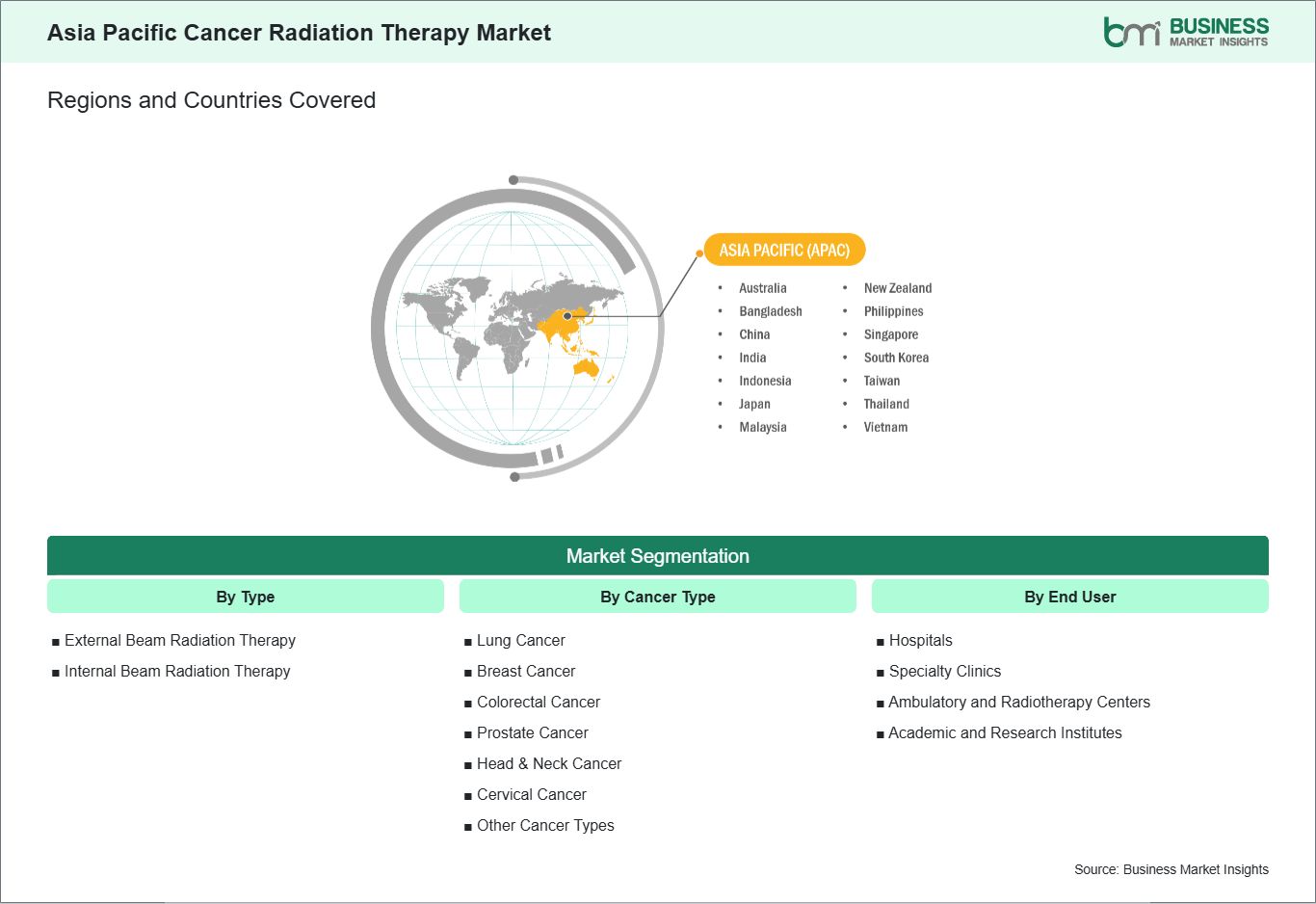

Key segments that contributed to the derivation of the Asia Pacific cancer radiation therapy market analysis are type, cancer type, and end user.

Cancer incidence is climbing across Asia Pacific as aging populations, environmental exposures, and shifting diets reshape disease patterns. Japan and South Korea face high burdens of colorectal and gastric cancers linked to aging and screening uptake, while China and India report rising lung and head‑and‑neck cancers associated with air pollution and tobacco use. Australia and New Zealand continue to experience elevated melanoma rates due to UV exposure, adding distinct radiotherapy needs alongside breast and prostate cancers prevalent in urban centers.

Expanding screening programs and improved imaging are increasing detection at stages where radiation therapy is integral to multimodal care. Australia's organized breast and colorectal screening, Japan's gastric cancer surveillance, and China's pilot lung cancer CT initiatives are channeling more patients into radiotherapy pathways. External beam radiation therapy remains the backbone across tertiary hubs in Sydney, Tokyo, and Shanghai, while brachytherapy is prioritized for gynecologic and prostate indications in India and China, reflecting local disease profiles and resource configurations.

Infrastructure growth is uneven, creating capacity pressures and access gaps between metropolitan and regional areas. High‑end linear accelerators and stereotactic platforms are concentrated in advanced economies, whereas populous countries such as Indonesia and India are scaling basic radiotherapy capacity to meet surging demand. Public investments, private hospital expansion, and cross‑border care—such as patients traveling to Singapore for complex cases—underscore how rising prevalence is a durable driver of the Asia Pacific cancer radiation therapy market.

Personalized oncology is accelerating across Asia Pacific, propelled by genomics, precision imaging, and data‑driven planning. Japan and South Korea integrate molecular profiling into treatment decisions, enabling radiotherapy to be tailored to tumor biology and radio-sensitivity. Australia's multidisciplinary tumor boards routinely combine PET/CT and MRI for adaptive planning, while India's leading centers are adopting contouring standardization and dose‑painting strategies to align with diverse tumor presentations.

Advanced technologies are widening the personalization toolkit. Intensity‑modulated and image‑guided radiotherapy are now standard in major urban hospitals, with stereotactic body radiotherapy used for oligometastatic disease in Australia and Korea. Proton therapy—available in Japan, China, and Australia—offers organ‑sparing options for pediatric, head‑and‑neck, and thoracic tumors, and AI‑assisted planning is emerging in Singapore and Japan to refine dose distributions and reduce variability across clinicians.

Policy and reimbursement shifts are reinforcing the move toward individualized care. Australia's public funding for advanced radiotherapy techniques, Japan's coverage for select proton indications, and China's tiered reimbursement pilots are encouraging the adoption of precision platforms. Patients are increasingly seeking shorter, hypofractionated courses with fewer side effects, and regional training collaborations are building expertise in adaptive workflows. These trends create a strong opportunity for vendors and providers to deliver integrated, patient‑specific radiation therapy solutions tailored to the heterogeneity of Asia Pacific market.

The Asia Paific cancer radiation therapy market demonstrates steady growth, with size and share analysis highlighting evolving trends and competitive dynamics among key players. The report further examines subsegments categorized within type, cancer type, and end user, offering insights into their contribution to overall market performance.

By type, the external beam radiation therapy subsegment dominated the market in 2024. Due to its widespread availability, precision targeting, noninvasive nature, and effectiveness in treating diverse cancers, it is the preferred choice across global oncology practices.

Based on cancer type, the lung cancer subsegment dominated the market in 2024. Due to its high incidence, strong link with smoking and pollution, late‑stage diagnoses, and reliance on advanced radiation techniques, it is the most treated cancer type globally.

In terms of end user, the hospitals subsegment dominated the market in 2024. Hospitals dominated the market since they provide comprehensive cancer care, advanced radiation infrastructure, skilled oncologists, and integrated treatment pathways, making them the primary setting for delivering radiation therapy services.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 12,002.7 Million |

| Market Size by 2031 | US$ 33,161.3 Million |

| CAGR (2025 - 2031) | 15.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered | By Type

|

| Regions and Countries Covered | Asia Pacific

|

| Market leaders and key company profiles |

|

The "Asia Pacific Cancer Radiation Therapy Market Size and Forecast (2021 - 2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Asia Pacific Cancer Radiation Therapy market report is divided into: China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, the Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh, and the Rest of Asia. China held the largest share in 2024.

China dominates the Asia Pacific cancer radiation therapy market due to its expansive oncology network, strong domestic manufacturing ecosystem, and significant government focus on strengthening cancer treatment capacity. The country has rapidly expanded radiotherapy infrastructure across major metropolitan areas, integrating advanced linear accelerators, precision imaging, and treatment‑planning platforms into large tertiary hospitals. China's academic medical centers serve as hubs for clinical innovation, supporting research on adaptive radiotherapy, AI‑driven planning, and integrated imaging workflows. These institutions also play a critical role in training a large pool of radiation oncologists, physicists, and technologists, enabling the country to scale modern treatment techniques across a wide geography.

China's strong industrial capabilities give it a unique advantage in the region. Domestic manufacturers contribute to the radiotherapy supply chain, enhancing equipment availability, lowering time-to-installation, and supporting more predictable service cycles. The country also emphasizes digital transformation within healthcare, promoting data interoperability, imaging standardization, and cloud‑based oncology platforms. This allows smoother implementation of advanced workflows and consistent quality assurance practices. Additionally, China's extensive patient volume drives continuous skill enhancement across disease sites, reinforcing its status as a regional leader. Its combination of research intensity, large-scale infrastructure, clinical expertise, and manufacturing strength positions China as the primary driver shaping the future of radiotherapy in Asia Pacific.

The Asia Pacific Cancer Radiation Therapy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Asia Pacific cancer radiation therapy market are:

The Asia Pacific Cancer Radiation Therapy Market is valued at US$ 12,002.7 Million in 2024, it is projected to reach US$ 33,161.3 Million by 2031.

As per our report Asia Pacific Cancer Radiation Therapy Market, the market size is valued at US$ 12,002.7 Million in 2024, projecting it to reach US$ 33,161.3 Million by 2031. This translates to a CAGR of approximately 15.7% during the forecast period.

The Asia Pacific Cancer Radiation Therapy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Cancer Radiation Therapy Market report:

The Asia Pacific Cancer Radiation Therapy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Cancer Radiation Therapy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Cancer Radiation Therapy Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)