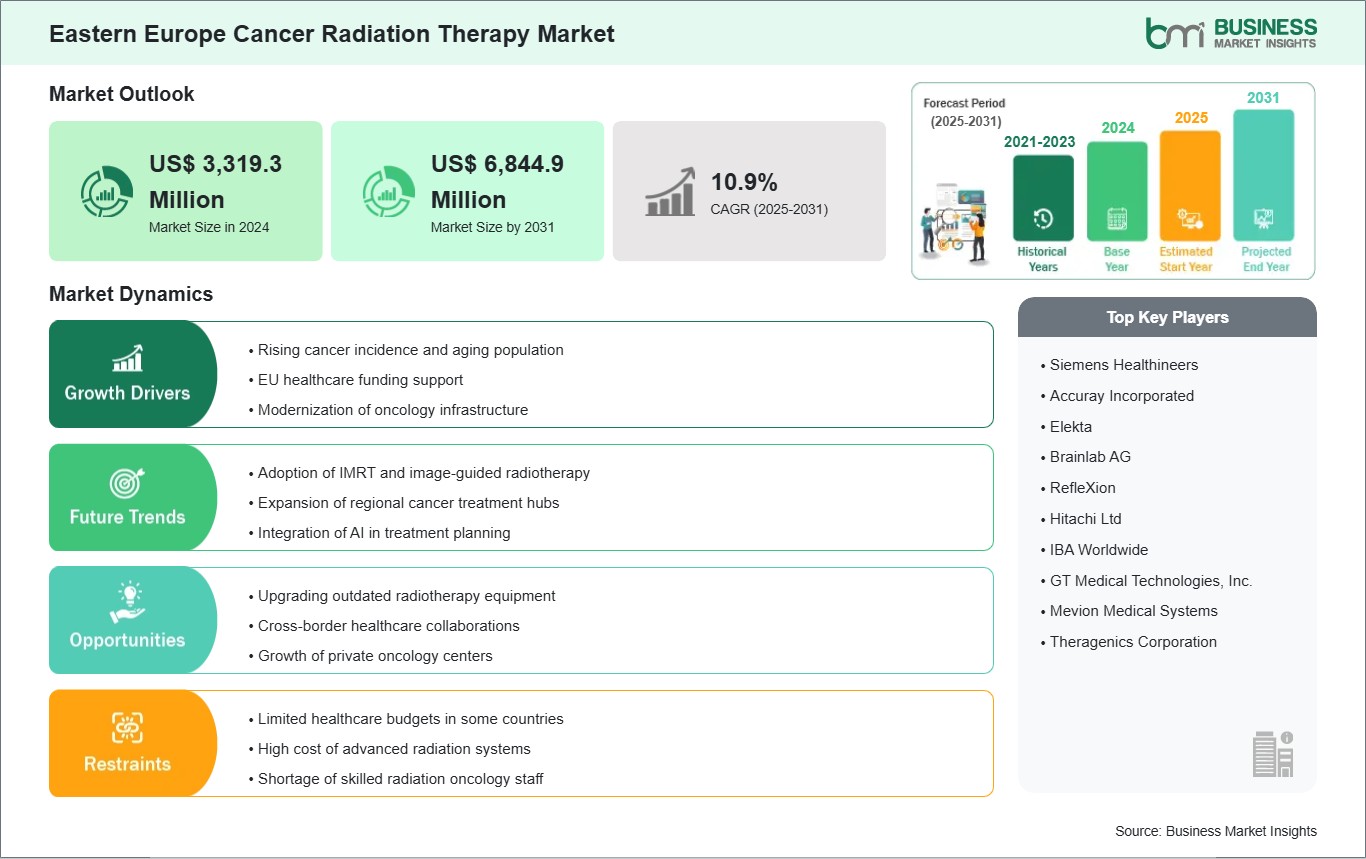

The Eastern Europe cancer radiation therapy market size is expected to reach US$ 6,844.9 million by 2031 from US$ 3,319.3 million in 2024. The market is estimated to record a CAGR of 10.9% from 2025 to 2031.

The cancer radiation therapy market in Eastern Europe is shaped by the steady modernization of oncology infrastructure, expanding diagnostic capacity, and rising adoption of advanced radiotherapy techniques across several countries. Governments are prioritizing cancer care within national health strategies, leading to upgrades in treatment centers, improved access to imaging, and expanded workforce training programs. Urban oncology hubs in Russia, Poland, the Czech Republic, and Hungary have been integrating sophisticated planning systems, image‑guided workflows, and precision‑based modalities that support complex treatment pathways. Cross‑border collaboration within the region enhances best‑practice sharing and strengthens clinical competencies.

Despite these advances, the market faces structural constraints. Rural‑urban disparities in treatment access remain significant, and several countries experience procurement delays that slow the replacement of aging equipment. Limited availability of specialized medical physicists and dosimetrists can hinder uniform adoption of high‑complexity techniques. Moreover, fragmented health system financing can influence the consistency of care delivery across regions. However, Eastern Europe presents a notable opportunity for growth through the expansion of digital oncology ecosystems. Cloud-based planning, tele‑mentoring networks, AI‑assisted contours, and standardized QA frameworks can help balance workloads, improve treatment accuracy, and extend advanced radiotherapy capabilities beyond major cities. As regional healthcare systems strengthen long-term oncology strategies, radiotherapy is expected to play a central role in cancer management.

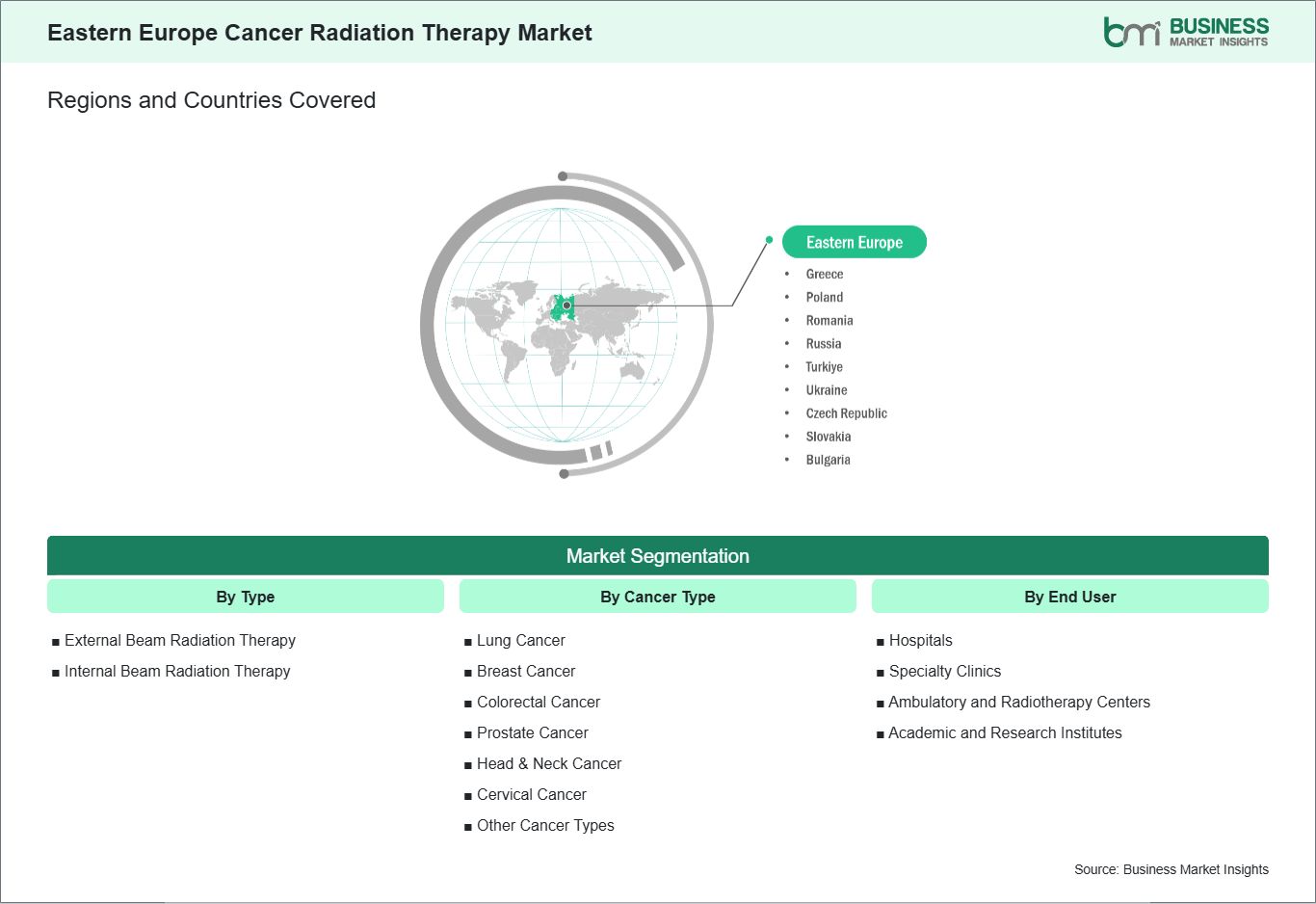

Key segments that contributed to the derivation of the Eastern Europe cancer radiation therapy market analysis are type, cancer type, and end user.

Cancer incidence is rising across Eastern Europe as aging demographics intersect with persistent risk factors such as tobacco use, alcohol consumption, and occupational exposures. Poland, Romania, and Hungary report growing burdens of lung and colorectal cancers, while cervical cancer remains elevated in parts of the Balkans due to uneven HPV vaccination and screening coverage. Ukraine and Bulgaria face late-stage presentations linked to access barriers and fragmented primary care, intensifying the need for radiotherapy within multimodal treatment pathways.

Diagnostic capacity is improving, but legacy infrastructure and uneven distribution of equipment create bottlenecks in radiotherapy access. Major urban centers—Warsaw, Prague, and Budapest—host high-throughput linear accelerators and advanced planning systems, whereas smaller cities rely on older cobalt units or limited EBRT capacity. Brachytherapy remains a practical option for gynecologic and prostate cancers in resource-constrained hospitals, and cross-border referrals to Czechia and Poland are common for complex cases requiring stereotactic or proton-based approaches.

Public investment and EU-aligned reforms are gradually expanding oncology networks, yet workforce shortages and maintenance backlogs persist. National cancer plans in Poland and Romania prioritize equipment renewal and quality assurance, while hospital modernization programs in the Baltics aim to reduce regional disparities. As screening uptake improves and more patients enter formal care pathways, the growing prevalence of cancer is a durable driver for the Eastern Europe radiation therapy market, pushing systems to scale capacity and standardize treatment quality.

Personalized oncology is gaining traction in Eastern Europe through wider use of molecular diagnostics, advanced imaging, and adaptive planning. Czechia and Poland integrate genomic testing for selected tumor types, enabling radiotherapy strategies that reflect radiosensitivity and tumor heterogeneity. Multidisciplinary boards combine PET/CT and MRI for precise contouring, while radiomics pilots in Prague and Krakow explore image-derived biomarkers to refine dose escalation and de-escalation decisions.

Technology upgrades are broadening the personalization toolkit beyond conventional EBRT. IMRT and IGRT are routine in leading centers, with SBRT adopted for oligometastatic disease and early-stage lung cancer in Hungary and Czechia. Brachytherapy programs are modernizing with 3D image-guided planning for cervical cancer, and proton therapy access—centered in Prague with growing regional referral pathways—offers organ-sparing options for pediatric and head-and-neck indications where dose conformity is critical.

Policy and reimbursement changes are gradually aligning incentives with precision care. National registries and e-health platforms in the Baltics and Poland support outcomes tracking, enabling value-based decisions on hypofractionation and adaptive workflows. Patients seek shorter courses with fewer side effects, and regional training collaborations—often supported by EU funds—are building expertise in contouring standards and AI-assisted planning. These shifts create a clear opportunity for vendors and providers to deliver integrated, patient-specific radiation therapy solutions tailored to Eastern Europe's diverse clinical and resource environments.

The Eastern Europe cancer radiation therapy market demonstrates steady growth, with size and share analysis highlighting evolving trends and competitive dynamics among key players. The report further examines subsegments categorized within type, cancer type, and end user, offering insights into their contribution to overall market performance.

By type, the external beam radiation therapy subsegment dominated the market in 2024. Due to its widespread availability, precision targeting, noninvasive nature, and effectiveness in treating diverse cancers, it is the preferred choice across global oncology practices.

Based on cancer type, the lung cancer subsegment dominated the market in 2024. Due to its high incidence, strong link with smoking and pollution, late‑stage diagnoses, and reliance on advanced radiation techniques, it is the most treated cancer type globally.

In terms of end user, the hospitals subsegment dominated the market in 2024. Hospitals dominated the market since they provide comprehensive cancer care, advanced radiation infrastructure, skilled oncologists, and integrated treatment pathways, making them the primary setting for delivering radiation therapy services.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,319.3 Million |

| Market Size by 2031 | US$ 6,844.9 Million |

| CAGR (2025 - 2031) | 10.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered | By Type

|

| Regions and Countries Covered | Eastern Europe

|

| Market leaders and key company profiles |

|

The "Eastern Europe Cancer Radiation Therapy Market Size and Forecast (2021 - 2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the Eastern Europe Cancer Radiation Therapy market report is divided into: Russia, Poland, Romania, the Czech Republic, Ukraine, Romania, Greece, Slovakia, and Bulgaria. Russia held the largest share in 2024.

Russia dominates the Eastern Europe cancer radiation therapy market due to its extensive oncology infrastructure, strong technical capabilities, and significant investment in modernizing radiotherapy services across large metropolitan regions. The country has established a network of advanced cancer centers equipped with sophisticated planning software, high‑precision imaging systems, and modern treatment units that support complex radiotherapy techniques. Russian oncology institutions also benefit from strong clinical training programs, enabling a well‑developed cohort of radiation oncologists, physicists, and technologists who are proficient in advanced treatment workflows.

A key strength of Russia's market leadership is the scale and coordination of its national cancer care initiatives, which emphasize standardization, quality assurance, and evidence‑based practice. Many leading Russian cancer centers collaborate closely with research institutes to refine treatment protocols and evaluate emerging radiotherapy approaches. The country also invests in digital health infrastructure that supports centralized imaging archives, integrated oncology pathways, and analytics‑driven treatment planning. Additionally, Russia's domestic engineering and manufacturing capacity contributes to more efficient equipment deployment and long‑term service continuity. These combined factors—large-scale infrastructure, strong clinical expertise, research-driven innovation, and technology integration—position Russia as the leading force shaping radiotherapy development across Eastern Europe.

The Eastern Europe Cancer Radiation Therapy market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Eastern Europe cancer radiation therapy market are:

The Eastern Europe Cancer Radiation Therapy Market is valued at US$ 3,319.3 Million in 2024, it is projected to reach US$ 6,844.9 Million by 2031.

As per our report Eastern Europe Cancer Radiation Therapy Market, the market size is valued at US$ 3,319.3 Million in 2024, projecting it to reach US$ 6,844.9 Million by 2031. This translates to a CAGR of approximately 10.9% during the forecast period.

The Eastern Europe Cancer Radiation Therapy Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Eastern Europe Cancer Radiation Therapy Market report:

The Eastern Europe Cancer Radiation Therapy Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Eastern Europe Cancer Radiation Therapy Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Eastern Europe Cancer Radiation Therapy Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)