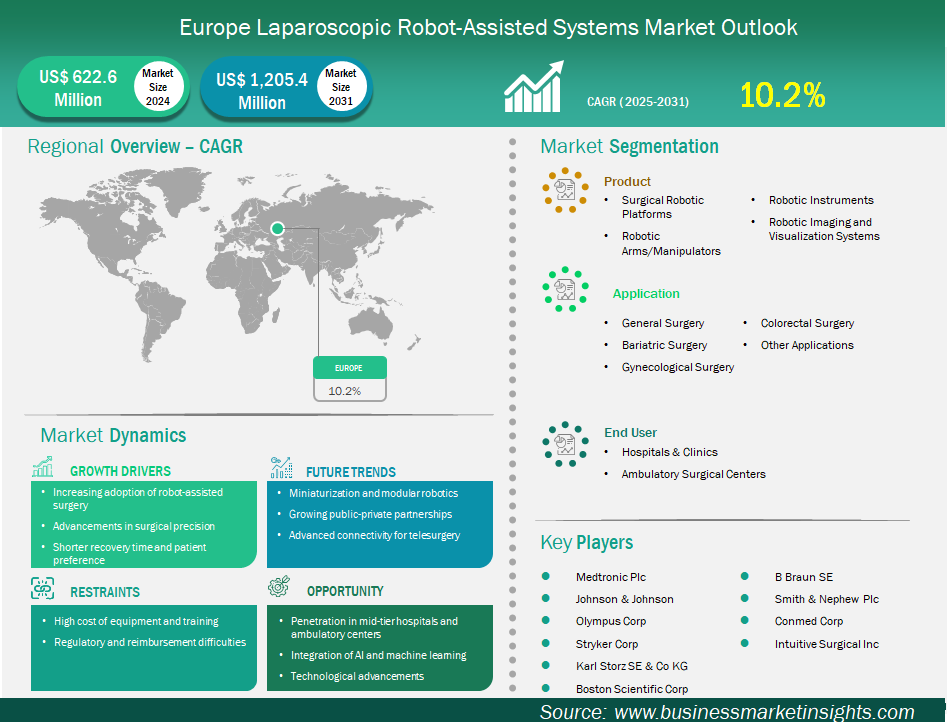

The Europe laparoscopic robot-assisted systems market size is expected to reach US$ 1,205.4 million by 2031 from US$ 622.6 million in 2024. The market is estimated to record a CAGR of 10.2% from 2025 to 2031.

The laparoscopic robot-assisted systems market in Europe is experiencing significant growth driven by increasing adoption of robot-assisted surgery, advancements in surgical precision, and shorter recovery times and patient preference. The market for European laparoscopic robot-assisted systems is evolving from the phase of initial usage to a phase of consolidation that is largely influenced by a combination of clinical requirements, technological innovation, and policy incentives for the healthcare sector. Among the factors contributing to this are the growing preference of hospital physicians and surgeons for minimally invasive surgery that ensures better accuracy, less patient trauma, and shorter recovery times. As a result, the competitive dynamics are changing: on one hand, major players are bringing next-generation robotic arms, improved vision systems (3D, augmented reality), and modular sets of instruments to the market, while on the other hand, new entrants are seeking to gain market shares by offering robots with a smaller footprint and cost-efficient models.

Major market studies show that regulatory requirements, especially those under the European Union's Medical Device Regulation (MDR), are becoming more stringent. Besides needing to prove safety and efficacy through clinical trials, manufacturers are also required to accept long-term post-market surveillance. Another analytical observation is that reimbursement policies are still unbalanced across different European healthcare systems. While Germany, France, and the UK are more supportive of adoption through reimbursement and hospital budget advantages, other Southern and Eastern European countries are going backward, mostly due to budget constraints or slower regulatory processes. In brief, the market is influenced by three key factors besides the clinical need for less invasiveness: technological maturity, and regulatory/reimbursement environments. The companies that will be able to manage the cost structure (upfront capital, maintenance, training), speed up regulatory clearances, and provide clear patient outcome value will be the ones to dominate the European laparoscopic robotic‑assisted systems market.

Europe Laparoscopic Robot Assisted Systems Market Strategic Insights

Key segments that contributed to the derivation of the laparoscopic robot-assisted systems market analysis are product, application, and end user.

Europe's laparoscopic robot-assisted systems market is expected to experience escalating innovation and growth across various specialties. Expansion will be robust in specialty areas, such as colorectal, bariatric, gynecologic, and urologic procedures, due to the need for tools that enable more intricate and sensitive procedures. A technological vision signifies improvements in automation, the consolidation of real-time imaging and AI-directed support (e.g., for tissue identification or adaptive motion correction), and greater modularity to enable phased expansion of robotic platforms by hospitals, rather than requiring huge upfront capital expenditures. Another trend will be greater affordability, as manufacturers drive reduced total cost of ownership through more long-lasting instruments, improved software update models, and shared services. Regulatory harmonization will also be enhanced, as European institutions and national regulators align in interpreting the MDR and supporting clinical evidence requirements, thereby decreasing the time-to-market for newer systems. Yet, a number of constraints may temper growth, including large capital expenses (such as purchase and upkeep), the learning curves of surgeons and operating room personnel, and differing reimbursement schemes between nations. Additionally, prospective supply chain issues (e.g., components, chips, sterile tool supply) may periodically hinder rollout. But rising demographic trends—aging population, greater incidence of obesity and related comorbidities—and patient pressure for minimally invasive surgery will build a demand. Hospitals will increasingly value robots that offer better workflow (lower setup & turnover times), fewer complications, and measurable cost reductions over the long term. Overall, the future is one of steady to strong expansion, with focus shifting toward affordability, specialization, and regulation efficiency.

Based on country, the Europe laparoscopic robot-assisted systems market is segmented into Belgium, Austria, Finland, Denmark, Greece, Poland, Romania, Russia, Ukraine, the Czech Republic, Slovakia, Bulgaria, Italy, Luxembourg, Germany, Switzerland, France, the Netherlands, Norway, Portugal, Spain, Sweden, and the United Kingdom. Germany held the largest share in 2024.

Europe is homogeneous in its uptake, and country‐level variance will be imperative in determining where and how quickly the market develops. Germany is still a top market. It has high healthcare expenditures, robust engineering/manufacturing capacity, more transparent reimbursement of technology, and numerous hospitals that can afford to invest in top‐tier robotics; these factors make Germany a hub for product launches and local R&D. France is also signifying strong momentum, especially in centers of excellence and university hospitals, which tend to be leaders when it comes to embracing new robotic platforms for complicated surgeries like oncology and bariatrics.

The United Kingdom, despite the strain on hospital budgets and changes to the post-Brexit regulatory environment, continues to promote robotic surgery in both the private and NHS sectors, particularly in urology and general surgery. Government policy and funding for life sciences innovation support this effort. In Southern Europe—Spain, Italy, and Portugal—the uptake is increasing, but it is frequently irregular: large city hospitals adopt early, while smaller rural or poorer-region hospitals fall behind due to cost, personnel, and reimbursement variations. Eastern Europe has fastening‑up potential: various countries are investing in healthcare modernization, yet barriers persist in training, facility, and robotic system affordability. Nordic nations (Sweden, Denmark, Finland) generally have high adoption rates per capita, but they may be more specialized; they have high expectations for quality evidence and robust outcomes. The policy context (regulation, reimbursement, and public versus private mix) within each country will significantly influence which robotic systems will be successful. Manufacturers must tailor their strategy to specific national health systems, local clinical practice norms, and budget constraints to gain market traction.

Europe Laparoscopic Robot Assisted Systems Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 622.6 Million |

| Market Size by 2031 | US$ 1,205.4 Million |

| CAGR (2025 - 2031) | 10.2% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Medtronic Plc; Johnson & Johnson; Olympus Corp; Stryker Corp; Karl Storz SE & Co KG, Boston Scientific Corp, B Braun SE, Smith & Nephew Plc, Conmed Corp, and Intuitive Surgical Inc., are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Europe Laparoscopic Robot Assisted Systems Market is valued at US$ 622.6 Million in 2024, it is projected to reach US$ 1,205.4 Million by 2031.

As per our report Europe Laparoscopic Robot Assisted Systems Market, the market size is valued at US$ 622.6 Million in 2024, projecting it to reach US$ 1,205.4 Million by 2031. This translates to a CAGR of approximately 10.2% during the forecast period.

The Europe Laparoscopic Robot Assisted Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Laparoscopic Robot Assisted Systems Market report:

The Europe Laparoscopic Robot Assisted Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Laparoscopic Robot Assisted Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Laparoscopic Robot Assisted Systems Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)