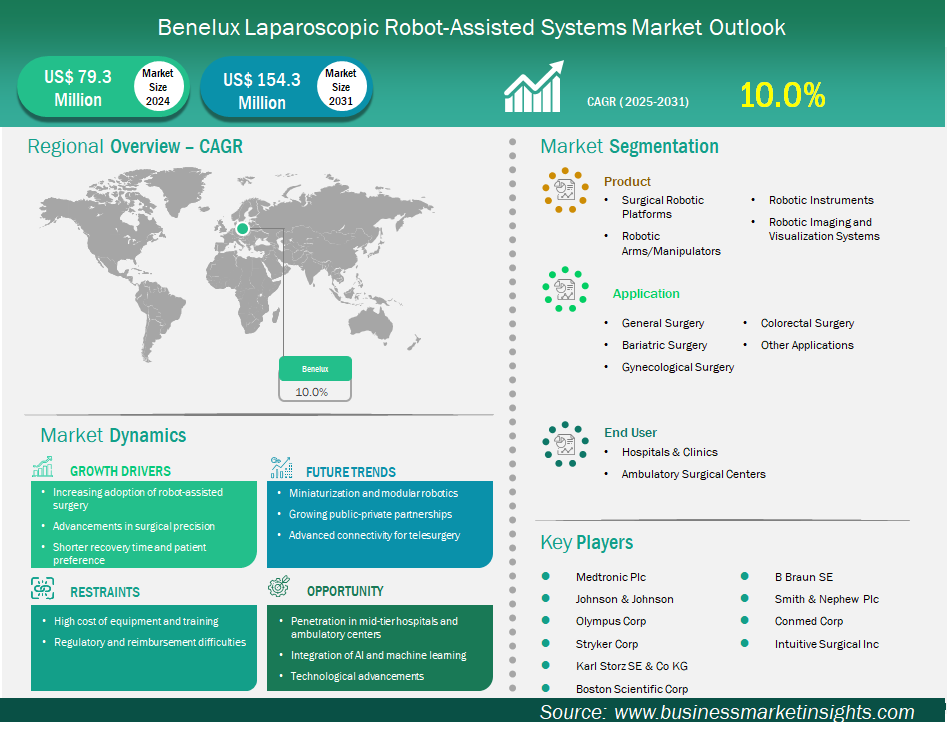

The Benelux laparoscopic robot-assisted systems market size is expected to reach US$ 154.3 million by 2031 from US$ 79.3 million in 2024. The market is estimated to record a CAGR of 10.0% from 2025 to 2031.

The laparoscopic robot-assisted systems market in Benelux is experiencing significant growth driven by increasing adoption of robotic-assisted surgery, advancements in surgical precision, and shorter recovery times and patient preference. The Benelux region, comprising Belgium, the Netherlands, and Luxembourg, is emerging as a notable contributor to the overall European market for laparoscopic robot-assisted systems. This is due to the advanced healthcare infrastructure and resources, as well as substantial healthcare expenditure and strong efforts to adopt innovative medical technology. Year-over-year laparoscopic cholecystectomies in Belgium have risen significantly. Additionally, Luxembourg anticipates an increase in demand for bariatric procedures. Surgical robotic platforms comprise the largest segment of the market and are considered the principal technology for performing a wide range of robotic-assisted surgical procedures across various surgical specialties. Within the application segment, general surgery represents the leading application based on the volume of minimally invasive procedures performed, established clinical protocols for these procedures, and the existing surgeon experience in the region. In terms of end-users, hospitals and clinics comprise the largest segment.

Benelux Laparoscopic Robot Assisted Systems Market Strategic Insights

Key segments that contributed to the derivation of the laparoscopic robot-assisted systems market analysis are product, application, and end user.

The Benelux laparoscopic robotic-assisted systems market is expected to perform well due to several key factors. The growing incidence of chronic diseases such as colorectal cancer, obesity, and gynecological disorders is projected to increase the demand for minimally invasive surgical procedures and robotic assistance. Significant technological advancements, including the integration of artificial intelligence (AI), more advanced imaging systems, and augmented reality, are enhancing the accuracy and effectiveness of surgeries. As a result, healthcare partners find robotic platforms appealing for these reasons. These solutions are designed for more formal surgical planning and decision-making during surgery, which can lead to improved patient outcomes.

Additionally, value-based healthcare models are supporting the adoption of technologies that improve patient outcomes and efficiencies, with measurable public and private insurance savings. Hybrid financing models, which aim to alleviate the burden of rising upfront capital costs, are gaining traction through options such as leasing, pay-per-usage, and outcome-based payment systems.

Based on country, the Benelux laparoscopic robot-assisted systems market is segmented into Belgium, the Netherlands, and Luxembourg. Belgium held the largest share in 2024.

The dynamics between countries in the Benelux region provide a range of contexts for the adoption and use of laparoscopic robot-assisted systems. Belgium appears to be leading the way in the adoption of robotic surgery. The country has a generally developed regulatory environment, a strong private healthcare system, and a concentration of tertiary hospitals with robotic platforms. Belgium has also demonstrated a firm commitment to adopting and integrating innovative, advanced medical technologies into practice, in the same manner hospitals are committing to replace older endoscopic equipment with newer towers to gain adoption of high-definition visualizations across many hospital sites. The Netherlands is closely behind, owing to robust private hospital networks, the growth of medical tourism, and proactive regulatory agencies. Reimbursement policies are being developed but are not yet fully evolved, along with disparities in adoption between urban and rural areas. Although Luxembourg is smaller in size, it is also experiencing an increase in interest in bariatric procedures. Opportunities to engage partners, such as local distributors, and collaborate with academic centers to promote adoption among clinicians are an important area for success. Cultural acceptance of robotic-assisted surgery is also changing with patient awareness and preference for minimally invasive surgery.

Benelux Laparoscopic Robot Assisted Systems Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 79.3 Million |

| Market Size by 2031 | US$ 154.3 Million |

| CAGR (2025 - 2031) | 10.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Benelux

|

| Market leaders and key company profiles |

|

Medtronic Plc; Johnson & Johnson; Olympus Corp; Stryker Corp; Karl Storz SE & Co KG, Boston Scientific Corp, B Braun SE, Smith & Nephew Plc, Conmed Corp, and Intuitive Surgical Inc, are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Benelux Laparoscopic Robot Assisted Systems Market is valued at US$ 79.3 Million in 2024, it is projected to reach US$ 154.3 Million by 2031.

As per our report Benelux Laparoscopic Robot Assisted Systems Market, the market size is valued at US$ 79.3 Million in 2024, projecting it to reach US$ 154.3 Million by 2031. This translates to a CAGR of approximately 10.0% during the forecast period.

The Benelux Laparoscopic Robot Assisted Systems Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Benelux Laparoscopic Robot Assisted Systems Market report:

The Benelux Laparoscopic Robot Assisted Systems Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Benelux Laparoscopic Robot Assisted Systems Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Benelux Laparoscopic Robot Assisted Systems Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)