Laparoscopic Devices Market Outlook (2021-2031)

No. of Pages: 200 | Report Code: BMIPUB00031631 | Category: Life Sciences

No. of Pages: 200 | Report Code: BMIPUB00031631 | Category: Life Sciences

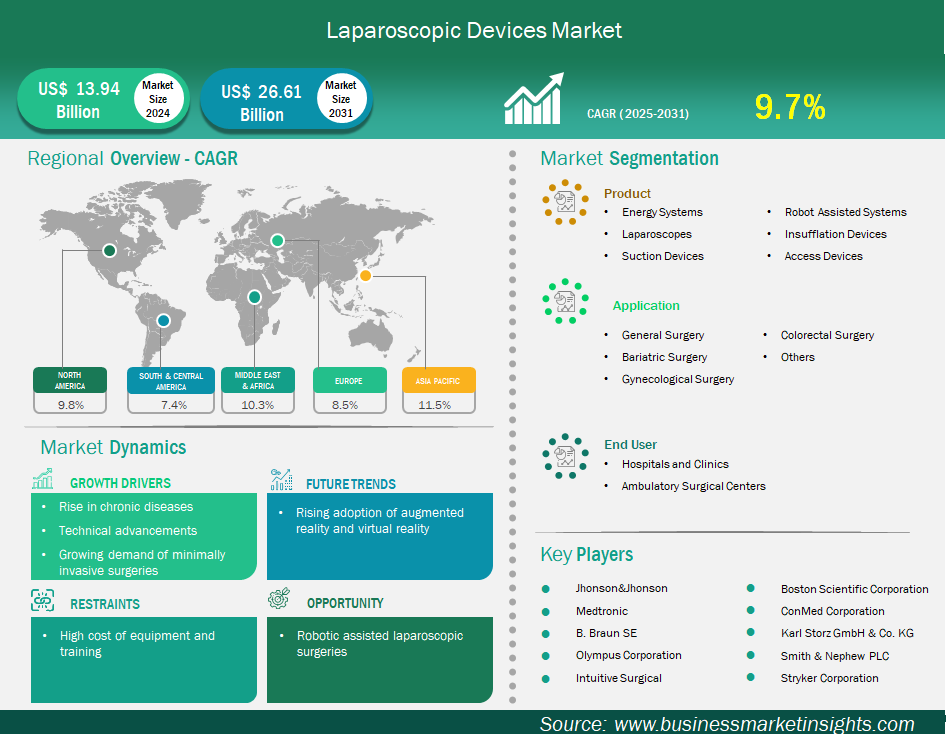

The laparoscopic devices market size is expected to reach US$ 26,609.70 million by 2031 from US$ 13,935.68 million in 2024. The market is estimated to record a CAGR of 9.7% from 2025 to 2031.

Executive Summary and Global Market Analysis:

The global laparoscopic devices market is experiencing significant growth driven by rising prevalence of chronic diseases, increasing tech breakthroughs in laparoscopy, and growing demand of minimally invasive surgeries. Laparoscopic Devices encompasses energy systems, laparoscopes, suction devices, robot assisted systems, insufflation device, and access devices. With the demand for minimally invasive surgeries is skyrocketing, manufacturers are coming up with advanced laparoscopic solutions to enhance patient convenience and treatment efficiency. Thus, the future of the global laparoscopic devices market lies in robotic assisted laparoscopic solutions, making laparoscopies more accessible and efficient while improving patient outcomes worldwide.

One of the primary drivers of the market is the increasing prevalence of chronic disease. Increasing prevalence of chronic disease, often leading to surgical action. Here, minimally invasive approaches seem to be increasingly favoured. Therefore, the growing burden of chronic diseases drives the laparoscopic devices market. Similarly, the increasing tech breakthroughs in laparoscopy, is another key contributor to rising demand for laparoscopic devices. These technological advancements improve precision, increase visualization, and expand the number of procedures that can be performed minimally invasively, which is leading to the increased uptake of laparoscopic surgery.

Laparoscopic Devices Market Strategic Insights

Laparoscopic Devices Market Segmentation Analysis

Key segments that contributed to the derivation of the Laparoscopic Devices market analysis are product, application, and end user.

Laparoscopic Devices Market Drivers and Opportunities:

Increasing Prevalence of Chronic Diseases Driving Laparoscopic Devices Market

One of the primary drivers for the laparoscopic devices market is the increasing prevalence of chronic disease, often leading to surgical action. Here, minimally invasive approaches seem to be increasingly favoured. For example, the global incidence of obesity - a significant risk factor for many chronic diseases - continues to increase, with estimates that by 2025, 167.0 million people will experience worsened health from being overweight or obese. This directly stimulates the need for laparoscopic bariatric surgery. A study performed from March 2023 through February 2024 in Jeddah, Saudi Arabia explained that most patients (93.3% of the 208 patients studied) underwent laparoscopic sleeve gastrectomy (LSG), and that BMI decreased, while comorbidities of obesity, including hypertension and diabetes improved. The global prevalence of gallstones is on the rise as well. Specifically, a systematic review in February 2025 published prevalence estimates of gallstones to be 6.1%, surgical resection in the form of laparoscopic cholecystectomy continues to be the gold standard for symptomatic patients.

Furthermore, a report published in May 2025 stated that laparoscopic approaches are taking over, with a report of greater than 80% of cholecystectomies being performed laparoscopically - alleviating patients' experience of surgical intervention with shorter recovery and fewer complications. Colorectal cancer is another significant driver of laparoscopic procedures as well; GLOBOCAN 2022 published in February 2025 reported that over 53,941 new colorectal cancer cases in the Eastern Mediterranean Region alone, while the American Cancer Society's estimates for colorectal cancer in America showed over 107,320 new cases of colon cancer and 46,950 new cases of rectal cancer in the United States.

These high incidence rates drive the demand for laparoscopic colorectal surgeries, with advancements in robotic-assisted proctectomy improving precision, as noted in a 2025 market report. The shift towards less invasive appendectomy is also evident, with a January 2025 report on the Appendicitis market noting increased adoption of laparoscopic appendectomy due to reduced incisions and quicker recovery. These instances underscore how the growing burden of chronic diseases directly translates into an escalating demand for laparoscopic procedures and the advanced devices required for them.

Robotic Assisted Laparoscopic Surgeries

The RALS market will continued to be assured as it quickly becomes the norm in many specialties, 15% of general surgeries being robotic-assisted in 2023, likely to 30% in the next 5 years, and languishing adoption in some procedures like thyroid cancer (38%) and prostate cancer (27.8%), as well as colorectal and cardiothoracic surgeries. In addition to rapid usage growth of VATS, the integration of various advanced technologies like artificial intelligence (AI) will only faster the proliferation of robotic-assisted laparoscopic surgery as AI improves preoperative planning, decision making in real time, and postoperative analysis.

As AI-assisted robotic procedures also lower the chance for surgical errors, facilitate faster recovery timelines, and improved patient outcomes by enhancing surgical procedures and decreasing tissue trauma. Additional advances from the likes of Intuitive Surgical (the da Vinci 5 offers real time force feedback and multi-dimensional view) and Medtronic (Hugo system) all advocate for premium new product development in robotic-assisted laparoscopic surgery. The overall trend of increasing demand for minimally invasive procedures, offering benefits such as less pain, reduced blood loss, shorter hospital stays, and quicker recovery times for patients, solidifies RALS as a highly promising area for innovation and market growth within laparoscopic devices, with over 2,000 US hospitals already utilizing robotic surgical systems.

Laparoscopic Devices Market Size and Share Analysis

The laparoscopic devices market is classified according to products into energy systems, laparoscopes, suction devices, robot assisted systems, insufflation device, and access devices. The laparoscopes segment led the market in 2024 and beyond. This segment's leading position is reinforced by the widespread adoption of High-Definition (HD), 3D, and 4K laparoscopes, which are rapidly becoming the standard of care. The integration of 4K camera systems has caused a "seismic shift" in the surgical camera market since their introduction, offering four times higher resolution than HD predecessors and significantly improving image quality and accuracy in minimally invasive surgeries, despite higher costs, as highlighted in reports from late 2023. Leading manufacturers like Olympus Corporation have been at the forefront, launching new 4K laparoscopy systems as early as 2021, and the global trend sees hospitals and ambulatory surgical centers increasingly leveraging these advanced systems for a wider range of procedures.

In terms of applications, the market is segmented into general surgery, bariatric surgery, gynecological surgery, colorectal surgery, others. The general surgery segment had the largest market share in 2024. This is because laparoscopic devices and instrumentation are now commonly used in a wide array of procedures using minimally invasive techniques. This segment dominates the market landscape primarily due to the proposed patient benefits of laparoscopic surgery over open surgery, including small incisions, decreased postoperative pain, shorter length of hospital stays, earlier return to normal activities, and lower incidence of infectious complications. For example, study published in the International Surgery Journal in February 2025, demonstrated that for patients undergoing a laparoscopic appendectomy had an average of 1.77 days in the hospital versus 7.73 days for the open appendectomy, significantly smaller pain levels (average pain score of 2.77 vs 5.36 at day 0), and faster return to normal activity (2.42 days vs 5.15 days).

By end user, the market is segmented into hospitals and clinics, and ambulatory surgical centers. The hospitals and clinics segment held the largest share of the market in 2024. This is owing to presence of hospitals everywhere and they continue to adopt robotic-assisted laparoscopic systems, and presents an example of how hospitals and clinics are at the forefront of facilitating the advance of laparoscopic surgery with new technology, specialty care, and evidence-based practices.

Laparoscopic Devices Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 13.94 Billion

Market Size by 2031

US$ 26.61 Billion

Global CAGR (2025 - 2031) 9.7%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Product

By Application

By End User

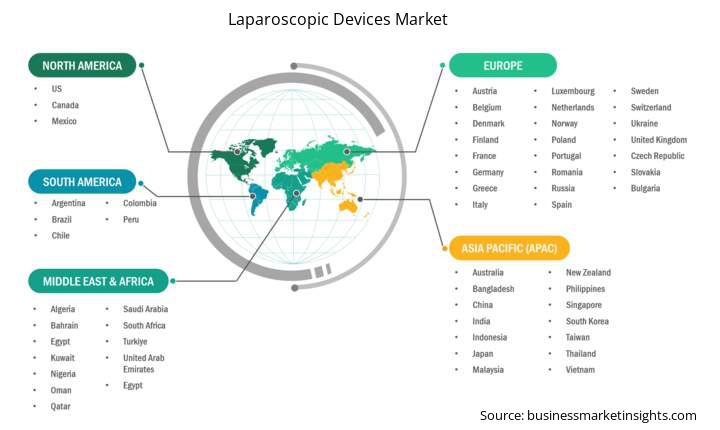

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

Laparoscopic Devices Market Report Coverage and Deliverables

The "Laparoscopic Devices Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

Laparoscopic Devices Market Country and Regional Insights

The geographical scope of the laparoscopic devices market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The Laparoscopic Devices market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific Laparoscopic Devices market consists of China, Japan, India, South Korea, Australia, Bangladesh, New Zealand, Philippines, Singapore, Indonesia, Taiwan, Malaysia, Vietnam, and the Rest of Asia Pacific. Countries such as China, and India are witnessing a surge in laparoscopic surgeries. This increase is further driven by surgical capabilities, robotic systems, as well as improvements in training programs for the practicing surgeons in the region as whole. South Korea, Singapore and Australia have been leading the implementation of robotic systems into clinical practice besides the above advancements in surgery. In other particular countries, including India, the formal training of general surgeons in adopting laparoscopic techniques is inconclusive (limited to residencies), which may slow the implementation of MIS services. In terms of bariatric surgery, the APAC region continues to experience substantial increases in procedures as the rates of obesity continue to expand within the population. As an example, the IFSO Global Registry Report (data up to 2023) reported a significate number of bariatric procedures performed globally; APAC counties were also a heavily contributor to the volume.

The trend is one of higher volumes of procedures, and with sleeve gastrectomy being the most common. For example, a 2024 bibliometric analysis of obesity surgery research in Asia indicated a significant upward trend in publications, reflecting growing surgical activity. General surgery in APAC is increasingly dominated by minimally invasive approaches. The widespread adoption of laparoscopic and robotic-assisted procedures is evident across various specialties. In South Korea, for instance, robotic thyroidectomy and colorectal procedures accounted for over 25.42% of all MIS surgeries performed in 2023. Over 75.74% of all minimally invasive abdominal surgeries performed in Japan involve reusable or disposable surgical devices, underscoring their necessity. Furthermore, over 90.65% of complex gynecologic and oncologic MIS cases in India are performed in tertiary care hospitals, emphasizing the indispensable role of institutional settings in driving this dominant segment. The combination of economic growth, increasing healthcare spending, and demographic shifts continues to propel the Laparoscopic Devices market forward, making Asia Pacific one of the fastest-growing regions in the global dialysis industry.

Laparoscopic Devices Market Research Report Guidance

Laparoscopic Devices Market News and Key Development:

The laparoscopic devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the Laparoscopic Devices market are:

Key Sources Referred:

The Laparoscopic Devices Market is valued at US$ 13.94 Billion in 2024, it is projected to reach US$ 26.61 Billion by 2031.

As per our report Laparoscopic Devices Market, the market size is valued at US$ 13.94 Billion in 2024, projecting it to reach US$ 26.61 Billion by 2031. This translates to a CAGR of approximately 9.7% during the forecast period.

The Laparoscopic Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Laparoscopic Devices Market report:

The Laparoscopic Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Laparoscopic Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Laparoscopic Devices Market value chain can benefit from the information contained in a comprehensive market report.