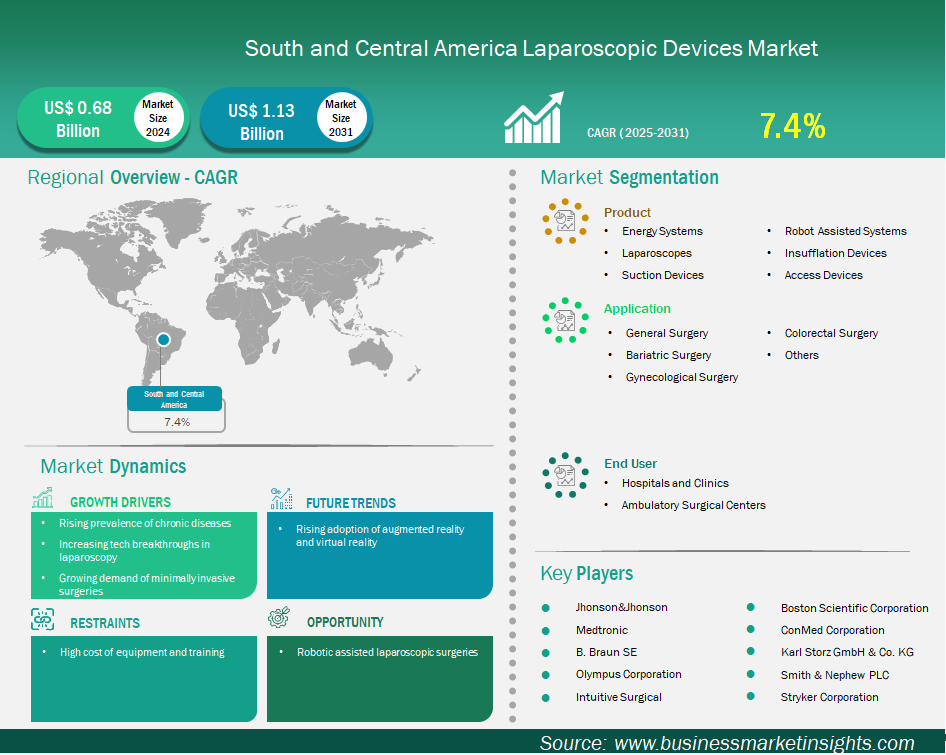

South and Central America laparoscopic devices market size is expected to reach US$ 1,125.6 million by 2031 from US$ 681.5 million in 2024. The market is estimated to record a CAGR of 7.4% from 2025 to 2031.

The laparoscopic devices market in South and Central America is experiencing significant growth driven by the increasing adoption of minimally invasive surgical (MIS) techniques, which offer significant benefits such as faster recovery times, reduced pain, and shorter hospital stays for patients, alongside technological advancements in surgical instrumentation. General Surgical Devices Market, which includes laparoscopic instruments, is estimated for stable growth, which reflects constant changes to less aggressive processes. All over the SACA region is the market characterized by the presence of the key global players like Medtronic, Johnson & Johnson (Ethicon), Carl Storz and Olympus, who continue to present innovative equipment and technologies, including increased surgical technology, better imaging and visualization (e.g. Higher language and 3D Visualization systems), short equipment and advanced energy sources. While high costs for advanced equipment and processes can be a challenge, the overall drive towards better patient outcomes and resource efficiency IS pushing hospitals and healthcare systems in the SACA region to increasingly invest in and utilize laparoscopic devices.

Key segments that contributed to the derivation of the laparoscopic devices market analysis are product, application, and end user.

The South and Central America laparoscopic devices market is segmented into Brazil, Argentina, Peru, Chile, and Colombia. Brazil stands out as the largest and fastest-growing regional market in Latin America for laparoscopic devices. The demand for MIS is accelerating due to a rising incidence of chronic diseases like colorectal cancer and an aging population. Brazil has also seen a significant increase in the adoption of robotic-assisted surgery, with over 200 robotic surgeries conducted monthly in major hospitals during 2023, a 20% rise from the previous year, indicating a clear trend towards highly advanced laparoscopic platforms. Energy systems and robotic-assisted systems are key growth segments within Brazil's laparoscopic device market. Argentina is also witnessing a surge in the use of minimally invasive devices, driven by an increasing prevalence of chronic diseases and injuries, coupled with rising healthcare expenditures.

In Peru, while specific recent statistics are less prominent, the global trend towards MIS and its advantages in terms of reduced hospital stays and fewer procedures for complex conditions like common bile duct stones suggest a similar embrace of laparoscopic techniques. Chile is actively integrating advanced laparoscopic procedures, contributing to the overall expansion of the MIS market in Latin America. The country, like others in the region, is experiencing a surge in the adoption of laparoscopy due to ongoing training and education initiatives, leading to a broader acceptance of the technique as a standard of care. Colombia demonstrates a strong uptake of laparoscopic procedures, particularly in gynecological surgeries. This is driven by an increasing incidence of gall bladder and colorectal cancers, indicating a broader application of laparoscopic techniques beyond gynecology.

Based on region, the South and Central America laparoscopic devices market is further segmented into the Brazil, Argentina, Peru, Chile, and Colombia. The Brazil held the largest share in 2024.

Brazil's laparoscopic devices market is currently experiencing significant expansion, driven by a strong national push towards minimally invasive surgical (MIS) techniques and substantial investments in healthcare modernization. The country is a leading force in Latin America for the adoption of laparoscopic technologies, benefiting from a growing awareness of MIS advantages, such as reduced patient recovery times and improved clinical outcomes. Recent data underscores this trend. Energy systems were the largest revenue-generating product segment within Brazil's laparoscopic device market in 2024, reflecting the increasing demand for advanced tools for precise tissue and vessel sealing. This is exemplified by the rising number of robotic-assisted surgeries being performed; while exact 2024-2025 figures are in development, Brazil saw over 200 robotic surgeries conducted monthly in major hospitals in 2023, representing a 20% increase from the previous year. In bariatric surgery, a field heavily reliant on laparoscopic techniques, Brazil recorded a substantial 80,441 bariatric surgeries in 2023, a 7.6% increase from 74,738 procedures in 2022. Argentina's laparoscopic devices market is experiencing robust growth, driven by an increasing embrace of minimally invasive surgical (MIS) techniques across various medical specialties. This shift is fuelled by a growing awareness among both patients and healthcare providers of the significant benefits of MIS, including reduced pain, shorter hospital stays, faster recovery, and improved cosmetic outcomes.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 681.5 Million |

| Market Size by 2031 | US$ 1,125.6 Million |

| CAGR (2025 - 2031) | 7.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

Medtronic Plc; Johnson & Johnson; Olympus Corp; Stryker Corp; Karl Storz SE & Co KG, Boston Scientific Corp, B Braun SE, Smith & Nephew Plc, Conmed Corp, and Intuitive Surgical Inc, are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The South and Central America Laparoscopic Devices Market is valued at US$ 681.5 Million in 2024, it is projected to reach US$ 1,125.6 Million by 2031.

As per our report South and Central America Laparoscopic Devices Market, the market size is valued at US$ 681.5 Million in 2024, projecting it to reach US$ 1,125.6 Million by 2031. This translates to a CAGR of approximately 7.4% during the forecast period.

The South and Central America Laparoscopic Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South and Central America Laparoscopic Devices Market report:

The South and Central America Laparoscopic Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South and Central America Laparoscopic Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South and Central America Laparoscopic Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)