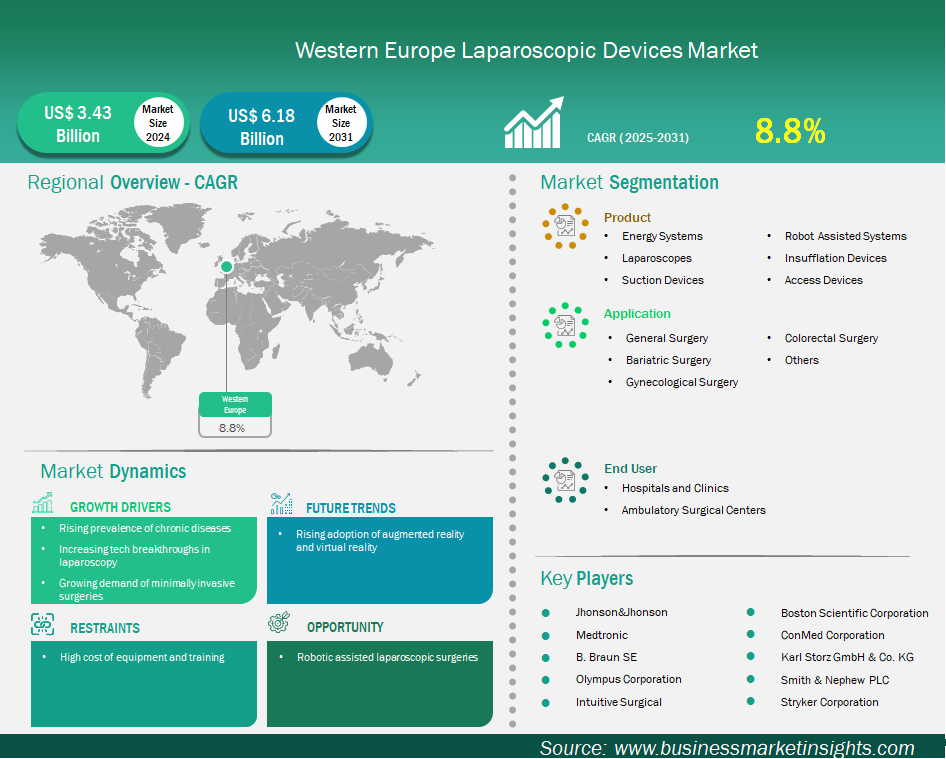

Western Europe laparoscopic devices market size is expected to reach US$ 6,185.0 million by 2031 from US$ 3,425.6 million in 2024. The market is estimated to record a CAGR of 8.8% from 2025 to 2031

The laparoscopic devices market in Western Europe is experiencing significant growth driven by rising prevalence of chronic diseases, increasing tech breakthroughs in laparoscopy, and growing demand of minimally invasive surgeries. The laparoscopic devices market in Western Europe has grown significantly due to established healthcare systems, a high prevalence of chronic diseases, and a preference for minimally invasive techniques in Belgium, Netherlands, Luxembourg, Germany, Italy, Spain, Switzerland, UK, Denmark, Portugal, Norway and Finland. Key players in the laparoscopic devices market include Ethicon (Johnson & Johnson) and Medtronic that sell a variety of products. The market trend appears to be shifting toward disposables, especially in trocars, to mitigate the risk of cross-contamination and minimizes the burden for cleaning, and in fact disposable trocars account for 62.86% of the global market in 2023. The introduction of AI systems and reusable energy devices in laparoscopic colorectal surgery, as explored in a review published in February 2025 articles could help with providing greater precision, better visualization, and sustainability. The most recent example of new technology includes the AESCULAP EinsteinVision 3 FI system by B. Braun in Germany and received regulatory approval in May 2023, which offered advancements in high-definition imaging during laparoscopic procedures.

Key segments that contributed to the derivation of the laparoscopic devices market analysis are product, application, and end user.

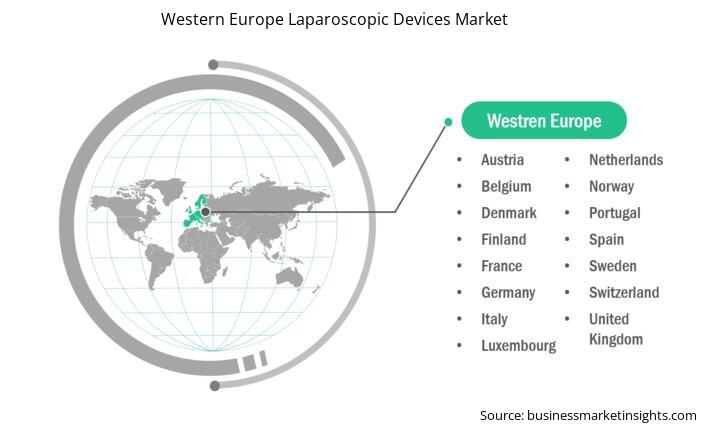

The Western Europe laparoscopic devices market is segmented into Belgium, Netherlands, Luxembourg, Germany, France, Italy, Spain, Switzerland, Sweden, Austria, United Kingdom, Denmark, Portugal, Norway, and Finland. Laparoscopic surgery has been highly successful in Western Europe, due to the benefits of minimizing trauma to the patient, decreased recovery time, and shortened lengths of stay. In 2022, almost 70% of hysterectomies performed in Denmark and Finland were laparoscopic. The laparoscopic appendectomy adoption also followed with rates exceeding 90% in Denmark in 2022. While laparoscopic repair of inguinal hernia has been high in Denmark, its adoption was below 50% in Sweden in 2022, and Finland even saw a decrease in these procedures from 2012 to 2022. Across various Western European countries, robotic-assisted laparoscopy is also gaining traction, though challenges like high installation costs and extensive training requirements remain.

Bariatric surgeries are a growing segment within the laparoscopic market, primarily driven by the increasing prevalence of obesity. Spain, for instance, saw sleeve gastrectomy dominate its bariatric surgery market in 2023. The country is also seeing a rising demand for bariatric surgery due to growing awareness of obesity-associated health risks, with gastric balloons also holding a significant market share in 2023.

Based on region, the Western Europe laparoscopic devices market is further segmented into the Belgium, Netherlands, Luxembourg, Germany, France, Italy, Spain, Switzerland, Sweden, Austria, United Kingdom, Denmark, Portugal, Norway, and Finland. The Germany held the largest share in 2024.

Countries like Sweden, Denmark, Norway, and Finland, demonstrates a substantial volume of bariatric surgeries performed, with Sweden contributing the largest number of patients. Data from 2019-2021 from the Scandinavian Obesity Surgery Registry shows that in Sweden, Roux-en-Y Gastric Bypass (RYGBP) has historically been prevalent, with Sleeve Gastrectomy (SG) stabilizing around 50% of primary procedures, while in Norway, SG and RYGBP were performed at comparable rates.

Colorectal cancer is a significant concern in Western Europe, with high incidence rates driving the demand for surgical interventions, often performed laparoscopically. GLOBOCAN 2022 data, published in February 2025, indicated high age-standardized incidence rates for colorectal cancer in Norway and Denmark. In the broader European colorectal surgery market, endoscopes were the largest revenue-generating product segment in 2024, emphasizing the critical role of laparoscopic visualization. A prospective observational study from Belgium, presented in February 2025, highlighted positive long-term outcomes of robotic surgery for older patients with colorectal cancer, demonstrating its feasibility and safety. This ongoing adoption of minimally invasive techniques for colorectal conditions underscores the continued growth and innovation in the Western European laparoscopic devices market.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,425.6 Million |

| Market Size by 2031 | US$ 6,185.0 Million |

| CAGR (2025 - 2031) | 8.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Western Europe

|

| Market leaders and key company profiles |

|

Medtronic Plc; Johnson & Johnson; Olympus Corp; Stryker Corp; Karl Storz SE & Co KG, Boston Scientific Corp, B Braun SE, Smith & Nephew Plc, Conmed Corp, and Intuitive Surgical Inc, are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Western Europe Laparoscopic Devices Market is valued at US$ 3,425.6 Million in 2024, it is projected to reach US$ 6,185.0 Million by 2031.

As per our report Western Europe Laparoscopic Devices Market, the market size is valued at US$ 3,425.6 Million in 2024, projecting it to reach US$ 6,185.0 Million by 2031. This translates to a CAGR of approximately 8.8% during the forecast period.

The Western Europe Laparoscopic Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Western Europe Laparoscopic Devices Market report:

The Western Europe Laparoscopic Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Western Europe Laparoscopic Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Western Europe Laparoscopic Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)