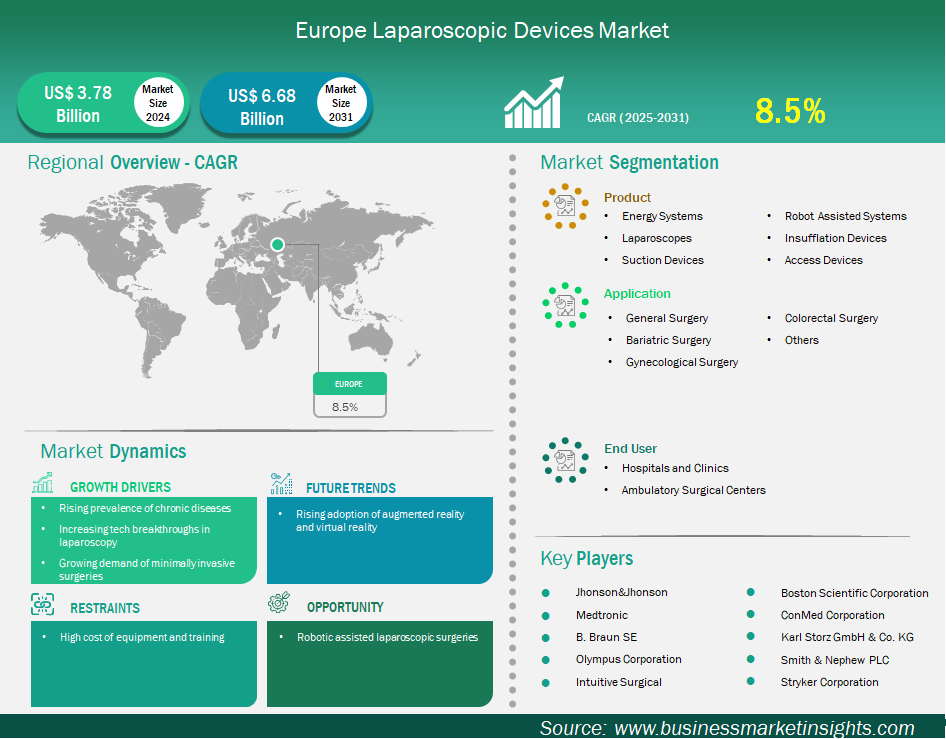

Europe laparoscopic devices market size is expected to reach US$ 6,684.4 million by 2031 from US$ 3,782.8 million in 2024. The market is estimated to record a CAGR of 8.5% from 2025 to 2031.

The laparoscopic devices market in Europe is experiencing significant growth driven by their advanced healthcare systems, emphasis on minimally invasive surgery, and increasing burden of chronic disease. Their emphasis on needing to improve surgical outcomes and patient pathways, because of the potential enabled via laparoscopic technology, is an important variable in market growth. A major driver for the growth in laparoscopic devices in Europe is the growing uptake of minimally invasive techniques in many European countries. For example, 87% of cholecystectomies (gall bladder removal surgery) that occurred in EU countries were done laparoscopically, with the lowest share coming from Bulgaria (79%) and the highest share coming from the Netherlands (96%).

Likewise, of the laparoscopic repair of inguinal hernias, 21 out of 22 EU countries saw increases in laparoscopic shares between 2012 and 2022, with the highest share being 99% in Cyprus. Laparoscopic appendectomies had similar high share adoption rates, particularly France, Bulgaria, Belgium, and the Netherlands which reported shares above 90%.

Key segments that contributed to the derivation of the laparoscopic devices market analysis are product, application, and end user.

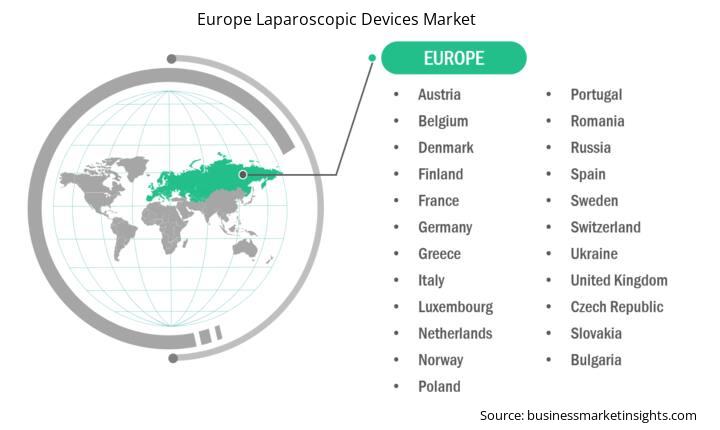

The Europe laparoscopic devices market is segmented into Belgium, Netherlands, Luxembourg, Germany, France, Italy, Russian Federation, Spain, Switzerland, Turkiye, Poland, Sweden, Austria, Switzerland, United Kingdom, Denmark, Ukraine, Romania, Greece, Portugal, Norway, and Finland. Healthcare systems rapidly take up new technology trends in Europe. In Germany, Karl Storz brought a total of 1,200 new laparoscopic instruments introduced in 2024 which includes more specialized devices to carry out minimally invasive surgeries more precisely. Furthermore, the public healthcare systems in Belgium introduced 220 high definition endoscopy towers from Olympus in 2024, this marks a step towards advancing visualization and standard patterns across many facilities. The integration of robotic-assisted surgical systems is also a significant trend, with Robot-Assisted Systems being the fastest-growing product segment in the European laparoscopic devices market. For example, Portugal integrated 40 robotic laparoscopic arms from Intuitive Surgical in 2024 into community hospitals, expanding access to minimally invasive care.

The rising incidence of chronic diseases like obesity and diabetes further propels the demand for laparoscopic devices across Europe, as these conditions often necessitate surgical interventions, with estimates suggesting that 167 million people in Europe will experience deteriorating health due to being overweight or obese by 2025. This combination of advanced healthcare infrastructure, high adoption rates, and continuous technological innovation solidifies Europe's vital role in the global laparoscopic devices market.

Based on region, the Europe laparoscopic devices market is further segmented into the Belgium, Netherlands, Luxembourg, Germany, France, Italy, Russian Federation, Spain, Switzerland, Turkiye, Poland, Sweden, Austria, Switzerland, United Kingdom, Denmark, Ukraine, Romania, Greece, Portugal, Norway, and Finland. The Germany held the largest share in 2024.

In Germany, Karl Storz brought a total of 1,200 new laparoscopic instruments introduced in 2024 which includes more specialized devices to carry out minimally invasive surgeries more precisely. Furthermore, the public healthcare systems in Belgium introduced 220 high definition endoscopy towers from Olympus in 2024, this marks a step towards advancing visualization and standard patterns across many facilities. The integration of robotic-assisted surgical systems is also a significant trend, with Robot-Assisted Systems being the fastest-growing product segment in the European laparoscopic devices market. For example, Portugal integrated 40 robotic laparoscopic arms from Intuitive Surgical in 2024 into community hospitals, expanding access to minimally invasive care. The rising incidence of chronic diseases like obesity and diabetes further propels the demand for laparoscopic devices across Europe, as these conditions often necessitate surgical interventions, with estimates suggesting that 167 million people in Europe will experience deteriorating health due to being overweight or obese by 2025.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 3,782.8 Million |

| Market Size by 2031 | US$ 6,684.4 Million |

| CAGR (2025 - 2031) | 8.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

Medtronic Plc; Johnson & Johnson; Olympus Corp; Stryker Corp; Karl Storz SE & Co KG, Boston Scientific Corp, B Braun SE, Smith & Nephew Plc, Conmed Corp, and Intuitive Surgical Inc, are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Europe Laparoscopic Devices Market is valued at US$ 3,782.8 Million in 2024, it is projected to reach US$ 6,684.4 Million by 2031.

As per our report Europe Laparoscopic Devices Market, the market size is valued at US$ 3,782.8 Million in 2024, projecting it to reach US$ 6,684.4 Million by 2031. This translates to a CAGR of approximately 8.5% during the forecast period.

The Europe Laparoscopic Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Laparoscopic Devices Market report:

The Europe Laparoscopic Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Laparoscopic Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Laparoscopic Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)