Latin America Laparoscopic Devices Market Outlook (2021-2031)

No. of Pages: 150 | Report Code: BMIPUB00031737 | Category: Life Sciences

No. of Pages: 150 | Report Code: BMIPUB00031737 | Category: Life Sciences

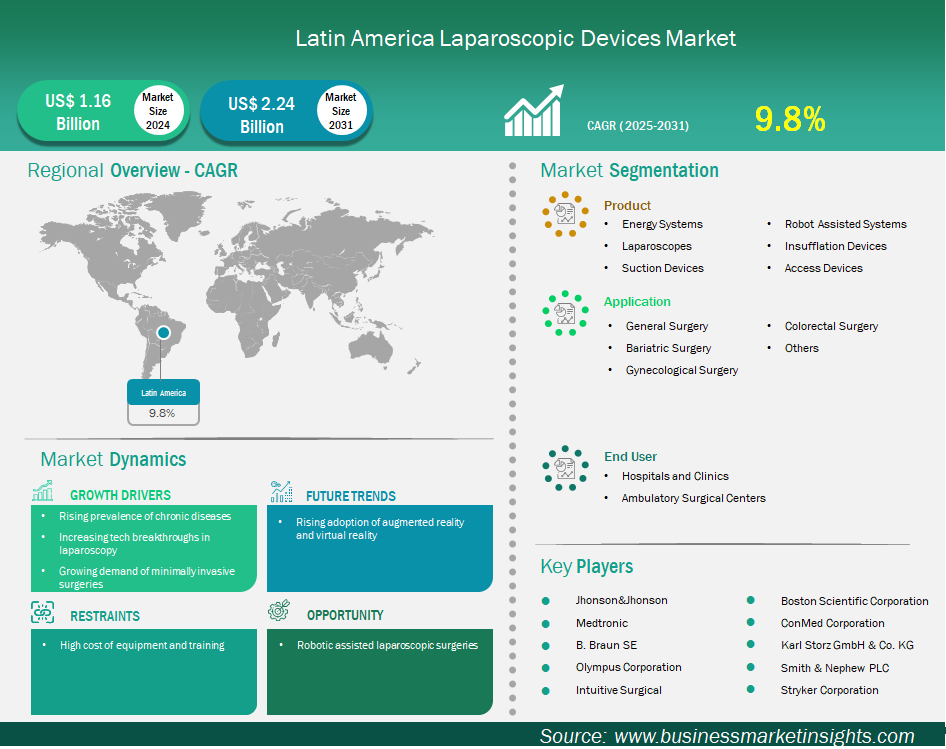

Latin America laparoscopic devices market size is expected to reach US$ 2,242.6 million by 2031 from US$ 1,161.9 million in 2024. The market is estimated to record a CAGR of 9.8% from 2025 to 2031.

The laparoscopic devices market in Latin America is experiencing significant growth driven by rising prevalence of chronic diseases, increasing tech breakthroughs in laparoscopy, and growing demand of minimally invasive surgeries. The Latin America laparoscopic devices market is growing at a rapid pace and will continue to do so because of the adoption of minimally invasive surgery and procedures, and an ever-increasing number of chronic disease cases. Market drivers include technological advancements, and countries like Brazil, Mexico, and Argentina are leading the way with the advancement of healthcare infrastructure in part to a growing understanding of the benefits of laparoscopic procedures. With the launch of CMR Surgical's Versius Surgical Robotic System in Brazil in May 2022, there is a growing trend towards robotic-assisted laparoscopic surgeries in the Brazilian area, pushing forward the laparoscopic devices market. Other trends impacting the Latin America laparoscopic devices market are found in the greater laparoscopic devices market. For example, Medtronic's release of AI capabilities with their Touch Surgery Live Stream in April 2024 would aid in improved analysis of post-operative procedures; and Olympus Corporation's launch of the new 5mm POWERSEAL Sealer/Divider devices in August 2024 that increase improvement to sealing while aiding with dissection.

Key segments that contributed to the derivation of the laparoscopic devices market analysis are product, application, and end user.

The Latin America laparoscopic devices market is segmented into Mexico, Brazil, Argentina, Peru, Chile, and Colombia. The laparoscopic devices market in Latin America is experiencing notable growth, fuelled by way of growing healthcare investments, a growing choice for minimally invasive strategies, and advancements in scientific generation. Countries inclusive of Brazil, Mexico, and Argentina are at the vanguard of this growth, driven by using factors like the developing prevalence of continual illnesses, an getting older populace, and a shift towards cost-powerful surgical alternatives. The adoption of robot-assisted laparoscopic systems is gaining momentum, particularly in personal healthcare centers, enhancing surgical precision and patient effects. However, challenges along with high system fees, restrained get admission to to professional professionals, and disparities in healthcare infrastructure throughout the place may affect the tempo of marketplace growth. Despite these challenges, the Latin American laparoscopic gadgets marketplace provides promising opportunities for growth, driven by way of ongoing healthcare reforms, technological innovations, and increasing patient call for minimally invasive surgical alternatives.

Based on region, the Latin America laparoscopic devices market is further segmented into the Mexico, Brazil, Argentina, Peru, Chile, and Colombia. The Brazil held the largest share in 2024.

Egypt has shown notable progress, being the first Latin American country to introduce robotic surgery in 2003 and maintaining well- In regards to specific surgical procedures, laparoscopic procedures continue to become more common throughout Latin America. A large study was recently done called the Latin American Surgical Outcomes Study (LASOS), conducted from June 2022 to April 2023 involving 17 Latin American countries, including Brazil, Mexico, Argentina, Peru, Chile and Colombia, surveyed just over 22,000 patients who underwent inpatient surgery, pointing to vast surgical intervention. In the realm of bariatric surgeries, a 2024 study analysing 5 years of data from the "LATAM CQI" multi-institutional registry revealed that in Mexico, Roux-en-Y gastric bypass (RYGB) was the most frequently performed bariatric procedure, followed by sleeve gastrectomy (SG). Across the broader LATAM registry (including other countries), SG was more common, followed by RYGB. This study, published December 2024, reported on 3,344 patients in Mexico and 10,383 patients from other LATAM institutions. For colorectal surgeries, research published in January 2025 indicated that Brazil has been the most prolific country in colorectal cancer research in Latin America, followed by Mexico and Argentina, suggesting a high incidence and focus on this area. While specific numbers on laparoscopic colorectal procedures are less readily available, the increasing incidence of colorectal cancer across the region, as noted in a February 2024 report, underscores the growing need for surgical interventions, with laparoscopy being a preferred method due to its advantages. Furthermore, a systematic review published in October 2024 on robotic colorectal surgery in Latin America noted the first robotic-assisted colorectal procedure in the region was conducted in Brazil in 2008, signifying the gradual adoption of advanced laparoscopic techniques.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,161.9 Million |

| Market Size by 2031 | US$ 2,242.6 Million |

| CAGR (2025 - 2031) | 9.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered | Latin America

|

| Market leaders and key company profiles |

|

Medtronic Plc; Johnson & Johnson; Olympus Corp; Stryker Corp; Karl Storz SE & Co KG, Boston Scientific Corp, B Braun SE, Smith & Nephew Plc, Conmed Corp, and Intuitive Surgical Inc, are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Latin America Laparoscopic Devices Market is valued at US$ 1,161.9 Million in 2024, it is projected to reach US$ 2,242.6 Million by 2031.

As per our report Latin America Laparoscopic Devices Market, the market size is valued at US$ 1,161.9 Million in 2024, projecting it to reach US$ 2,242.6 Million by 2031. This translates to a CAGR of approximately 9.8% during the forecast period.

The Latin America Laparoscopic Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Latin America Laparoscopic Devices Market report:

The Latin America Laparoscopic Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Latin America Laparoscopic Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Latin America Laparoscopic Devices Market value chain can benefit from the information contained in a comprehensive market report.