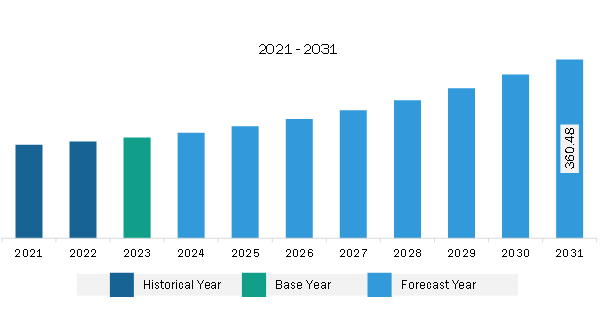

The North America flight planning software market was valued at US$ 202.71 million in 2023 and is expected to reach US$ 360.48 million by 2031; it is estimated to register a CAGR of 7.5% from 2023 to 2031.

The aviation industry has matured rapidly over the years, recording a significant number of aircraft production and deliveries. This has showcased massive order volumes for various commercial aircraft manufacturers worldwide. Commercial aviation is foreseen to surge in the coming years with an increase in air travel passengers and aircraft volumes. The increase in orders of narrow-body passenger and commercial aircraft across the globe drives the demand for flight planning software. After the COVID-19 pandemic and ongoing geopolitical wars in Europe and the Middle East, the global economy is weakening. However, people's desire to travel and the flow of travel have increased. In addition, the rapid growth of secondary and tertiary airports has continued due to the COVID-19 pandemic. Hence, airlines plan to expand to more remote locations by launching routes to smaller city airports. With the increasing number of aircraft and airports, the demand for flight planning software is also rising.

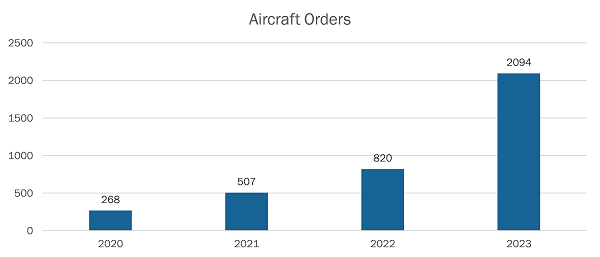

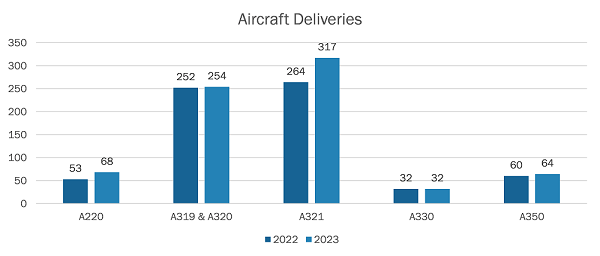

In 2022 and 2023, Boeing and Airbus have witnessed a significant increase in orders for narrow-body aircraft. According to the Airbus order and delivery database, there were 820 commercial aircraft orders in 2022, which rose to 2094 in 2023, as shown in the above figure. Moreover, according to the data, there was an increase in deliveries for narrow-body aircraft—such as A220, A319, A320, and A321—compared to the wide-body aircraft—such as A330 and A350—in 2023, which is shown in the figure below.

Airbus and Boeing are the two aircraft manufacturing giants with significantly higher volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) continuously encounter orders for various aircraft models from civil airlines. The table below highlights the comparison of orders and deliveries from Airbus and Boeing during 2020–2023:

|

Years |

2020 |

2021 |

2022 |

2023 |

||||

|

Commercial Aircraft |

||||||||

|

Aircraft Manufacturers |

Boeing |

Airbus |

Boeing |

Airbus |

Boeing |

Airbus |

Boeing |

Airbus |

|

Orders |

184 |

383 |

909 |

771 |

935 |

1078 |

1456 |

2319 |

|

Deliveries |

157 |

566 |

340 |

609 |

480 |

661 |

528 |

735 |

Airbus forecasts that 40,850 new passenger and cargo aircraft will be delivered from 2023 to 2042, of which 32,630 will be typical single-aisle aircraft, and 8,220 will be typical wide-body aircraft. In addition, the demand for freight aircraft is projected to reach 2,510 aircraft, with 920 newly built during the same timeframe. Thus, the increase in orders and deliveries of narrow-body aircraft drives the flight planning software market.

The US, Canada, and Mexico are the major economies in North America. The expansion of aircraft fleets across the region primarily drives the flight planning software industry in North America. Additionally, the growing aviation industry in countries such as the US and Canada drives the flight planning software market. The aviation industry is one of the most notable industries in the US. According to data released by Airlines for America in 2023, commercial aviation accounted for 5% of US GDP and US$ 1.37 trillion in 2023. In addition to the rise in air passenger traffic, government initiatives to increase aircraft fleets in defense and commercial aviation sectors are expected to fuel the demand for flight management solutions such as flight planning software during the forecast period.

According to The Insight Partners analysis, in 2023, North America had a fleet of more than 8,000 operational commercial aircraft, which is expected to reach ~10,000 by the end of 2033. Such a large number of operating commercial aircraft will further generate the demand for flight planning software in the region. Additionally, the increase in the number of aircraft fleets across North America is expected to increase the need for flight planning software solutions for applications, including flight route optimization, flight scheduling, reduced fuel consumption, and weather forecasting. Furthermore, one of the factors boosting the flight planning software market is the continued emphasis on increasing regulations related to the safety and security of travelers in the region.

The North America flight planning software market is categorized into deployment, application, component, and country.

Based on deployment, the North America flight planning software market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2023.

Based on component, the North America flight planning software market is bifurcated into software and services. The software segment held a larger market share in 2023.

By application, the North America flight planning software market is segmented into logistics and cargo, airport, private airlines, commercial airlines, flight school and training center, and military & defense. The commercial airlines segment held the largest market share in 2023.

By country, the North America flight planning software market is segmented into the US, Canada, and Mexico. The US dominated the North America flight planning software market share in 2023.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 202.71 Million |

| Market Size by 2031 | US$ 360.48 Million |

| CAGR (2023 - 2031) | 7.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

CAE Inc; Collins Aerospace; NAV Flight Services LLC; Jeppesen Sanderson, Inc.; Sabre Corp; NAVBLUE; FSS GmbH; Laminaar Aviation Infotech Pte Ltd; Chetu Inc; AIMS INTL DWC LLC; eTT Aviation; ForeFlight LLC; Amadeus IT Group SA; Universal Weather and Aviation, Inc.; Airsupport A/S; Deutsche Lufthansa AG; and RocketRoute Ltd. are some of the leading companies operating in the flight planning software market.

The North America Flight Planning Software Market is valued at US$ 202.71 Million in 2023, it is projected to reach US$ 360.48 Million by 2031.

As per our report North America Flight Planning Software Market, the market size is valued at US$ 202.71 Million in 2023, projecting it to reach US$ 360.48 Million by 2031. This translates to a CAGR of approximately 7.5% during the forecast period.

The North America Flight Planning Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Flight Planning Software Market report:

The North America Flight Planning Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Flight Planning Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Flight Planning Software Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)