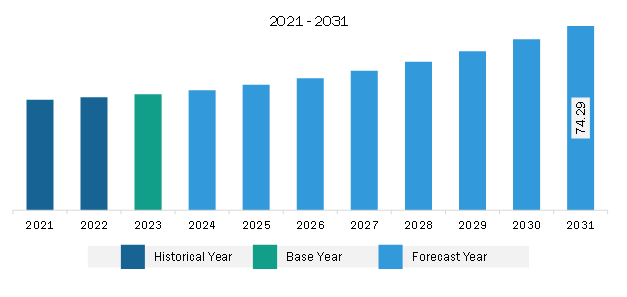

The South & Central America flight planning software market was valued at US$ 46.67 million in 2023 and is expected to reach US$ 74.29 million by 2031; it is estimated to register a CAGR of 6.0% from 2023 to 2031.

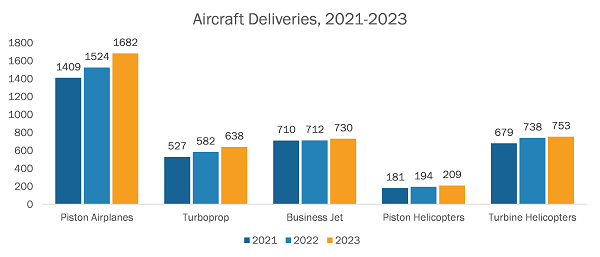

The global rise in orders for general aviation aircraft and helicopters from airlines in 2022 and 2023 resulted in increased deliveries in 2023. As per the General Aviation Manufacturers Association (GAMA) data, 3,050 airplanes and 962 helicopters were delivered in 2023, with an increase of 9% and 9.8%, respectively, compared to 2022. In addition, the increase in backlogs for all segments of general aviation aircraft and helicopters is expected to further surge deliveries from 2023 to 2031. As per the data from GAMA, the number of deliveries of different types of general aviation aircraft and helicopters from 2021 to 2023 is shown in the figure below.

Hence, according to GAMA data, airplane and helicopter deliveries increased from 2021 to 2023, resulting in a rise in demand for flight planning software for applications such as weather monitoring, flight schedule, operational efficiency, flight route planning, data-driven decision making, airline fuel efficiency, and altitude profiling.

Brazil has a large commercial aviation market. As per the National Civil Aviation Agency (ANAC), 831,000 flights were recorded in Brazil in 2022, an increase of 39% compared to 2021. Of these, 731,000 were domestic flights (an increase of 33.7%), and 100,000 were international flights (an increase of 89%). The Brazil flight planning software market is experiencing significant growth, driven by increased airport expansion plans, aircraft fleets, and economic development. Major airports in Brazil are undergoing expansions and modernization projects to accommodate the rising number of passengers, which is anticipated to boost the demand for flight management software for flight scheduling, route optimization, and increasing fuel efficiency. For example, in May 2023, VINCI Airports (a subsidiary of VINCI Group) started the expansion and modernization of Boa Vista airport in Roraima, Brazil, which included the complete renovation of the runway and terminal and expansion of the departure lounge.

The government has developed several initiatives to strengthen its aviation industry. Increasing support for improving the manufacturing production and supply chain which in turn is also supporting the aviation industry for the import and export of manufacturing goods by air cargo flights. For example, in December 2020, Embraer, one of the leading manufacturers in Brazil, delivered the C-390 Millennium medium multi-role transport aircraft to the Brazilian Air Force. It is the fourth aircraft the company has delivered out of 28 deliveries to the Brazilian Air Force (FAB). The company also delivered the first next-generation E2 Embraer aircraft to Belavia and Belarusian Airlines in Brazil. The increase in aircraft fleets and significant investments in the development of aircraft are expected to create key opportunities for flight planning software market growth during the forecast period.

The South & Central America flight planning software market is categorized into deployment, application, component, and country.

Based on deployment, the South & Central America flight planning software market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2023.

Based on component, the South & Central America flight planning software market is bifurcated into software and services. The software segment held a larger market share in 2023.

By application, the South & Central America flight planning software market is segmented into logistics and cargo, airport, private airlines, commercial airlines, flight school and training center, and military & defense. The commercial airlines segment held the largest market share in 2023.

By country, the South & Central America flight planning software market is segmented into Brazil, Argentina, and the Rest of SAM. Brazil dominated the South & Central America flight planning software market share in 2023.

CAE Inc; Collins Aerospace; NAV Flight Services LLC; Jeppesen Sanderson, Inc.; Sabre Corp; NAVBLUE; FSS GmbH; Laminaar Aviation Infotech Pte Ltd; Chetu Inc; AIMS INTL DWC LLC; eTT Aviation; ForeFlight LLC; Amadeus IT Group SA; Universal Weather and Aviation, Inc.; Airsupport A/S; Deutsche Lufthansa AG; and RocketRoute Ltd. are some of the leading companies operating in the flight planning software market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 46.67 Million |

| Market Size by 2031 | US$ 74.29 Million |

| CAGR (2023 - 2031) | 6.0% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Flight Planning Software Market is valued at US$ 46.67 Million in 2023, it is projected to reach US$ 74.29 Million by 2031.

As per our report South & Central America Flight Planning Software Market, the market size is valued at US$ 46.67 Million in 2023, projecting it to reach US$ 74.29 Million by 2031. This translates to a CAGR of approximately 6.0% during the forecast period.

The South & Central America Flight Planning Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Flight Planning Software Market report:

The South & Central America Flight Planning Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Flight Planning Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Flight Planning Software Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)