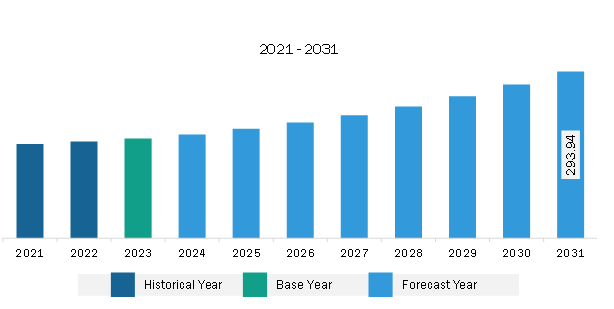

The Europe flight planning software market was valued at US$ 175.73 million in 2023 and is expected to reach US$ 293.94 million by 2031; it is estimated to register a CAGR of 6.6% from 2023 to 2031.

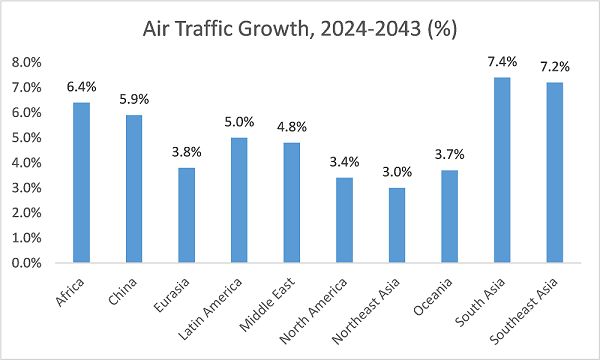

According to Airbus GMF 2024 study on global aircraft fleet and traffic, the aviation fleet is expected to grow from 24,260 aircraft in 2023 and reach 48,230 aircraft by 2043. This is owing to the continued growth in demand for air travel, building on the rapid recovery since COVID-19 travel restrictions. According to the study by Avolon, China, India, Asia, and South America are expected to show more than 3.5% growth in air travel from 2023 to 2042; however, North America and Europe will register moderate growth between 2 and 3% during this timeframe. In addition, the massive rise in the number of aircraft fleets from the regions mentioned above is expected to create opportunities for key flight-planning software manufacturers across the globe.

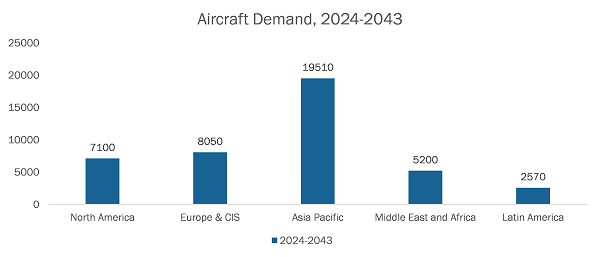

According to the Airbus GMF, the demand for new aircraft between 2024 and 2043 was valued at 42,430 units. Asia Pacific is expected to register 45.98% of the total demand for new aircraft during the study period, followed by Europe & CIS and North America. Single Aisle body aircraft is expected to account for more than 80% of the total new aircraft demand globally from 2024 to 2043. In addition, the demand for freight aircraft is expected to be valued at 2,470 units during 2024–2043.

According to the ch-aviation GmbH data on aircraft fleet orders from across the world, in June 2023, the US accounted for the highest number of aircraft orders (excluding military aircraft and aircraft with unknown operator/engine) globally, with a total of 3,147 aircraft on order, followed by Ireland, China, and India with 1,247; 1,239; and 888 aircraft orders, respectively. According to the same data, the top five consumers with aircraft orders were United Airlines, IndiGo Airlines, Lion Air, Air Lease Corporation, and AirAsia. Such an increase in orders and the growth of the global aircraft fleet are expected to fuel the demand for flight planning software, creating opportunities for the key players operating in the market from 2023 to 2031. According to the Oliver Wyman analysis, the global commercial aircraft fleet currently stands at ~28,398 aircraft and is expected to reach ~36,413 aircraft by the end of 2034.

Hence, the increasing global aircraft fleet size and air traffic growth are projected to generate new opportunities for software (digital solution) suppliers, including flight planning software providers, in the coming years.

The Europe flight planning software market is segmented into Germany, Italy, Russia, France, the UK, and the Rest of Europe. With more than 20,000 flights per day and ~500 million passengers per year, Europe is considered the busiest airspace in the world. In addition, defense and commercial aviation sectors in Europe are inclining toward advanced flight management technologies. Strong economic conditions and increased initiatives by European governments to ensure aviation sector growth are the main factors driving the flight planning software market in the region. Countries such as France, Germany, and the UK are the leading countries in Europe with a large number of aircraft and airports. Germany and France are among the major exporters of advanced aircraft technologies and are leaders in the region's flight planning software market.

Other countries in Europe, such as Poland, the UK, and Belgium, are initiating new airport projects, resulting in a significant demand for aircraft fleets. Poland, for example, has announced a plan to build a Solidarity Transport Hub in Baranow County, near Warsaw, by 2027 to handle almost 40 million passengers. The renovation of Son Sant Joan Airport in Mallorca, Spain, began in the first quarter of 2023 and is expected to be completed by 2026. Therefore, the construction of new airports and renovation of existing airports will increase the aircraft fleet in the region, driving the flight planning software market growth from 2023 to 2031.

The Europe flight planning software market is categorized into deployment, application, component, and country.

Based on deployment, the Europe flight planning software market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2023.

Based on component, the Europe flight planning software market is bifurcated into software and services. The software segment held a larger market share in 2023.

By application, the Europe flight planning software market is segmented into logistics and cargo, airport, private airlines, commercial airlines, flight school and training center, and military & defense. The commercial airlines segment held the largest market share in 2023.

By country, the Europe flight planning software market is segmented into Germany, France, Italy, the UK, Russia, and the Rest of Europe. Germany dominated the Europe flight planning software market share in 2023.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 175.73 Million |

| Market Size by 2031 | US$ 293.94 Million |

| CAGR (2023 - 2031) | 6.6% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

CAE Inc; Collins Aerospace; NAV Flight Services LLC; Jeppesen Sanderson, Inc.; Sabre Corp; NAVBLUE; FSS GmbH; Laminaar Aviation Infotech Pte Ltd; Chetu Inc; AIMS INTL DWC LLC; eTT Aviation; ForeFlight LLC; Amadeus IT Group SA; Universal Weather and Aviation, Inc.; Airsupport A/S; Deutsche Lufthansa AG; and RocketRoute Ltd. are some of the leading companies operating in the flight planning software market.

The Europe Flight Planning Software Market is valued at US$ 175.73 Million in 2023, it is projected to reach US$ 293.94 Million by 2031.

As per our report Europe Flight Planning Software Market, the market size is valued at US$ 175.73 Million in 2023, projecting it to reach US$ 293.94 Million by 2031. This translates to a CAGR of approximately 6.6% during the forecast period.

The Europe Flight Planning Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Flight Planning Software Market report:

The Europe Flight Planning Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Flight Planning Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Flight Planning Software Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)