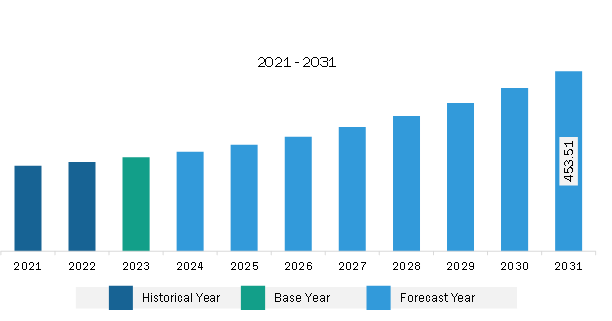

The Asia Pacific flight planning software market was valued at US$ 236.22 million in 2023 and is expected to reach US$ 453.51 million by 2031; it is estimated to register a CAGR of 8.5% from 2023 to 2031.

The evolving scenario of modern warfare has forced governments of various countries worldwide to allocate significant resources and financial assistance to respective defense and military forces. The defense budget supports the army and armed forces in purchasing improved technologies and equipment from domestic or international developers. On the other hand, modernizations of military and army vehicles are increasing due to the increasing defense spending. In addition, the increasing government spending shows that the government is focused on strengthening the national security forces.

Governments of various countries are taking several initiatives to deploy a huge number of military bases and military airports for ground, airborne, and naval operations. As per the Stockholm International Peace Research Institute (SIPRI), global military expenditure increased to US$ 2,332 billion in 2023, representing a 6% increase from 2022. The US, China, India, Russia, the UK, and Saudi Arabia were a few major military spending countries in 2023, with increased new military air base and airport deployments. The figure given below depicts the yearly spending of the countries mentioned above.

|

Country |

2020 (US$ Million) |

2021 (US$ Million) |

2022 (US$ Million) |

2023 (US$ Million) |

|

US |

880,185.2 |

870,751.2 |

860,692.2 |

880,070.6 |

|

China |

257,973.4 |

293,351.9 |

291,958.4 |

309,484.3 |

|

Russia |

77,544.9 |

79,081.2 |

102,366.6 |

126,473.4 |

|

UK |

62,064.9 |

63,008.2 |

64,081.6 |

69,153.2 |

|

India |

77,085.5 |

76,596.9 |

79,976.8 |

83,334.5 |

|

Saudi Arabia |

68,182.2 |

64,758.1 |

70,920.0 |

73,983.9 |

Source: SIPRI

The increasing military expenditure encourages investments in the development of new military infrastructure such as air bases, runways, and other military airport infrastructures and military fleet expansion. Thus, the rising investment in new military infrastructure development projects and fleet expansion is expected to provide growth opportunities for flight planning software providers across the globe.

China is densely populated and one of the major exporters of consumer and industrial goods. As a result, the airlines with cargo services are investing significant capital in expanding the aircraft fleet to fulfill the demand for cargo transportation. For instance, in June 2023, China Airlines signed firm orders for eight Boeing 787 passenger aircraft at the Paris Air Show. The 787 fleet will increase to 24 aircraft after all ordered aircraft are delivered by 2028. In August 2022, China Airlines decided to purchase 16 Boeing 787 passenger aircraft fitted with General Electric GEnx engines, with expected delivery by 2025. The rise in investment in expanding the aircraft fleet is anticipated to drive the flight planning software market from 2023 to 2031. The government of China's commitment to establishing key airports as international hubs has resulted in colossal investments, cutting-edge terminals, and advanced technologies. For example, according to the government's transportation network planning outline, China aimed to add 400 airports by 2035, with a current fleet of more than 240 in 2022. In addition, as per the Civil Aviation Administration of China (CAAC), China has 32 airports suffering from capacity overload, and 40 of the country's 50 largest airports need renovation or expansion. China's 14th Five-Year Plan covers 140 airport projects, including greenfield construction, relocation, renovation, and expansion, by 2025. With sustained investments and a focus on innovation toward airport infrastructure, China continues to shape its airport infrastructure to accommodate escalating passenger numbers and assert its influence in the global aviation landscape. This is expected to boost the demand for flight planning software to monitor and analyze the rise in the number of flights, schedule routes, and optimize fuel efficiency and air traffic in the coming years.

The Asia Pacific flight planning software market is categorized into deployment, application, component, and country.

Based on deployment, the Asia Pacific flight planning software market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2023.

Based on component, the Asia Pacific flight planning software market is bifurcated into software and services. The software segment held a larger market share in 2023.

By application, the Asia Pacific flight planning software market is segmented into logistics and cargo, airport, private airlines, commercial airlines, flight school and training center, and military & defense. The commercial airlines segment held the largest market share in 2023.

By country, the Asia Pacific flight planning software market is segmented into Australia, China, India, Japan, South Korea, and the Rest of Asia Pacific. China dominated the Asia Pacific flight planning software market share in 2023.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 236.22 Million |

| Market Size by 2031 | US$ 453.51 Million |

| CAGR (2023 - 2031) | 8.5% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

CAE Inc; Collins Aerospace; NAV Flight Services LLC; Jeppesen Sanderson, Inc.; Sabre Corp; NAVBLUE; FSS GmbH; Laminaar Aviation Infotech Pte Ltd; Chetu Inc; AIMS INTL DWC LLC; eTT Aviation; ForeFlight LLC; Amadeus IT Group SA; Universal Weather and Aviation, Inc.; Airsupport A/S; Deutsche Lufthansa AG; and RocketRoute Ltd. are some of the leading companies operating in the flight planning software market.

The Asia Pacific Flight Planning Software Market is valued at US$ 236.22 Million in 2023, it is projected to reach US$ 453.51 Million by 2031.

As per our report Asia Pacific Flight Planning Software Market, the market size is valued at US$ 236.22 Million in 2023, projecting it to reach US$ 453.51 Million by 2031. This translates to a CAGR of approximately 8.5% during the forecast period.

The Asia Pacific Flight Planning Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Flight Planning Software Market report:

The Asia Pacific Flight Planning Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Flight Planning Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Flight Planning Software Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)