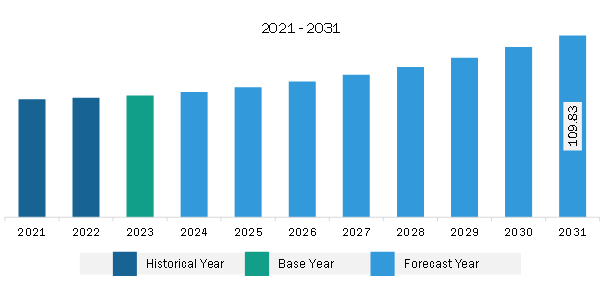

The Middle East & Africa flight planning software market was valued at US$ 73.65 million in 2023 and is expected to reach US$ 109.83 million by 2031; it is estimated to register a CAGR of 5.1% from 2023 to 2031.

The use of artificial intelligence (AI) in the field of flight management operations, such as flight planning, route optimization, and flight scheduling, has gained a lot of attention and interest in recent years. The development of AI-supported flight planning systems is still in its nascent stage; however, it holds the potential to fundamentally change the process of flight planning. The discipline of flight planning is undergoing significant change and transformation due to the emergence and further development of artificial intelligence (AI). AI-supported systems are currently being used to automate various operations, make predictions, and provide helpful recommendations to pilots and dispatchers in planning flights that are both more efficient and safer. This allows airlines to quickly adapt to dynamic circumstances and improve real-time flight plans in flight.

Applications of artificial intelligence (AI) contribute to the establishment of an air transport system that is both effective and efficient while promoting sustainability. AI technologies have the potential to revolutionize flight planning operations, resulting in increased efficiency and effectiveness. There is one worldwide growing trend among airlines to implement artificial intelligence (AI) systems for the purpose of optimizing flight routes. Notable airline examples include United Airlines, Delta Airlines, Alaska Airlines, and American Airlines, which use AI-integrated software for flight management operations. It is expected that the continuous development of AI technology will lead to the dissemination of breakthrough and paradigm-changing applications within this domain. Airline operators are integrating artificial intelligence (AI)-capable software for subsequent tasks such as analyzing weather data, traffic data, weather forecasting, fuel-use optimization, and flight planning analysis.

Companies and airline operators are increasingly engaged in adopting strategies to focus on the integration of advanced technologies such as AI, machine learning, automation, and digitalization to improve flight management experience. Hence, the rise in the adoption of artificial intelligence (AI) in flight management operations is expected to be the key trend in the flight planning software market during the forecast period.

The UAE is moving strongly toward industrialization; hence, the adoption of modern technologies is increasing, which is boosting the country's economic growth. Due to industrialization, growing trade, and rise in air passengers, air traffic is growing, and an increase in the number of international passengers and aircraft is being witnessed. Many airlines operate in the country. As a result of the growing air traffic, airport facilities are expanding their passenger handling capacity. For example, the Sharjah Airport Authority (SAA) initiated the New Sharjah International Airport Expansion project and expected to be completed by 2027, aiming to accommodate 20 million passengers by 2027. Therefore, the increasing number of airport expansion projects is expected to increase the number of aircraft fleets and ultimately boost the demand for flight management solutions such as flight planning software, which help pilots in route planning and optimization, flight planning, fuel consumption, travel duration, vehicle weight, weather condition forecast, and air traffic management.

As per the International Trade Administration (ITA), in 2023, Emirates Airlines operated 120 Airbus A380-800s, 124 Boeing 777-300ERs, and 10 Boeing 777-200LRs. Its SkyCargo division also operates 11 Boeing 777 freighters. Etihad Airways operated 79 aircraft: 39 Boeing 787s, 7 Boeing 777s, 19 Airbus A320s, 5 Airbus 350s, and 5 Boeing 777 freighters. Air Arabia Airlines operated 42 Airbus 320 aircraft, and Flydubai operated 78 Boeing 737 aircraft in 2023. Wizz Air Abu Dhabi operated 9 aircraft, and Air Arabia Abu Dhabi operated 8 aircraft. Emirates and Etihad are in talks with Boeing and Airbus about delivering new aircraft and changing orders to better align their fleet mix with the expected demand. In November 2023, Emirates ordered 95 additional wide-body aircraft from Boeing, including Boeing 777-8s, 777-9s, and 787s worth US$ 52 billion. The expansion of aircraft fleets by airlines is expected to fuel the demand for flight planning software to help pilots derive the best flight route, travel period, weather forecast, and fuel use optimization, which, in turn, is projected to boost the market growth during the forecast period.

The Middle East & Africa flight planning software market is categorized into deployment, application, component, and country.

Based on deployment, the Middle East & Africa flight planning software market is bifurcated into cloud and on-premise. The cloud segment held a larger market share in 2023.

Based on component, the Middle East & Africa flight planning software market is bifurcated into software and services. The software segment held a larger market share in 2023.

By application, the Middle East & Africa flight planning software market is segmented into logistics and cargo, airport, private airlines, commercial airlines, flight school and training center, and military & defense. The commercial airlines segment held the largest market share in 2023.

By country, the Middle East & Africa flight planning software market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The UAE dominated the Middle East & Africa flight planning software market share in 2023.

CAE Inc; Collins Aerospace; NAV Flight Services LLC; Jeppesen Sanderson, Inc.; Sabre Corp; NAVBLUE; FSS GmbH; Laminaar Aviation Infotech Pte Ltd; Chetu Inc; AIMS INTL DWC LLC; eTT Aviation; ForeFlight LLC; Amadeus IT Group SA; Universal Weather and Aviation, Inc.; Airsupport A/S; Deutsche Lufthansa AG; and RocketRoute Ltd. are some of the leading companies operating in the flight planning software market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 73.65 Million |

| Market Size by 2031 | US$ 109.83 Million |

| CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Component

|

| Regions and Countries Covered |

Middle East and Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Flight Planning Software Market is valued at US$ 73.65 Million in 2023, it is projected to reach US$ 109.83 Million by 2031.

As per our report Middle East & Africa Flight Planning Software Market, the market size is valued at US$ 73.65 Million in 2023, projecting it to reach US$ 109.83 Million by 2031. This translates to a CAGR of approximately 5.1% during the forecast period.

The Middle East & Africa Flight Planning Software Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Flight Planning Software Market report:

The Middle East & Africa Flight Planning Software Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Flight Planning Software Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Flight Planning Software Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)