Europe Clinical Trials Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 136 | Report Code: BMIRE00028989 | Category: Life Sciences

No. of Pages: 136 | Report Code: BMIRE00028989 | Category: Life Sciences

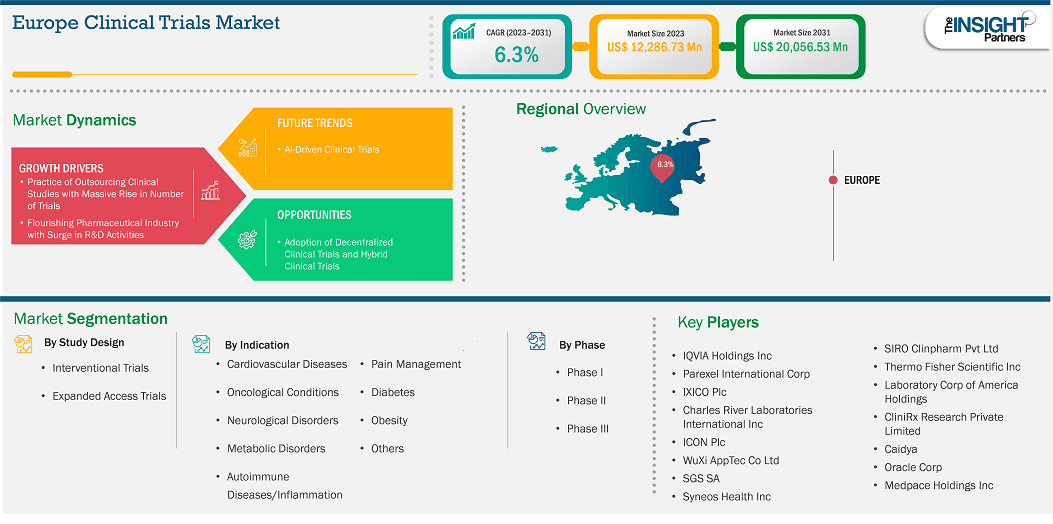

The Europe clinical trials market size is expected to reach US$ 20,056.53 million by 2031 from US$ 12,286.73 million in 2023. The market is estimated to record a CAGR of 6.3% from 2023 to 2031.

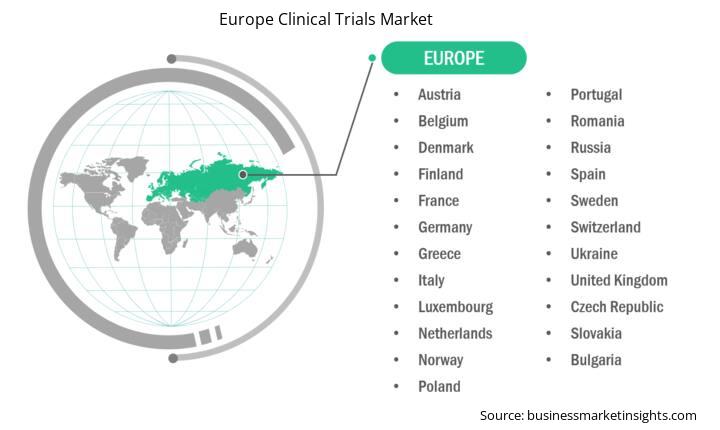

The Europe clinical trials market has been segmented into the UK, France, Germany, Italy, Spain, Poland, Switzerland, Sweden, Denmark, Belgium, the Netherlands, and the Rest of Europe. The increase in the number of clinical trial activities for new drug development and innovative product launches by companies are likely to boost the market growth in Europe during the forecast period. The clinical trials market in Europe is shaped by strong regulatory frameworks, robust healthcare infrastructure, and increased focus on rare and chronic diseases. Governments and regulatory bodies promote transparency and patient safety, while growing partnerships with contract research organizations (CROs) support efficiency. However, lengthy approval timelines and high costs remain key challenges.

Key segments that contributed to the derivation of the Europe clinical trials market analysis are study design, indications, and phase type.

Subjects enrolled in decentralized clinical trials (DCT) do not need to access hospital-based trial sites frequently. In DCTs, digital technologies are used to enable access of patients for clinical research, remote data collection and monitoring, and communication between investigators and participants. A hybrid clinical trial approach combines home-based and on-site activities, bringing the best patient experience and meeting complex protocol regimes, gaining traction across various therapeutic areas and trial phase journeys. Initially, the adoption of DCT was affected due to challenges such as patient privacy, data security, regulatory barriers, and complex protocol regimes. However, the COVID-19 pandemic compelled the sponsors of clinical trials to adopt decentralized and hybrid clinical techniques for developing drugs, as in-person studies were not feasible amid this health crisis. With restrictions imposed on commute, the only way to gather data and keep trials going was to work remotely and make optimal use of technologies to accelerate processes. According to the data provided by McKinsey, ~70% of the potential participants for clinical trials stay away from trial sites. Therefore, decentralization broadens trial access to reach a larger number of subjects, consisting of potentially a more diverse pool of patients.

Hybrid clinical trials allow sponsors to strategically incorporate DCT elements into study designs. These trial models offer unprecedented flexibility; thus, more companies are showing interest in hybrid trials, which is redefining the industry landscape. According to ObvioHealth, the FDA had plans to unveil protocols to support the use of DCT methods in 2023 to enhance the credibility of future clinical research. Thus, the increasing focus on using decentralized and hybrid clinical trials over traditional clinical trial methods is expected to provide lucrative opportunities for the clinical trials market during the forecast period.

Based on country, the Europe clinical trials market comprises the UK, Germany, France, Spain, Italy, Poland, Switzerland, Sweden, Denmark, Belgium, the Netherlands, and the Rest of Europe. Germany held the largest share in 2023.

According to Clinical Trials Arena, Germany held ~3.9% of the total clinical trials carried out globally in 2021. Moreover, there is a large patient pool and a high demand for quality healthcare in the country. Coordinating centers for clinical trials were established as part of a new funding program under the Federal Ministry of Education and Research to foster academic clinical research. Clinical trials in Germany are approved by the Federal Institute for Drugs and Medical Devices or the Paul-Ehrlich Institute, depending on the product to be investigated. Therefore, Germany's clinical trial approval processes are standardized, reliable, transparent, and approved for relatively short study start-up timelines. Further, top CROs in Germany provide several clinical trial services. Sofpromed manages clinical trials in Germany and other EU member states. It offers a full range of CRO services for pharmaceutical and biotechnology companies. Similarly, CONET GmbH, headquartered in Mannheim, Germany, offers clinical trial management services from small pilot studies to large multicenter international clinical trials for all phases (1–4), including pediatric clinical trials and medical device trials as per EU Directives.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 12,286.73 Million |

| Market Size by 2031 | US$ 20,056.53 Million |

| CAGR (2023 - 2031) | 6.3% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Study Design

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include QVIA Holdings Inc, Parexel International Corp, IXICO Plc, Charles River Laboratories International Inc, ICON Plc, WuXi AppTec Co Ltd, SGS SA, Syneos Health Inc, Thermo Fisher Scientific Inc, Laboratory Corp of America Holdings, CliniRx Research Private Limited, Caidya, Oracle Corp, Medpace Holdings Inc, and SIRO Clinpharm Pvt Ltd, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Clinical Trials Market is valued at US$ 12,286.73 Million in 2023, it is projected to reach US$ 20,056.53 Million by 2031.

As per our report Europe Clinical Trials Market, the market size is valued at US$ 12,286.73 Million in 2023, projecting it to reach US$ 20,056.53 Million by 2031. This translates to a CAGR of approximately 6.3% during the forecast period.

The Europe Clinical Trials Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Clinical Trials Market report:

The Europe Clinical Trials Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Clinical Trials Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Clinical Trials Market value chain can benefit from the information contained in a comprehensive market report.