North America Clinical Trials Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 125 | Report Code: BMIRE00029014 | Category: Life Sciences

No. of Pages: 125 | Report Code: BMIRE00029014 | Category: Life Sciences

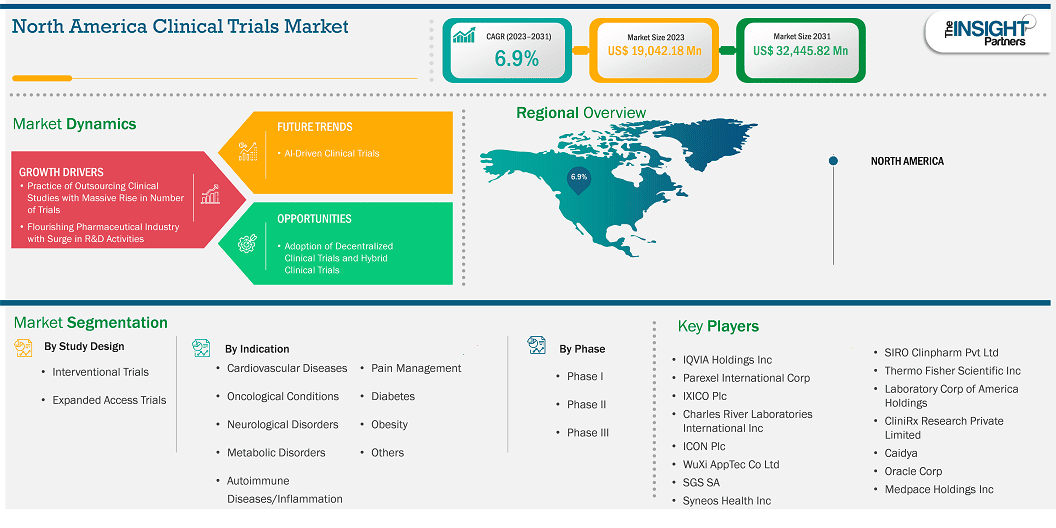

The North America clinical trials market size is expected to reach US$ 32,445.82 million by 2031 from US$ 19,042.18 million in 2023. The market is estimated to record a CAGR of 6.9% from 2023 to 2031.

The North America clinical trials market is highly advanced, supported by strong healthcare infrastructure, extensive research funding, and a large patient pool. Innovation in technology and personalized medicine drives trial design and execution. Collaboration between pharmaceutical companies and contract research organizations (CROs) enhances efficiency. However, stringent regulatory requirements and rising costs remain challenges, requiring continuous adaptation to maintain growth and streamline drug development processes.

Key segments that contributed to the derivation of the North America clinical trials market analysis are study design, indications, and phase type.

Research is a significant and essential part of the pharmaceutical, biopharmaceutical, and medical device industries, among others, which enables them to come up with new solutions for various therapeutic applications with significant medical and commercial potential. The pharmaceutical industry is one of the most R&D-intensive industries in the world. Efforts are being made to achieve greater effectiveness and efficiency in fulfilling patients' needs. The cost of medicines has been a prime concern for pharmaceutical companies as they bank on their R&D activities to achieve intended cost targets. Over the last decade, the number of new drugs approved yearly has also increased. The Food and Drug Administration (FDA) approved 37 new drugs annually in 2022. Globally, the US is a leading country in terms of R&D investments, and the country produced over 50% of the world's new molecules in the past decade. As per the European Federation of Pharmaceutical Industries and Associations (EFPIA), in 2021, North America accounted for 49.1% of global pharmaceutical sales. The US accounted for 64.4% of sales of new medicines launched during 2016–2021.

|

|

|

Takeda Pharmaceutical Co Ltd | 4.2 | 5.08 |

Pfizer Inc | 11.4 | 10.6 |

Grifols SA | 427.05 | 432.71 |

Note: The current conversion rate is considered for presenting the currencies.

Source: Annual Reports and The Insight Partners Analysis

R&D expenditure is instrumental in companies' efforts to discover, examine, and produce new products; make upfront payments; improve existing outcomes; and demonstrate product efficacy and regulatory compliance before launch. These investments differ as per the need and demand for clinical trials. The cost includes materials, supplies used, and employee salaries, along with the cost of developing quality control. According to PhRMA Member Companies 2021 report, the top 15 largest pharmaceutical companies by revenue invested US$ 133 billion in R&D cumulatively, and ~44% of the total R&D investment was allocated to clinical trials. These companies, in collaboration with hospitals, are investing in developing products to treat various diseases and disorders, including immunological disorders. In June 2021, Takeda announced ADVANCE-1, a randomized, placebo-controlled, double-blind Phase 3 clinical trial to evaluate HYQVIA [Immune Globulin Infusion 10% (Human) with Recombinant Human Hyaluronidase] to maintain treatment of chronic inflammatory demyelinating polyradiculoneuropathy (CIDP) as its primary endpoint. Thus, increasing R&D investments by companies are fueling the clinical trials market growth.

Based on country, the North America clinical trials market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

The US has become a leading clinical research destination. Nearly half of the clinical trials are conducted in the US. Additionally, most pharmaceutical research companies prefer to conduct clinical trials in the US due to established medical infrastructure, rapid approval timelines, a favorable regulatory framework, and accepted clinical trial-generated data globally. A World Health Organization (WHO) report states that the US had the highest number of clinical trials, with 157,618 trials in 2021. The growth of the clinical trials market in the US can be attributed to innovative products launched by companies for applications in clinical trials. Medical Metrics, a clinical research organization (CRO) providing various services for clinical trials, offers "Assessa." This product assists in the decision-making process of drug discovery and related clinical studies. It helps discover drugs for neurological disorders, such as dementia, cognitive impairment, Alzheimer's disease, Parkinson's Disease, Schizophrenia, and other memory-related diseases. The rising number of clinical trials in the US favors the growth of the clinical trials market in the country.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 19,042.18 Million |

| Market Size by 2031 | US$ 32,445.82 Million |

| CAGR (2023 - 2031) | 6.9% |

| Historical Data | 2021-2022 |

| Forecast period | 2024-2031 |

| Segments Covered |

By Study Design

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include QVIA Holdings Inc, Parexel International Corp, IXICO Plc, Charles River Laboratories International Inc, ICON Plc, WuXi AppTec Co Ltd, SGS SA, Syneos Health Inc, Thermo Fisher Scientific Inc, Laboratory Corp of America Holdings, CliniRx Research Private Limited, Caidya, Oracle Corp, Medpace Holdings Inc, and SIRO Clinpharm Pvt Ltd, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Clinical Trials Market is valued at US$ 19,042.18 Million in 2023, it is projected to reach US$ 32,445.82 Million by 2031.

As per our report North America Clinical Trials Market, the market size is valued at US$ 19,042.18 Million in 2023, projecting it to reach US$ 32,445.82 Million by 2031. This translates to a CAGR of approximately 6.9% during the forecast period.

The North America Clinical Trials Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Clinical Trials Market report:

The North America Clinical Trials Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Clinical Trials Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Clinical Trials Market value chain can benefit from the information contained in a comprehensive market report.