Europe Aircraft Floor Panel Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 175 | Report Code: TIPRE00017242 | Category: Aerospace and Defense

No. of Pages: 175 | Report Code: TIPRE00017242 | Category: Aerospace and Defense

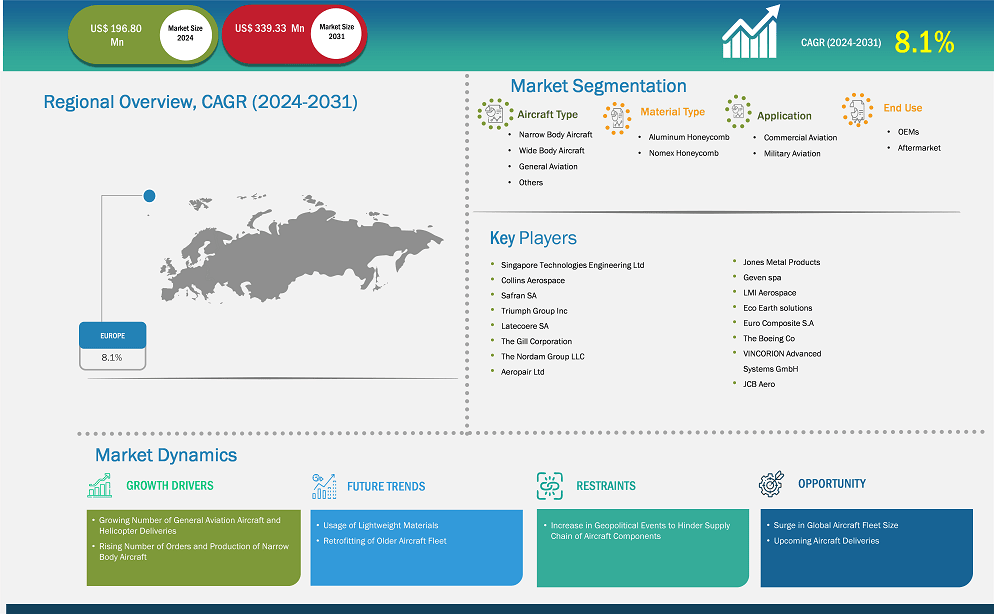

The Europe aircraft floor panel market size is expected to reach US$ 339.33 million by 2031 from US$ 196.80 million in 2024. The market is estimated to record a CAGR of 8.1% from 2024-2031.

The aircraft floor panel market in Europe is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. The Europe aircraft floor panel market is witnessing moderate growth owing to increasing air traffic, rising contracts to purchase new aircraft by airlines, and growing demand from MRO service providers. Europe is recognized as having the busiest airspace in the world, with more than 20,000 flights a day and ~500 million passengers traveling every year by air. The strength of the regional economy and a rise in air travel are boosting the use of aircraft floor panels owing to growing flying hours. The requirement for new modern aircraft in the commercial and military aircraft fleets in the region is also driving the aircraft floor panel market. For instance, in December 2024, Swiss Airlines expanded its new fleet with the addition of 10 Airbus A350-900 aircraft. The new aircraft are aimed to be delivered between 2025 and 2031. Initially, five aircraft will be delivered by 2025, and the next five aircraft will be delivered gradually by 2030. This significant investment aims to modernize the carrier's long-haul fleet, enhance passenger experience, and support the aviation industry. The surge in new aircraft contracts by European airlines has significantly increased the demand for aircraft floor panels. Airlines in Europe need to adhere to stringent rules and regulations set by the European Aviation Safety Agency (EASA) to ensure passenger safety, which is directly positively impacting the growth of the aircraft floor panel market. Europe has multiple suppliers that provide aircraft floor panels for both narrow-body and wide-body aircraft models. For instance, Elbe Flugzeugwerke GmbH (EFW), has its base in Germany to supply aircraft floor panels to the Airbus aircraft models. Recently, the company reached 6 million lightweight panels production capacity at its plant in Dresden and Kodersdorf (Gorlitz). EFW has been a direct supplier of important components and systems for Airbus. EFW's lightweight aircraft floor panel products are already implemented in more than 14,000 Airbus aircraft. This year in 2023, EFW equipped more than 700 Airbus aircraft with its lightweight aircraft floor panel products. In addition, the market in Europe is influenced by market players' inorganic growth strategies, such as partnerships, which help establish relationships with other suppliers while also allowing them to gain market position. For instance, Lufthansa Technik, Germany's largest MRO service provider, teamed up with Collins Aerospace, a US-based aerospace and defense products supplier. The collaboration aims to provide maintenance services for the Airbus A380 main landing gear. As a result of the collaboration, the Germany aircraft floor panel market is expected to expand, which will eventually boost the Europe aircraft floor panel market. FL Technics, Lufthansa Technik, and Rolls-Royce Plc are among the players operating in the Europe aircraft floor panel market. In November 2024, JCB Aero developed a floorboard panel system compliant with BMS4-17/20/23 for the aircraft MRO market. These aircraft panels offer a substantial weight reduction. Through their EASA-certified design (Part 21J), production Part 21G, and EASA Part 145 capabilities, the JCB panels can be installed on 95% of Boeing Cabins on variants including B737, B747, and B777.In June 2023, Pratt and Whitney, a subsidiary of RTX (Raytheon Technologies Corporation), announced the completion of significant engine and aftermarket agreements with Croatia Airlines. These agreements pertain to the state-of-the-art Geared Turbofan (GTF) engines designated to power Croatia Airlines' extensive fleet comprising 15 Airbus A220-100 and A220-300 aircraft. This fleet encompasses both acquired and leased planes, with six being purchased outright and nine procured under lease arrangements, including six from Air Lease Corporation (ALC). As part of these agreements, Pratt and Whitney will assume responsibility for comprehensive engine maintenance for Croatia Airlines' fleet through a long-term EngineWise maintenance agreement. This collaboration highlights Pratt and Whitney's commitment to providing robust aftermarket support and maintenance services to optimize the performance and reliability of Croatia Airlines' Airbus A220 aircraft fleet. The agreement between Pratt and Whitney and Croatia Airlines reinforces the capability and capacity of European MRO providers.

Europe Aircraft Floor Panel Market Strategic Insights

Europe Aircraft Floor Panel Market Segmentation Analysis

Key segments that contributed to the derivation of the Europe Aircraft Floor Panel Market analysis are aircraft type, material type, application, and end use.

The aerospace industry has been developing rapidly over the years, recording a substantial number of aircraft production and deliveries. This has demonstrated massive order volumes for various commercial aircraft manufacturers across the globe. Commercial aviation is anticipated to surge in the coming years with an increase in air travel passengers and aircraft volumes. The increase in orders of narrow body passenger and commercial aircraft across the globe drives the demand for aircraft components and aircraft assemblies. As the number of air travel passengers increases, airlines are focusing on expanding to more remote locations by launching routes to smaller city airports. This is further propelling the need for new commercial and cargo aircraft. In 2023, Boeing and Greater Bay Airlines (GBA) received an order for 15 units of 737-9 airplanes. The agreement also incorporates a pledge for five 787 Dreamliners to support GBA's long-term strategy to introduce international long-haul service.

In the last two years, Boeing and Airbus have experienced a significant increase in orders for narrow body aircraft. According to the Airbus order and delivery database, there were 820 commercial aircraft orders in 2022, which reached 2,094 in 2023. However, there was a rise in deliveries for narrow body aircraft—such as A220, A319 & A320, and A321—compared to the wide body aircraft—such as A330 and A350—in 2023, shown in the figure below.

Airbus and Boeing are the two aircraft manufacturing giants with significantly higher volumes of orders and delivery statistics. These two aircraft original equipment manufacturers (OEMs) continuously encounter orders for various aircraft models from civil airlines. The table below highlights the comparison of orders and deliveries from Airbus and Boeing during 2020–2023:

Year | 2020 | 2021 | 2022 | 2023 | ||||

Commercial Aircraft | ||||||||

Aircraft Manufacturers | Boeing | Airbus | Boeing | Airbus | Boeing | Airbus | Boeing | Airbus |

Orders | 184 | 383 | 909 | 771 | 935 | 1078 | 1456 | 2319 |

Deliveries | 157 | 566 | 340 | 609 | 480 | 661 | 528 | 735 |

Such a growing number of aircraft deliveries by two of the largest aircraft OEMs is driving the demand for aircraft floor panels across different regions.

Based on country, the Europe Aircraft Floor Panel Market comprises Germany, France, Italy, the UK, Russia, and the Rest of Europe. France held the largest share in 2024.

The aviation industry is among the key contributors to the GDP of France. Airbus supports the design, production, and delivery of different models of Airbus aircraft in France. The Airbus exports in France contribute mainly to the economic growth of the country. For instance, in September 2023, Air France-KLM, the fourth airline group in Europe, planned the purchase of 50 Airbus A350 family aircraft. The company has planned options for an additional 40 planes. This order is the group's effort to renew its existing fleets and include both the A350-900 and A350-1000 passenger aircraft variants. Deliveries of these models are anticipated to start in 2026, with all deliveries completed by 2030. Such an increase in the number of aircraft orders in France, along with the growing significant investments by the airlines, has created a massive demand for aircraft floor panels. Further, the presence of one of the largest aircraft OEMs i.e., Airbus and Dassault in France is one of the major factors supporting the market growth. The increase in the number of air travel passengers directly impacts the growth of aircraft fleet and flying hours, which eventually would drive the demand for aircraft maintenance, thereby contributing to the aircraft floor panel market growth in France.

Europe Aircraft Floor Panel Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 196.80 Million

Market Size by 2031

US$ 339.33 Million

CAGR (2024 - 2031) 8.1%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Aircraft type

By Material Type

By Application

Regions and Countries Covered

Europe

Market leaders and key company profiles

Europe Aircraft Floor Panel Market Company Profiles

Some of the key players operating in the market include Singapore Technologies Engineering Ltd; Collins Aerospace; Safran SA; Triumph Group Inc; Latecose SA; The Gill Corporation; The Nordam Group LLC; Aeropair Ltd; The Boeing Co; VINCORION Advanced Systems GmbH; JCB Aero; Jones Metal Products; Geven spa; LMI Aerospace; Eco Earth solutions; and Euro Composite S.As, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Europe Aircraft Floor Panel Market is valued at US$ 196.80 Million in 2024, it is projected to reach US$ 339.33 Million by 2031.

As per our report Europe Aircraft Floor Panel Market, the market size is valued at US$ 196.80 Million in 2024, projecting it to reach US$ 339.33 Million by 2031. This translates to a CAGR of approximately 8.1% during the forecast period.

The Europe Aircraft Floor Panel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Aircraft Floor Panel Market report:

The Europe Aircraft Floor Panel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Aircraft Floor Panel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Aircraft Floor Panel Market value chain can benefit from the information contained in a comprehensive market report.