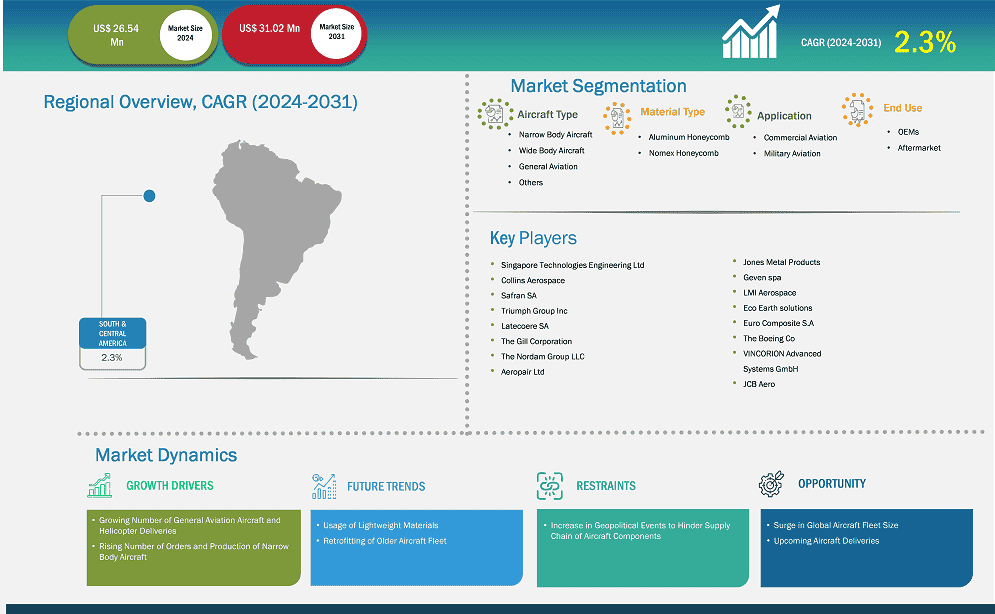

The South & Central America aircraft floor panel market size is expected to reach US$ 31.02 million by 2031 from US$ 26.54 million in 2024. The market is estimated to record a CAGR of 2.3% from 2024-2031.

The South America aircraft floor panel market is showing moderate growth owing to the lack of presence of key manufacturers and lower economic spending in the aviation sector. Despite the lower demand in the region, countries such as Brazil, Argentina, and Chile are witnessing significant demand in the coming years. The IATA has directed governments of South American countries to implement smart industry regulations to ensure the establishment of appropriate infrastructure for the growth of the aviation sector. According to The Insight Partners analysis, in 2023, South America had a fleet of more than 1,500 operational commercial aircraft, which is expected to surpass 2,100 by the end of 2033. In September 2024, Brazilian Total Linhas Aereas, a small cargo and charter airline, planned to buy planes from China's COMAC. The increase in aircraft fleets is anticipated to generate demand for aircraft floor panels in the region. The aviation sector in South America has a promising future, as indicated by the forecasts and analyses provided by major aircraft manufacturers such as Boeing, Airbus, and Embraer. These players are offering significant opportunities in the South America region to meet growing demand for newer aircrafts.

South & Central America Aircraft Floor Panel Market Segmentation Analysis:

Key segments that contributed to the derivation of the Aircraft Floor Panel Market analysis are aircraft type, material type, application, and end use.

As per the Insight Partners analysis and various aerospace industry resources in 2024, the total number of existing commercial aircraft was more than 28,395 across the globe, including over 17,260 narrow body aircraft; approximately 5,755 widebody aircraft; ~3,040 regional jets; and ~2,334 Turboprop. By 2034, the total number of commercial aircraft is expected to exceed 36,400 worldwide, including over 22,974 narrow body aircraft; ~7,400 widebody aircraft; approximately 3,465 regional jets; and ~2,565 Turboprop. Engine and airframe maintenance and repair were the most prominent in 2024. Thus, the growing global aircraft fleet size is expected to generate new opportunities for aircraft component suppliers, including aircraft floor panel manufacturers, in the coming years.

Based on country, the South & Central America aircraft floor panel market comprises Brazil and the Rest of South & Central America. Brazil held the largest share in 2024.

Brazil is one of the important hubs for aerospace manufacturing in the global arena and is responsible for the manufacturing of commercial, executive, and military aircraft. Aerospace manufacturing is one of the key industries for the Brazilian economy. The MRO sector of Brazil is currently witnessing continuous growth, and various companies are focusing on expanding their presence in Brazil. For instance, in June 2022, Embraer doubled its MRO facility center in Sorocaba, Brazil. Similarly, in August 2023, Synerjet added a new maintenance center in Goianápolis, Brazil. Therefore, the growing aviation sector in the country and various players expanding their business in the country are the major factors expected to drive the growth of the aircraft floor panel market in Brazil.

The increase in orders of military and commercial aircraft in Brazil has created a massive demand for aircraft floor panel products. For instance, in September 2024, Brazil's Total Linhas Aereas airline ordered C919 aircraft from the Chinese manufacturer COMAC. Further, in December 2024, Brazilian airline Gol added a new 737 MAX aircraft to meet the growing demand for air travel in the country. Increasing aircraft orders and expanding MRO services in Brazil drive the aircraft floor panel market growth.

South & Central America Aircraft Floor Panel Market Company Profiles

Some of the key players operating in the market include Singapore Technologies Engineering Ltd; Collins Aerospace; Safran SA; Triumph Group Inc; Latecose SA; The Gill Corporation; The Nordam Group LLC; Aeropair Ltd; The Boeing Co; VINCORION Advanced Systems GmbH; JCB Aero; Jones Metal Products; Geven spa; LMI Aerospace; Eco Earth solutions; and Euro Composite S.As among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 26.54 Million |

| Market Size by 2031 | US$ 31.02 Million |

| CAGR (2024 - 2031) | 2.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Aircraft type

|

| Regions and Countries Covered |

South and Central America

|

| Market leaders and key company profiles |

|

The South & Central America Aircraft Floor Panel Market is valued at US$ 26.54 Million in 2024, it is projected to reach US$ 31.02 Million by 2031.

As per our report South & Central America Aircraft Floor Panel Market, the market size is valued at US$ 26.54 Million in 2024, projecting it to reach US$ 31.02 Million by 2031. This translates to a CAGR of approximately 2.3% during the forecast period.

The South & Central America Aircraft Floor Panel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Aircraft Floor Panel Market report:

The South & Central America Aircraft Floor Panel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Aircraft Floor Panel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Aircraft Floor Panel Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)