Middle East & Africa Aircraft Floor Panel Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 163 | Report Code: TIPRE00017244 | Category: Aerospace and Defense

No. of Pages: 163 | Report Code: TIPRE00017244 | Category: Aerospace and Defense

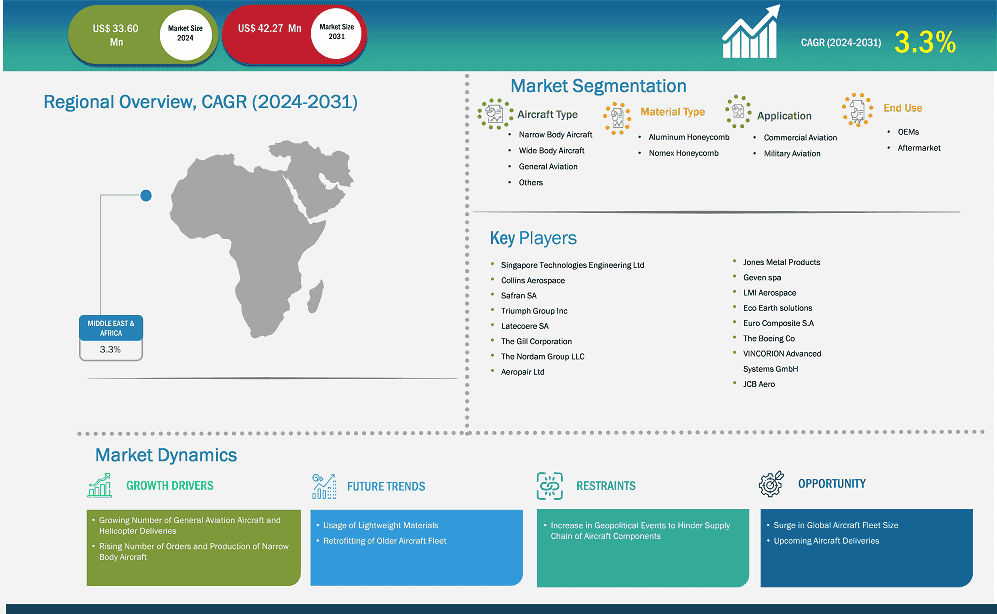

The Middle East & Africa aircraft floor panel market size is expected to reach US$ 42.27 million by 2031 from US$ 33.60 million in 2024. The market is estimated to record a CAGR of 3.3% from 2024-2031.

The MEA has recorded higher air traffic capacity, resulting in a significant supply of capacity offered by almost all major operators in the region. However, the limited economic activity in the region might adversely impact the growth of the airline industry in the coming years. Further, the Gulf countries are economically developed countries, while the African countries are yet to measure the economic conditions of the Gulf countries. The rising demand for new aircraft by the major airlines in the Middle East and African countries is one of the primary drivers for the aircraft floor panel market. For instance, in October 2024, Saudi Arabian Riyadh Airlines planned to buy 60 Airbus aircraft. The order was announced for single-aisle A321 neo jets. This aircraft uses a Gillfloor 4809 ultra-lightweight floor panel made from carbon fiber reinforced epoxy honeycomb core. The countries in the Middle East, such as the UAE, Saudi Arabia, and Turkey, spend significantly higher amounts on the procurement of new defense aircraft and MRO activities of the existing aircraft fleet. The increasing number of airports and aircraft, along with tremendous growth in the aviation industry, is bolstering the aircraft floor panel market growth. For instance, according to the Federal Aviation Administration, in 2023, the aviation industry in the Middle East witnessed annual growth of 10%.According to The Insight Partners analysis, in 2023, Africa had a fleet of more than 1,000 operational commercial aircraft, which is expected to reach ~1,500 by the end of 2033. Such an increase in the number of aircraft fleets across Africa is expected to catalyze the requirement for aircraft floor panels. However, economic and political issues impact airline traffic in Africa, resulting in minimal local traffic growth and limited opportunities for growth in the aircraft floor panel market.

Middle East & Africa Aircraft Floor Panel Market Strategic Insights

Middle East & Africa Aircraft Floor Panel Market Segmentation Analysis

Key segments that contributed to the derivation of the Middle East & Africa Aircraft Floor Panel Market analysis are aircraft type, material type, application, and end use.

The floor panels of an aircraft contribute significantly to its overall weight. This is mainly due to the large number and volume of floor panels installed inside the fuselage and airframe assemblies. The use of lightweight composite materials for floor panels that require adhesives reduces the need for fasteners used in traditional metal-based floor panels. Further, the use of lightweight materials for producing panels for aircraft flooring applications also offers several advantages, including improved fuel efficiency, extended range, greater strength-to-weight ratio, reduced structural stress, better corrosion resistance capabilities, easier inspection, optimized design, and better passenger comfort. Such factors are likely to boost the adoption of lightweight materials-based aircraft floor panels among aircraft manufacturers across different regions, bringing new trends in the aircraft floor panel market.

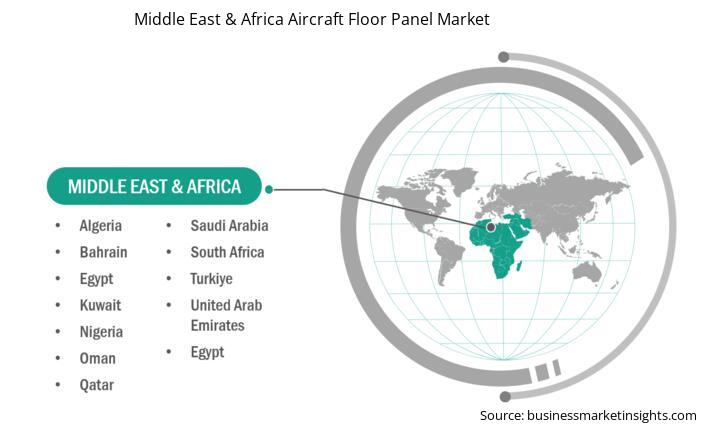

Based on country, the Middle East & Africa aircraft floor panel market comprises South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. Saudi Arabia held the largest share in 2024.

Saudi Arabia has been recognized as one of the prominent countries in the global aviation sector. The country's continued endeavor to boost its aviation sector has positively resulted in and showcased growth year-on-year. Saudi Vision 2030 has also partly contributed to the growth of the aviation industry. Saudia, the flagship carrier of the country, experiences significant growth in the number of passengers year-on-year, which has compelled the airline to procure a new aircraft fleet. The rise in the number of passengers has resulted in longer flying hours, which eventually led the aircraft fleet to the MRO shops. This has created a massive demand for lightweight aircraft floor panel products. The airline company has its own MRO service business, which offers maintenance activities to other airlines as well, helping the company grow its annual revenues. From a military perspective, Saudi Arabia has high military expenditures, and the country operates a large fleet of US-manufactured military aircraft. The continuous procurement of military aircraft has led the country to house 848 aircraft, which undergo regular maintenance, thereby contributing substantial amounts to the Saudi Arabia aircraft floor panel market. In March 2023, during the MRO Middle East 2023 event, Saudia Aerospace Engineering Industries (SAEI) and Lufthansa Technik Middle East (LTME) announced a strategic collaboration in the realm of aircraft component services. Under this agreement, Lufthansa Technik will provide its Total Component Support (TCS) to support Saudia's extensive fleet, which comprises 57 Boeing 777 and 787 aircraft. This long-term contract, spanning a decade, covers 39 Boeing 777 aircraft, including 35 777-300ER and four 777F, as well as 18 Boeing 787 aircraft, consisting of 13 787-9 and five 787-10 models. As part of the collaboration, SAEI will gain uninterrupted access to Lufthansa Technik's global components pool, ensuring efficient and timely component availability for their aircraft, particularly during critical Aircraft On Ground (AOG) situations. In September 2023, John Cockerill's Surface Treatment Business Line secured a substantial contract to provide a comprehensive MRO facility for the aviation sector. The contract was awarded by Saudia Aerospace Engineering Industries (SAEI), a wholly owned subsidiary of Saudi Arabian Airlines (Saudia). This state-of-the-art aircraft maintenance workshop is slated to become one of the largest in the world. It will encompass multiple surface treatment and testing lines, along with the requisite auxiliary equipment. The project's total worth exceeds EUR 20 million, marking a significant milestone as the most substantial single contract ever undertaken by John Cockerill Industry's Surface Treatment Business Line. In May 2024, Saudi Arabia's airline placed an order for ~105 Airbus airplanes, making the largest deal in the country to promote the aviation sector. Growing investment in aircraft MRO facilities and increasing aircraft orders by Saudi Arabian airlines have created a massive demand for aircraft floor panel products.

Middle East & Africa Aircraft Floor Panel Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 33.60 Million

Market Size by 2031

US$ 42.27 Million

CAGR (2024 - 2031) 3.3%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Aircraft type

By Material Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Aircraft Floor Panel Market Company Profiles

Some of the key players operating in the market include Singapore Technologies Engineering Ltd; Collins Aerospace; Safran SA; Triumph Group Inc; Latecose SA; The Gill Corporation; The Nordam Group LLC; Aeropair Ltd; The Boeing Co; VINCORION Advanced Systems GmbH; JCB Aero; Jones Metal Products; Geven spa; LMI Aerospace; Eco Earth solutions; and Euro Composite S.As among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Middle East & Africa Aircraft Floor Panel Market is valued at US$ 33.60 Million in 2024, it is projected to reach US$ 42.27 Million by 2031.

As per our report Middle East & Africa Aircraft Floor Panel Market, the market size is valued at US$ 33.60 Million in 2024, projecting it to reach US$ 42.27 Million by 2031. This translates to a CAGR of approximately 3.3% during the forecast period.

The Middle East & Africa Aircraft Floor Panel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Aircraft Floor Panel Market report:

The Middle East & Africa Aircraft Floor Panel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Aircraft Floor Panel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Aircraft Floor Panel Market value chain can benefit from the information contained in a comprehensive market report.