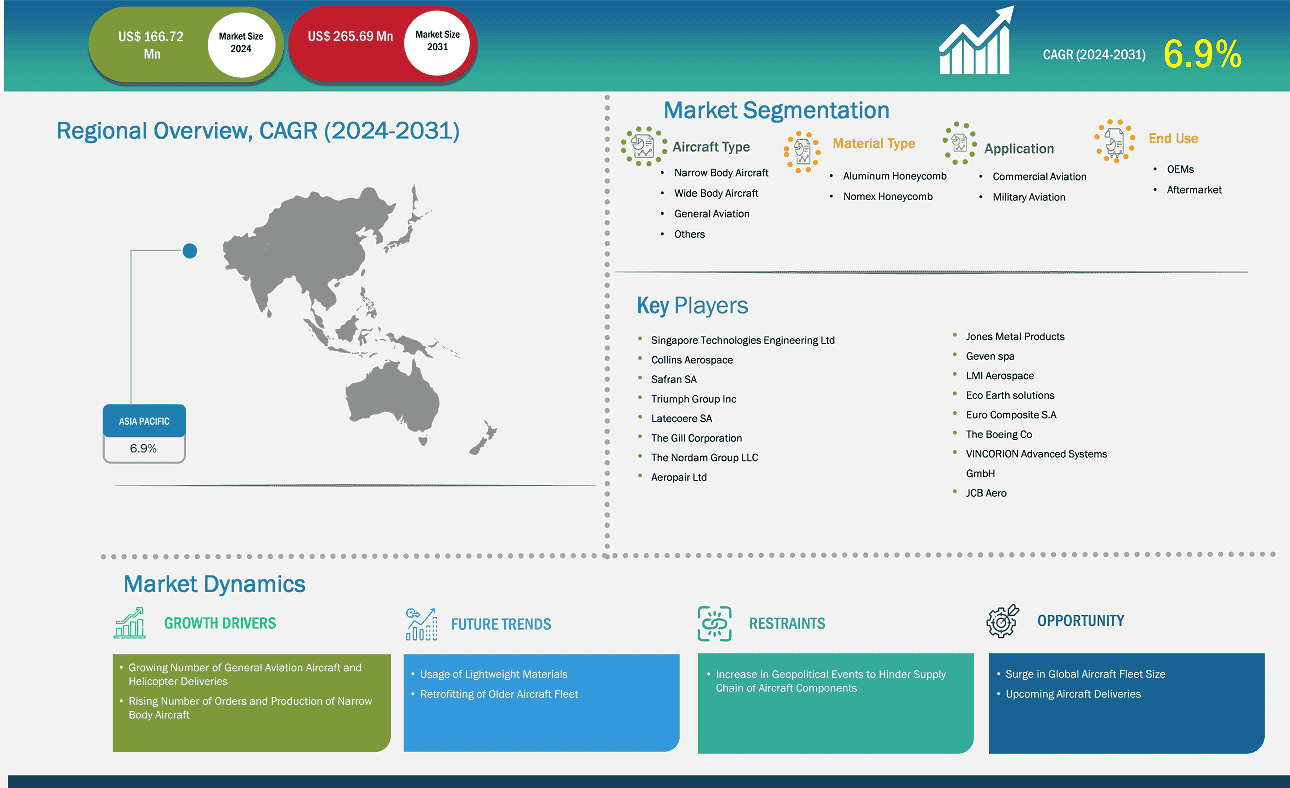

The Asia Pacific aircraft floor panel market size is expected to reach US$ 265.69 million by 2031 from US$ 166.72 million in 2024. The market is estimated to record a CAGR of 6.9% from 2024-2031.

Asia Pacific is the fastest-growing region owing to the rapid adoption of air travel and growing demand for new aircraft. The aviation industry in this region is a major contributor to its social and economic development. The growth of the Asia Pacific aviation sector has been primarily attributed to the wide range of income levels and the rapidly growing middle-class population. This resulted in robust sales of aircraft in Asia Pacific countries such as India, Japan, and China. The region is expected to create significant opportunities for providers of aircraft MRO services providers, and aircraft manufacturers. Asia Pacific comprises several growing economies, such as India, China, Japan, and South Korea. Government bodies in these countries are heavily investing in the procurement of new aircraft for military and commercial purposes. For instance, the demand for medium and large-size long-range aircraft, such as the A330 neo and A350, in Asia Pacific countries was approximately 3,500 aircraft as of November 2024. Also, according to the Airbus Asia Pacific regional president, more than 19,500 aircraft will be required by 2043. Such an increase in the demand for aircraft across Asia Pacific is expected to create ample opportunities for the aircraft floor panels market in this region. The increasing demand for aircraft floor panels is primarily driven by the rapid growth of aircraft MRO services in Asia Pacific. Numerous global players are expanding their MRO facilities across APAC. For instance, in July 2022, Safran AB (one of the leading suppliers of key aircraft components, including landing gear, wheels and brakes, and wiring) announced an investment of US$ 305 million in India to expand its MRO activities in the region. The company is planning to invest US$ 204.15 million in one of the largest MRO facilities in the world in Hyderabad, India. Several aircraft MRO companies are investing in Asia Pacific to increase their service capabilities. For instance, in February 2023, O Collins Aerospace aviation avionics manufacturers invested more than US$ 27 million to double the size of its aircraft MRO operations in Xiamen, China, and quadruple its facility size in Selangor, Malaysia. The additional capacity increased the demand for several aircraft components, including floor panels, airframes, and others. APAC has had a strong import of advanced commercial aircraft in the past few years owing to an increase in international travelers in countries such as India, China, Japan, and Taiwan. Owing to the increasing number of aircraft and airports, the demand for aircraft floor panel products is likely to increase during the forecast period. The region is expected to account for ~40% of the future airline production to cater to the aircraft demand. The growing number of airports and increasing regional flight connections among Asian nations are boosting the demand for aircraft floor panels. In addition, Southeast Asian countries have witnessed growth in the overall aviation industry in recent years. The rising demand for new aircraft from Southeast Asian countries is driving the aircraft floor panel market growth. For instance, in November 2024, Vietnam Airlines ordered 50 aircraft in 2025 with Boeing as the top contractor. Vietnam Airlines invested more than US$ 7.8 billion to procure 50 aircraft from different manufacturers across the globe.

Key segments that contributed to the derivation of the Asia Pacific aircraft floor panel market analysis are aircraft type, material type, application, and end use.

As per the Insight Partners analysis and various aerospace industry resources in 2024, the total number of existing commercial aircraft was more than 28,395 across the globe, including over 17,260 narrow body aircraft; approximately 5,755 widebody aircraft; ~3,040 regional jets; and ~2,334 Turboprop. By 2034, the total number of commercial aircraft is expected to exceed 36,400 worldwide, including over 22,974 narrow body aircraft; ~7,400 widebody aircraft; approximately 3,465 regional jets; and ~2,565 Turboprop. China and India are projected to show more than 3.5% growth in air travel from 2023 to 2042. In addition, according to the ch-aviation data on aircraft fleet orders from across the world, as of June 2023, the US accounted for the highest number of aircraft orders (excluding military aircraft and aircraft with unknown operator/engine) worldwide with a total of 3,147 aircraft on order—followed by Ireland, China, and India with 1,247; 1,239; and 888 aircraft orders, respectively. According to the same data, the top five consumers with aircraft orders are United Airlines, IndiGo Airlines, Lion Air, Air Lease Corporation, and AirAsia, among which two are based in Asia Pacific. Further, according to the various aerospace industry sources analysis, the total commercial aircraft fleet size in Asia Pacific stood at 8,653 in 2024, which is likely to reach approximately 11,582 aircraft by the end of 2034. Engine and airframe maintenance and repair were the most prominent in 2024. Thus, the growing global aircraft fleet size is expected to generate new opportunities for aircraft component suppliers, including aircraft floor panel manufacturers, in the coming years.

Based on country, the Asia Pacific aircraft floor panel market comprises China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China held the largest share in 2024.

The commercial aviation sector is booming at a rapid pace, which is providing new opportunities for Chinese airlines as well as international airlines to establish new routes to, from, and around China. The boosting demand for commercial aircraft is leading airlines to order more modern aircraft with the latest technologies integrated into the aircraft. In the long run, MRO activities would shift toward APAC as India and China are lined up to establish their importance as MRO centers. Companies around the world are focusing on expanding their presence in China; for instance, in September 2021, MTU Maintenance Zhuhai introduced a second test cell in China to accommodate the narrow body engine type. China has several composite aircraft floor panel manufacturers, such as CMAG, MAJET, and Huarui Honeycomb Technology Co., Ltd. These players are offering different types of aluminum and composite material-based honeycomb aircraft floor panels. China is the second-largest defense-spending nation after the US. In March 2023, the Federal Aviation Administration (FAA) officially certified 93 aircraft repair facilities within China. These facilities are staffed by a substantial workforce comprising nearly 23,000 skilled mechanics and maintenance specialists who are entrusted with the responsibility of servicing and maintaining the US aircraft fleet. This signifies a significant involvement and investment by the Chinese government in the aviation maintenance sector within the country. The aircraft MRO service providers require aircraft floor panel products to reduce the overall weight of the aircraft and improve the efficiency of the aircraft.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 166.72 Million |

| Market Size by 2031 | US$ 265.69 Million |

| CAGR (2024 - 2031) | 6.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Aircraft type

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Singapore Technologies Engineering Ltd; Collins Aerospace; Safran SA; Triumph Group Inc; Latecose SA; The Gill Corporation; The Nordam Group LLC; Aeropair Ltd; The Boeing Co; VINCORION Advanced Systems GmbH; JCB Aero; Jones Metal Products; Geven spa; LMI Aerospace; Eco Earth solutions; and Euro Composite S.As, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Aircraft Floor Panel Market is valued at US$ 166.72 Million in 2024, it is projected to reach US$ 265.69 Million by 2031.

As per our report Asia Pacific Aircraft Floor Panel Market, the market size is valued at US$ 166.72 Million in 2024, projecting it to reach US$ 265.69 Million by 2031. This translates to a CAGR of approximately 6.9% during the forecast period.

The Asia Pacific Aircraft Floor Panel Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Aircraft Floor Panel Market report:

The Asia Pacific Aircraft Floor Panel Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Aircraft Floor Panel Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Aircraft Floor Panel Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)