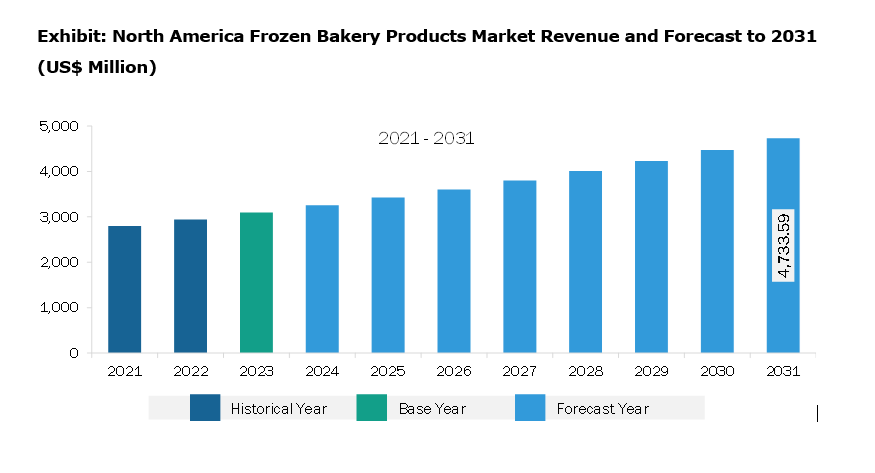

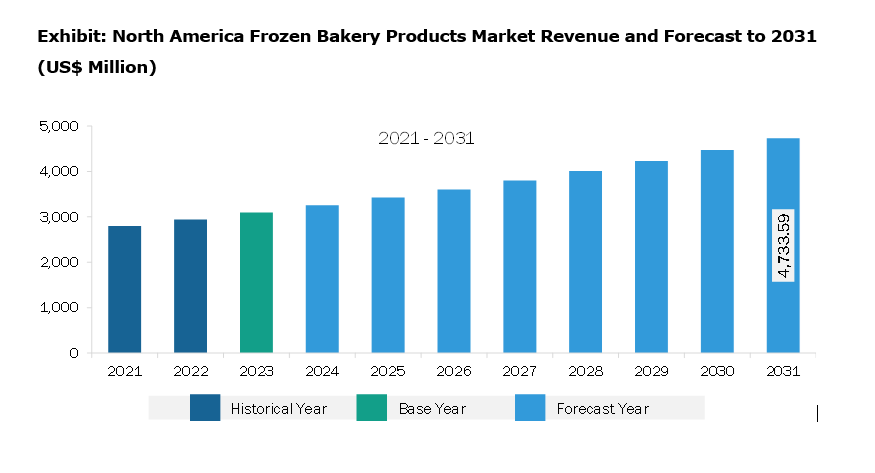

The North America frozen bakery products market was valued at US$ 3,094.59 million in 2023 and is expected projected to reach US$ 4,733.59 million by 2031; it is estimated to register a CAGR of 5.5% from 2023 to 2031.

Hectic work schedules are changing the lifestyle and eating habits of consumers, thereby increasing their dependency on convenience foods and frozen food products. Convenience foods, such as frozen bakery products, allow consumers to save time and effort associated with ingredient shopping and baking preparations. The food industry is witnessing a surge in the consumption of high-quality convenience food. Frozen bakery products also save the effort and time spent on food preparation and provide the convenience of storage.

According to the “2023 Power of Frozen in Retail” by The Food Industry Association and the American Frozen Food Institute, frozen food sales in the US increased by 7.9%, reaching US$ 74.2 billion, over the year ended July 2023. The Millennial and Gen X populations are the major consumers of these products, shopping mostly in supercenters and through online channels. As per the government of Canada, the retail sales of frozen bakery products in Canada were reported to be US$ 280.8 million in 2022. As per the International Institute of Refrigeration, the sales of frozen foods increased by 3.6% in volume, reaching 3.91 million metric tons in 2022, compared to 3.77 million metric tons in 2021, in Germany.

Prominent market players offer a variety of frozen bakery products, including bread and rolls, biscuits and cookies, donuts, and muffins. These products have extended product shelf-life due to the blast-freezing process. According to the “2023 Food and Health Survey” conducted by the International Food Information Council in 2023, out of 1,022 Americans (aged between 18 and 80 years), 61% of participants chose convenience as a major factor impacting food buying decisions in 2023, which was 56% in 2022. Preprocessed food allows consumers to save time and effort associated with food preparation and reduces baking time. Thus, the rising demand for frozen and convenience food drives the global frozen bakery products market.

In North America, consumer preferences are shifting toward healthy and nutritious food options, which has surged the demand for vegan, gluten-free, high-fiber, high-protein, or low-calorie food, further influencing the frozen bakery products market. According to the "2023 Power of Frozen in Retail" by The Food Industry Association and the American Frozen Food Institute, frozen food sales in the US increased by 7.9%, reaching US$ 74.2 billion between July 2022 and July 2023. The report also reveals that the number of online grocery shoppers' shares who purchase frozen food through e-commerce channels is rising significantly. In 2020, 86% of online shoppers in the US bought groceries online, purchased frozen products through online retail. The top six reasons for purchasing frozen food are the long shelf-life of frozen foods (60%), consumer desire to stock up in case of food shortages (58%), the ease of preparation (46%), saving time on preparation and cleanup (36%) and consumers' belief that frozen foods are safer than fresh items (33%). As per the government of Canada, most Canadian bakery products were distributed through store-based retailing, with supermarkets accounting for a significant share in the sales of bakery products. Thus, the rising demand for frozen food drives the frozen bakery products market in the region.

The North America frozen bakery products market is categorized into product type, category, distribution channel, and country.

Based on product type, the North America frozen bakery products market is segmented into breads and rolls, cakes and pastries, biscuits and cookies, and others. The breads and rolls segment held the largest market share in 2023.

In terms of category, the North America frozen bakery products market is bifurcated into gluten-free and conventional. The conventional segment held a larger market share in 2023.

By distribution channel, the North America frozen bakery products market is categorized into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the North America frozen bakery products market is segmented into the US, Canada, and Mexico. The US dominated the North America frozen bakery products market share in 2023.

Grupo Bimbo SAB de CV, Rhodes International Inc, General Mills Inc, Pepperidge Farm Inc, Bridgford Foods Corp, Conagra Brands Inc, Cole’s Quality Foods Inc, Sara Lee Frozen Bakery LLC, T. Marzetti Company, and The Edwards Baking Company are some of the leading companies operating in the North America frozen bakery products market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 3,094.59 Million |

| Market Size by 2031 | US$ 4,733.59 Million |

| CAGR (2023 - 2031) | 5.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Frozen Bakery Products Market is valued at US$ 3,094.59 Million in 2023, it is projected to reach US$ 4,733.59 Million by 2031.

As per our report North America Frozen Bakery Products Market, the market size is valued at US$ 3,094.59 Million in 2023, projecting it to reach US$ 4,733.59 Million by 2031. This translates to a CAGR of approximately 5.5% during the forecast period.

The North America Frozen Bakery Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Frozen Bakery Products Market report:

The North America Frozen Bakery Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Frozen Bakery Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Frozen Bakery Products Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)