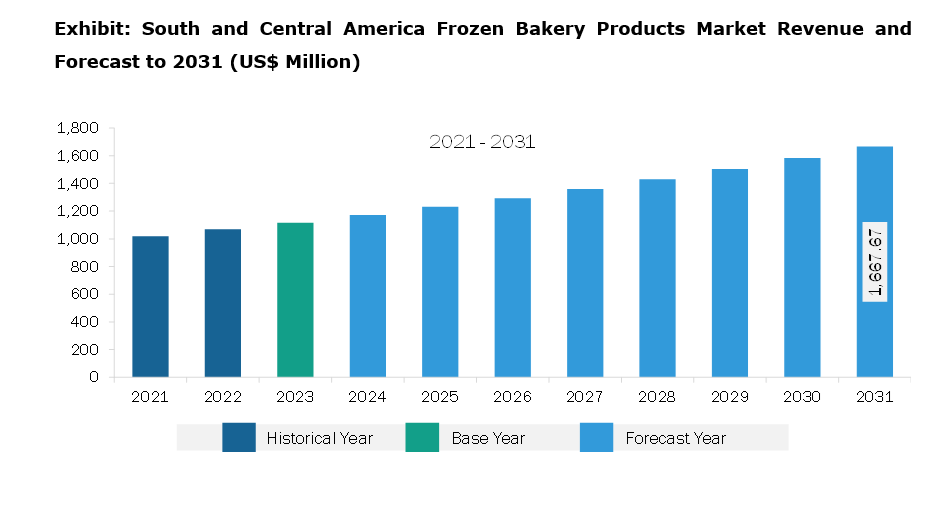

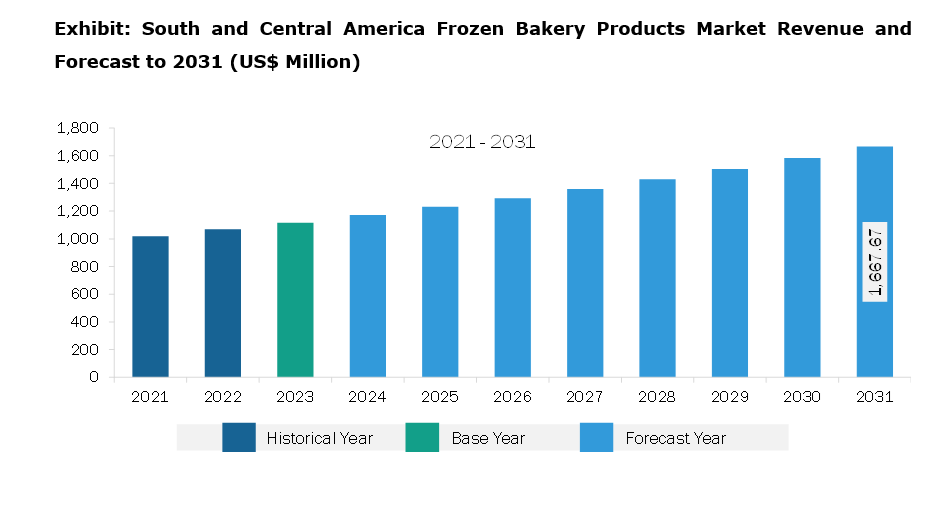

The South & Central America frozen bakery products market was valued at US$ 1,116.23 million in 2023 and is expected projected to reach US$ 1,667.67 million by 2031; it is estimated to register a CAGR of 5.1% from 2023 to 2031.

The emergence of e-commerce has transformed the way people shop and purchase food products. Increasing penetration of the Internet and smartphones, growing purchasing power of consumers, rising convenience provided by online retail shopping platforms, and rapid access to emerging technologies are among the key factors bolstering e-commerce.

The online sales of food and beverages were driven significantly during the COVID-19 outbreak due to the shutdown of brick-and-mortar stores and the imposition of several social restrictions by governments. Consumers continue to prefer buying frozen food via online retail channels.

With the rising penetration of e-commerce across the globe, the manufacturers of frozen bakery products are enhancing their online presence by selling products through Amazon, Tesco, Walmart, and other established e-commerce platforms. The growing adoption of e-commerce platforms is eliminating the dependency on offline retail stores. Thus, the increasing sales of frozen food products via e-commerce platforms are expected to provide lucrative opportunities for frozen bakery product manufacturers to reach a wide consumer base during the forecast period.

The demand for frozen food products, such as frozen bakery products, in South & Central America is rising owing to the advancements in the food retail sector, increasing consumer access to distinct frozen food products, and changing consumer lifestyles. Frozen bakery products offer an attractive ingredient option to consumers due to the long shelf life and ease of preparation of products compared to freshly baked goods. In addition, the expansion of modern retail channels such as supermarkets and hypermarkets make frozen bakery products accessible to consumers. As the region continues to urbanize and adopt modern lifestyles, the key market players continue to expand their presence in the region. In September 2024, Grupo Bimbo signed an agreement to acquire Wickbold, a Brazilian bakery offering a diverse range of special breads. This business strategy creates a lucrative opportunity for the company to expand its bakery product portfolio in Brazil. Thus, the trends are expected to drive the frozen bakery products market in South & Central America.

South & Central America Frozen Bakery Products Market Segmentation

South & Central America Frozen Bakery Products Market Segmentation

The South & Central America frozen bakery products market is categorized into product type, category, distribution channel, and country.

Based on product type, the South & Central America frozen bakery products market is segmented into breads and rolls, cakes and pastries, biscuits and cookies, and others. The breads and rolls segment held the largest market share in 2023.

In terms of category, the South & Central America frozen bakery products market is bifurcated into gluten-free and conventional. The conventional segment held a larger market share in 2023.

By distribution channel, the South & Central America frozen bakery products market is categorized into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the South & Central America frozen bakery products market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America frozen bakery products market share in 2023.

Grupo Bimbo SAB de CV, Rhodes International Inc, General Mills Inc, Pepperidge Farm Inc, Bridgford Foods Corp, Conagra Brands Inc, Cole’s Quality Foods Inc, Sara Lee Frozen Bakery LLC, T. Marzetti Company, The Edwards Baking Company, are among the leading companies operating in the South & Central America frozen bakery products market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,116.23 Million |

| Market Size by 2031 | US$ 1,667.67 Million |

| CAGR (2023 - 2031) | 5.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

South & Central America

|

| Market leaders and key company profiles |

|

The South & Central America Frozen Bakery Products Market is valued at US$ 1,116.23 Million in 2023, it is projected to reach US$ 1,667.67 Million by 2031.

As per our report South & Central America Frozen Bakery Products Market, the market size is valued at US$ 1,116.23 Million in 2023, projecting it to reach US$ 1,667.67 Million by 2031. This translates to a CAGR of approximately 5.1% during the forecast period.

The South & Central America Frozen Bakery Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Frozen Bakery Products Market report:

The South & Central America Frozen Bakery Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Frozen Bakery Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Frozen Bakery Products Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)