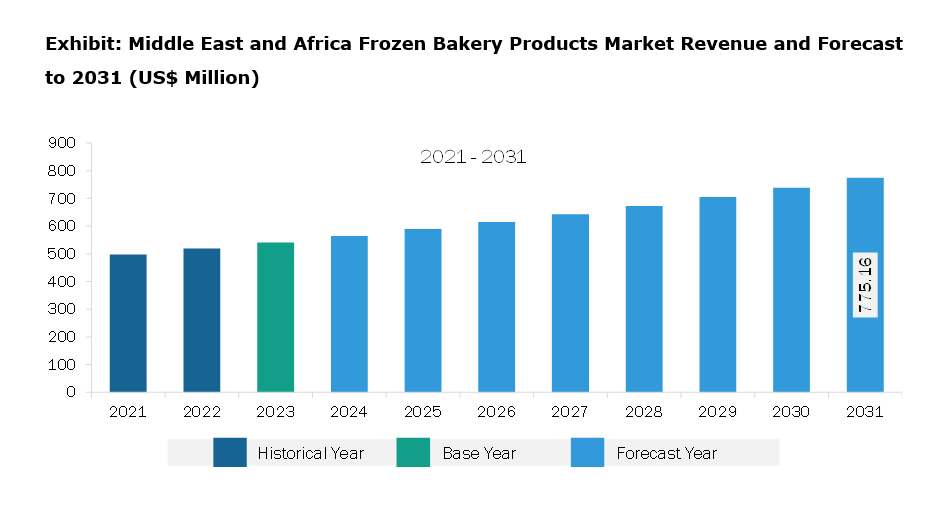

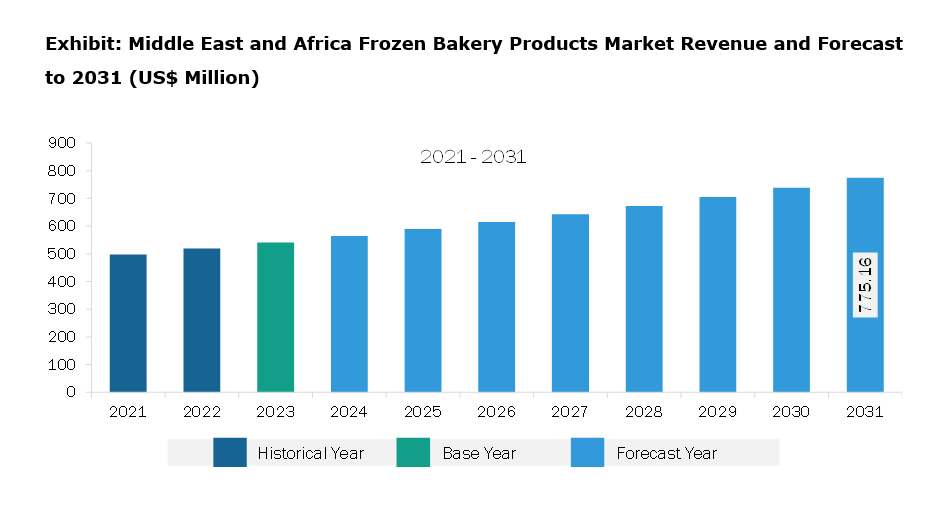

The Middle East & Africa frozen bakery products market was valued at US$ 541.47 million in 2023 and is expected projected to reach US$ 775.16 million by 2031; it is estimated to register a CAGR of 4.6% from 2023 to 2031.

The incidence of celiac disease (gluten sensitivity) is rising among the population worldwide. It is recommended to consume a 100% gluten-free diet for people suffering from celiac disease. As per the study published in the National Library of Medicine in 2019, celiac disease is common in Saudi Arabia, with prevalences in normal populations of biopsy-proven celiac disease of 10.6% and seroprevalence of 15.6%. The rising number of people diagnosed with celiac disease and growing awareness for gluten-free diets are a few factors positively impacting innovations pertaining to gluten-free bakery products. As a result, manufacturers are focusing on developing innovative products to cater to the consumer demand for healthy and gluten-free bakery food products.

Consumers are increasingly seeking healthy, nutritious food products, which has surged the demand for healthy alternatives such as gluten-free, high-fiber, high-protein, or low-calorie frozen food over conventional bakery goods. Gluten-free frozen products are convenient and accessible and contain healthy ingredients. Therefore, the rising consumer preference for gluten-free products is expected to bring new trends in the frozen bakery products market in the coming years.

According to the research conducted by Siwar Foods in Saudi Arabia, 80% of consumers prefer buying high-quality, distinct, and affordable frozen food. With the improved purchasing power, consumers are more inclined to explore a variety of frozen bakery products. The presence of supermarket chains and the development of cold chain infrastructure in countries across the Middle East further facilitate the availability and accessibility of frozen bakery products. The market also witnesses growing production and consumption of bakery products in a few countries, such as Saudi Arabia, Kuwait, and the UAE. The rising urbanization, increasing disposable income, and advancements in supply chain infrastructure are a few factors that drive the frozen bakery products market.

Middle East & Africa Frozen Bakery Products Market Segmentation

Middle East & Africa Frozen Bakery Products Market Segmentation

The Middle East & Africa frozen bakery products market is categorized into product type, category, distribution channel, and country.

Based on product type, the Middle East & Africa frozen bakery products market is segmented into breads and rolls, cakes and pastries, biscuits and cookies, and others. The breads and rolls segment held the largest market share in 2023.

In terms of category, the Middle East & Africa frozen bakery products market is bifurcated into gluten-free and conventional. The conventional segment held a larger market share in 2023.

By distribution channel, the Middle East & Africa frozen bakery products market is categorized into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the Middle East & Africa frozen bakery products market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. The Rest of Middle East & Africa dominated the Middle East & Africa frozen bakery products market share in 2023.

Grupo Bimbo SAB de CV, Rhodes International Inc, General Mills Inc, Pepperidge Farm Inc, Bridgford Foods Corp, Conagra Brands Inc, Cole’s Quality Foods Inc, Sara Lee Frozen Bakery LLC, T. Marzetti Company, and The Edwards Baking Company are some of the leading companies operating in the Middle East & Africa frozen bakery products market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 541.47 Million |

| Market Size by 2031 | US$ 775.16 Million |

| CAGR (2023 - 2031) | 4.6% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Middle East & Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Frozen Bakery Products Market is valued at US$ 541.47 Million in 2023, it is projected to reach US$ 775.16 Million by 2031.

As per our report Middle East & Africa Frozen Bakery Products Market, the market size is valued at US$ 541.47 Million in 2023, projecting it to reach US$ 775.16 Million by 2031. This translates to a CAGR of approximately 4.6% during the forecast period.

The Middle East & Africa Frozen Bakery Products Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Frozen Bakery Products Market report:

The Middle East & Africa Frozen Bakery Products Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Frozen Bakery Products Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Frozen Bakery Products Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)