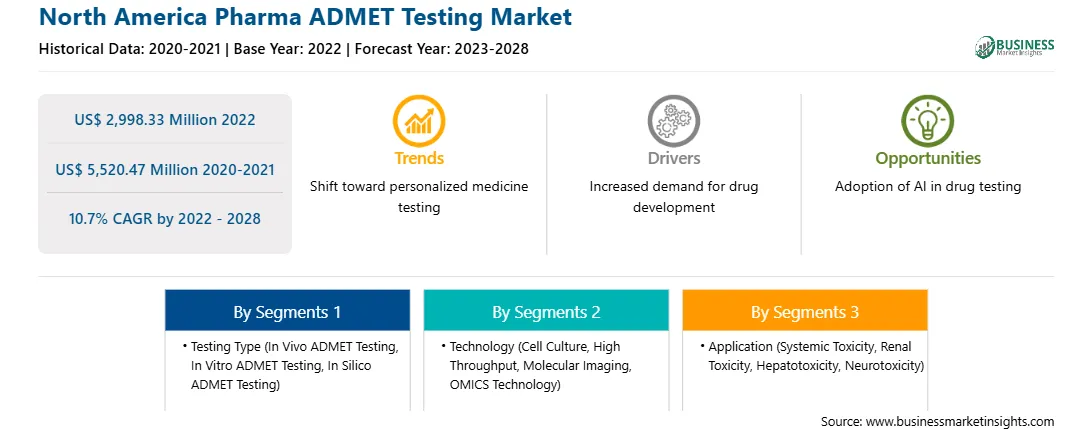

The pharma ADMET testing market in North America is expected to grow from US$ 2,998.33 million in 2022 to US$ 5,520.47 million by 2028. It is estimated to grow at a CAGR of 10.7% from 2022 to 2028.

The disaster of a rising number of therapeutic molecules in the last phases of clinical trials has cost money and valuable time invested in developing new drugs. This has led to higher investments being made in the development of fresher technology for toxicity testing. According to the article "Importance of ADME/Tox in Early Drug Discovery," 2022, in the current drug discovery and development pipeline, only 10 molecules out of 1,000 screened hits are projected to enter the preclinical testing stage, and only 9.6% will enter clinical trials.

The drug approval process is projected to take 15 years, and phases II and III are the most expensive phases of clinical trials. According to the study titled "Why 90% of Clinical Drug Development Fails and How to Improve It?", 2022, 90% of clinical drug development fails despite implementing many strategies. After entering clinical investigations, 9 out of 10 drug candidates fail during phase I, II, and III clinical trials and the drug approval process. Drug candidates rejected in preclinical stages are not included in the 90% failure rate of the drugs in clinical stages, as they do not enter the phase I clinical trials. If preclinical drug candidates are included, the drug discovery and development failure rate rise even higher than 90%. According to analyses of clinical trial data from 2010 to 2017, lacking clinical effectiveness (40–50%), uncontrollable toxicity (30%), poor drug-like qualities (10–15%), no commercial needs, and ineffective strategic planning (10%) are the 4 major causes of trial failure.

New drug development is both resource and time-intensive, where later clinical stages result in high costs. To lower the attrition rate in drug research & development, it is crucial to filter and optimize pharmaceuticals' absorption, distribution, metabolism, elimination, and toxicity (ADMET) characteristics at an early stage. It has been widely accepted that drug ADMET properties should be considered as early as possible to reduce failure rates in the clinical phase of drug discovery. In vitro and in vivo drug evaluation techniques have reached maturity in preclinical applications, and in silico technologies are gaining vast acceptance to evaluate the relevant properties of drugs in the preclinical stage. The development of software programs and in silico models is further promoting the implementation of ADMET studies. Thus, the increasing need for drug-development ADME testing boosts the pharma ADMET testing market.

Strategic insights for the North America Pharma ADMET Testing provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 2,998.33 Million |

| Market Size by 2028 | US$ 5,520.47 Million |

| CAGR (2022 - 2028) | 10.7% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By Testing Type

|

| Regions and Countries Covered | North America

|

| Market leaders and key company profiles |

|

The geographic scope of the North America Pharma ADMET Testing refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Pharma ADMET Testing Market Segmentation

The North America pharma ADMET testing market is segmented by testing type, technology, application, and country. Based on testing type, the market is segmented into in vivo ADMET testing, in vitro ADMET testing, and in silico ADMET testing. The in vivo ADMET testing segment is dominating the market in 2022. Based on technology, the market is segmented into cell culture, high throughput, molecular imaging, and OMICS technology. The cell culture segment is dominating the market in 2022. Based on application, the market is segmented into systemic toxicity, renal toxicity, hepatotoxicity, neurotoxicity, and others. The systemic toxicity segment is dominating the market in 2022. Based on country, the market is segmented into the US, Canada, and Mexico. Further, the US is dominating the market in 2022.

A few key players dominating the North America pharma ADMET testing market are Agilent Technologies, Inc.; Bio-Rad Laboratories, Inc.; Biovia (Dassault Systèmes); Charles River Laboratories; CMIC HOLDINGS Co., LTD.; Cyprotex Limited; IQVIA Inc.; MERCK KGaA; Promega Corporation; and Wuxi AppTec.

The North America Pharma ADMET Testing Market is valued at US$ 2,998.33 Million in 2022, it is projected to reach US$ 5,520.47 Million by 2028.

As per our report North America Pharma ADMET Testing Market, the market size is valued at US$ 2,998.33 Million in 2022, projecting it to reach US$ 5,520.47 Million by 2028. This translates to a CAGR of approximately 10.7% during the forecast period.

The North America Pharma ADMET Testing Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Pharma ADMET Testing Market report:

The North America Pharma ADMET Testing Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Pharma ADMET Testing Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Pharma ADMET Testing Market value chain can benefit from the information contained in a comprehensive market report.