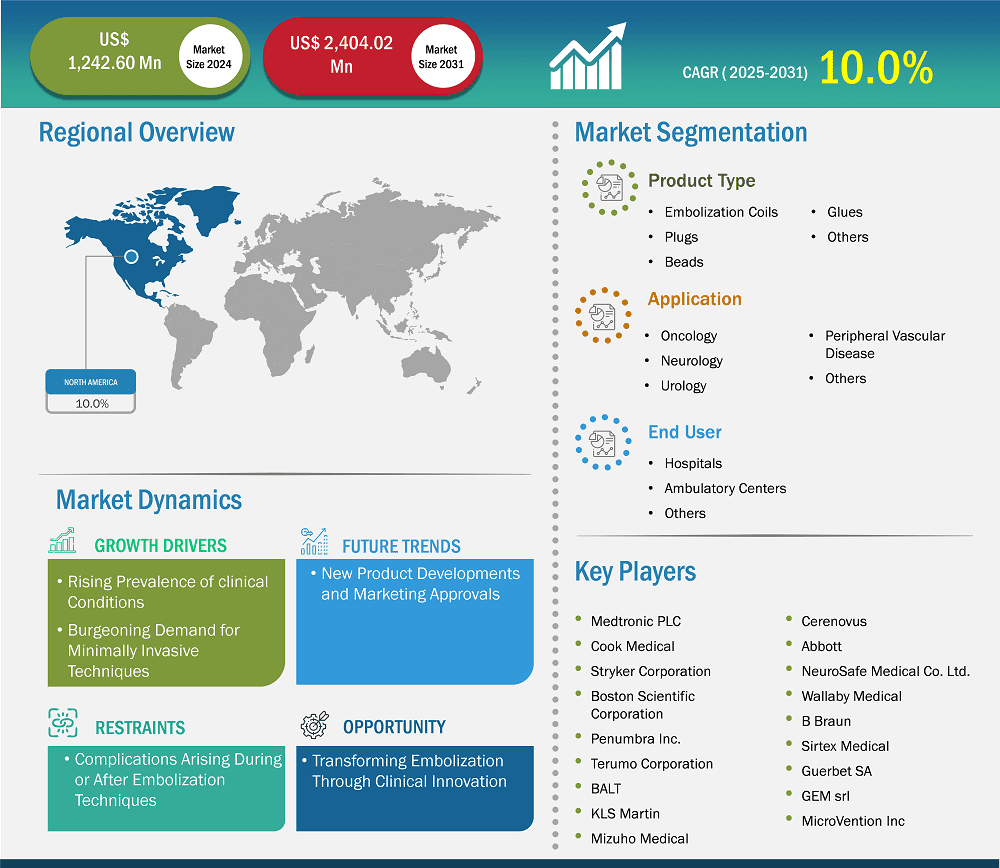

The North America embolization devices market size is expected to reach US$ 2,404.42 million by 2031 from US$ 1,242.60 million in 2024. The market is estimated to record a CAGR of 10.0% from 2025 to 2031.

The embolization devices market in North America is driven by the region's advanced healthcare infrastructure, increasing prevalence of vascular diseases, and growing adoption of minimally invasive procedures. Technological advancements have led to a significant enhancement in the precision and safety of embolization techniques, making them a preferred choice for treating conditions such as aneurysms, arteriovenous malformations, and tumors. The high patient awareness about various medical conditions and treatment options, strong healthcare reimbursement systems, and the presence of leading medical device companies contribute to market maturity in North America. Additionally, public health campaigns play a crucial role in promoting embolization procedures. Ongoing research and clinical trials are further expanding the scope of embolization technologies, with a particular focus on biodegradable and drug-eluting embolic agents. While the US leads in terms of adoption and innovation, Canada and Mexico are progressively increasing their market participation through supportive policies and infrastructure development. However, disparities in healthcare access across rural and urban settings remain a challenge. The region continues to attract significant investments and collaborations among hospitals, research institutes, and device manufacturers, ensuring sustained development and innovation in embolization technologies.

Key segments that contributed to the derivation of the North America embolization devices market analysis are type, application, and end user.

Innovations such as improved catheter designs, new embolic agents, and detachable coils have enhanced the efficacy and safety of embolization procedures. For example, the development of flow-diverting devices has revolutionized the treatment of complex intracranial aneurysms by redirecting blood flow away from the aneurysm sac, promoting thrombosis within the aneurysm.

Clinical studies are pivotal in advancing embolization techniques, leading to broader indications and improved patient outcomes. For instance, the IMPASS embolic coil device developed by Fluidx Medical Technology has shown promise in treating chronic subdural hematomas by embolizing the middle meningeal artery (MMA) in January 2023, as demonstrated in in-vivo studies. The Fluidx embolic platform is expected to bring simple preparation and controllable material delivery to various applications. The US FDA granted Investigational Device Exemption (IDE) approval to Fluidx Medical Technology to begin a pivotal clinical trial of the GPX embolic device in May 2024; the trial is designed to assess the safety and effectiveness of the device. Results from the study were recently published in the Journal of Vascular and Interventional Radiology, showing 100% technical success and high physician ratings for ease of preparation, deliverability, and visibility.

With the numerous applications for peripheral vascular embolization and the wide range of vessel sizes to be treated, no single agent or device fits all indications. The article titled "Results from the First-in-Human Study of the Caterpillar Arterial Embolization System," published in November 2022, assessed occlusion success and events associated with the use of a self-expanding device for peripheral artery embolization. The study was based on clinical outcomes of the Caterpillar Arterial Embolization Device, which features opposing nitinol fibers and a flow-occluding membrane. The device is designed for use in a broad range of arteries, aiming to reduce the number of devices required to achieve effective occlusion. In this first-in-human trial, the Caterpillar device was successfully deployed to embolize peripheral arteries. The procedure resulted in periprocedural occlusion in all participants and demonstrated a 94.7% rate of freedom from device-related serious adverse events (SAEs) at 30 days. The findings also suggest that the Caterpillar device can be used with minimal risk of SAEs related to the device or procedure.

As the market continues to evolve, the synergy between clinical research and device innovation will be crucial in addressing the growing demand for effective embolization therapies. Therefore, the integration of clinical studies into the development of embolization devices, fostering significant advancements in the field and leading to expanded treatment options and improved patient outcomes, is emerging as a significant trend in the embolization devices market.

Based on country, the North America embolization devices market comprises the US, Canada, and Mexico. The US held the largest share in 2024.

In the US, the embolization devices market is characterized by a high level of innovation, early adoption of emerging technologies, and a strong clinical focus on minimally invasive treatments. As per the study “Minimally Invasive Surgery in the United States, 2022: Understanding Its Value Using New Datasets,” the US exhibited a surging trend of minimally invasive surgeries (MIS), including robotic-assisted procedures, across both inpatient and ambulatory settings from 2016 to 2018.

According to the National Cancer Institute, HCC is the most prevalent type of liver cancer in the US, accounting for over 80% of all cases. Healthcare providers increasingly favor embolization procedures for treating conditions such as HCC, uterine fibroids, and brain aneurysms, given their lower risk profiles and quicker recovery times compared to traditional surgeries. The embolization devices market in the US also benefits from substantial investments made in medical technology and robust clinical research supporting the efficacy and safety of embolization therapies. The study titled "Results from a United States Investigational Device Study of Adhesive Capsulitis Embolization in the Treatment of Shoulder Pain," conducted at Prostate Centers USA and published in February 2022, aimed to assess the safety and efficacy of arterial embolization for treating shoulder pain caused by adhesive capsulitis (AC). The findings demonstrated that adhesive capsulitis embolization (ACE) significantly reduced pain and improved shoulder function in patients who were irresponsive to conservative treatments. The study also highlighted statistically significant improvements in VAS (Visual Analog Scale) and SANE (Single Assessment Numeric Evaluation)scores after one month post-procedure, with these benefits persisting through the six-month follow-up. Additionally, no major adverse events were reported, whereas minor adverse events subsided on their own without the need for intervention. Growing awareness among both patients and physicians regarding interventional radiology options contributes to the rising utilization of embolization techniques. The presence of major players such as Medtronic, Boston Scientific, and Stryker ensures continuous innovation and competition, keeping the market dynamic and progressive. Academic and medical institutions collaborate frequently with manufacturers to develop and evaluate new devices. In addition, the regulatory framework, although rigorous, supports a structured path of product approval.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,242.60 Million |

| Market Size by 2031 | US$ 2,404.42 Million |

| CAGR (2025 - 2031) | 10.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Medtronic Plc; Cook Medical Holdings LLC; Stryker Corp; Boston Scientific Corp; Terumo Corp; Johnson & Johnson; Abbott Laboratories; NeuroSafe Medical Co. Ltd; Wallaby Medical; Sirtex Medical Ltd; GEM srl; Penumbra Inc.; Balt; Lepu Medical Technology Beijing Co Ltd; INVAMED; Meril Life Sciences Pvt Ltd; Merit Medical Systems Inc; and Lifetech Scientific Corp among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insights Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Embolization Devices Market is valued at US$ 1,242.60 Million in 2024, it is projected to reach US$ 2,404.42 Million by 2031.

As per our report North America Embolization Devices Market, the market size is valued at US$ 1,242.60 Million in 2024, projecting it to reach US$ 2,404.42 Million by 2031. This translates to a CAGR of approximately 10.0% during the forecast period.

The North America Embolization Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Embolization Devices Market report:

The North America Embolization Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Embolization Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Embolization Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)