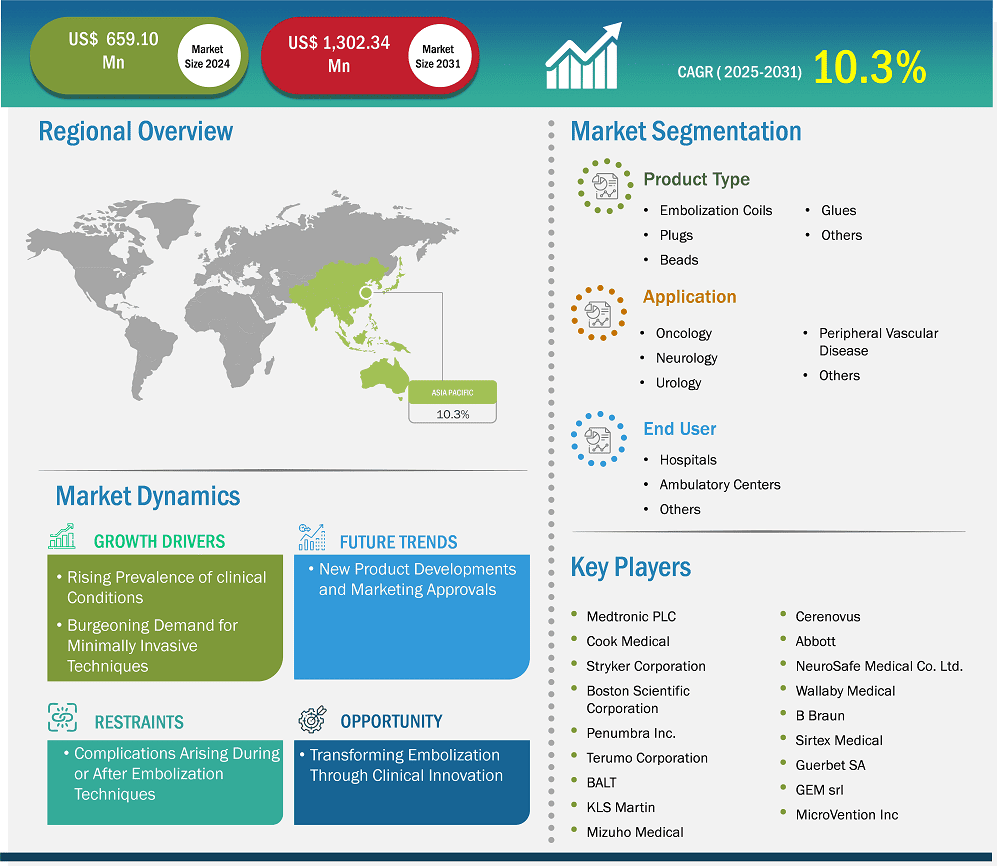

The Asia Pacific embolization devices market size is expected to reach US$ 1,302.34 million by 2031 from US$ 659.10 million in 2024. The market is estimated to record a CAGR of 10.3% from 2025 to 2031.

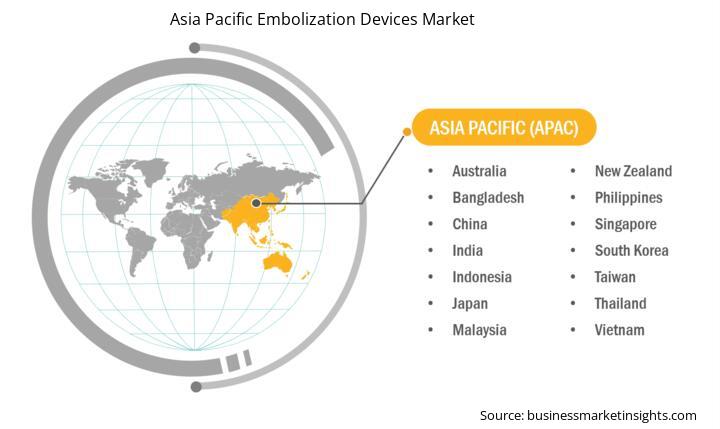

The Asia Pacific embolization devices market is segmented into China, Japan, India, South Korea, Australia, and the Rest of Asia Pacific. One of the primary drivers is the increasing prevalence of cancer and other clinical conditions, leading to a higher demand for interventional procedures like embolization. Technological advancements have also played a crucial role. Innovations in embolization devices, such as drug-eluting beads, microcatheters, and novel coil designs, have enhanced the efficacy and safety profiles of embolization procedures. These advancements not only improve clinical outcomes but also reduce procedure times and post-operative complications, making them more attractive to healthcare providers and patients alike. The shift towards minimally invasive surgical techniques is another significant factor. Minimally invasive procedures offer numerous benefits, such as reduced hospital stays, quicker recovery times, and lower risk of complications compared to open surgeries. As healthcare providers and patients increasingly recognize these advantages, the demand for embolization procedures is expected to rise.

Key segments that contributed to the derivation of the Asia Pacific embolization devices market analysis are type, application, and end user.

Embolization is a minimally invasive method used to block blood flow to targeted areas, such as tumors or abnormal blood vessels, by introducing embolic agents via catheters. This method has found wide application in treating AVMs, aneurysms, and certain types of cancer. The preference for such techniques has been on the rise due to their benefits over traditional surgical procedures, including reduced hospital stays, lower complication rates, and faster recovery times.

In uterine fibroid treatment, uterine artery embolization offers an alternative to the conventional treatment approach, such as hysterectomy. A study published in the Journal of Vascular and Interventional Radiology noted that uterine artery embolization had success rates of over 90%, significantly reducing symptoms while preserving the functioning of the uterus, which is particularly appealing among women of reproductive age. Additionally, older individuals often have comorbidities that make them poor candidates for traditional surgical procedures, thus increasing the demand for minimally invasive options. For instance, transarterial chemoembolization (TACE) has become a widely adopted first-line therapy in treating hepatocellular carcinoma (HCC), a common liver cancer in elderly patients. The use of microspheres and drug-eluting beads in TACE helps enhance the HCC treatment. In addition to blocking blood supply, these advanced embolic agents effectively deliver localized chemotherapy to the tumor, improving therapeutic efficacy while reducing systemic side effects. The National Cancer Institute reports that TACE can extend median survival in intermediate-stage HCC patients to 20 months, offering a safer alternative to surgical resection.

Bioresorbable embolic materials have emerged as another development in the embolic devices market; these materials offer temporary occlusion and are gradually absorbed by the body, reducing long-term complications and enabling future treatment options. As healthcare systems worldwide shift toward minimally invasive and cost-effective interventions, patients and clinicians increasingly prioritize treatment options that minimize trauma, recovery time, and complications. Thus, embolization provides a minimally invasive alternative to traditional surgeries, offering targeted treatment, symptom relief, and enhanced quality of life for patients. These benefits are driving the adoption of embolization devices in clinical practice.

Based on country, the Asia Pacific embolization devices market comprises China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China held the largest share in 2024.

China faces a high peripheral artery disease (PAD) burden. According to estimates published in the Journal of Vascular Surgery, in China, the total number of people affected by PAD increased by 40% during 2000–2020. China has the largest population with type 2 diabetes mellitus in the region, affecting over 116 million adults, and the number is estimated to rise to 147 million by 2045. People affected by type 2 diabetes are 1.5–4.0 times more likely to develop PAD than non-diabetic people. In China, the prevalence of PAD in diabetic patients ranges from 6% to 10%. The lack of awareness and lower treatment and control rates for PAD and its risk factors in China may be the reason for the higher prevalence of PAD in women than in men; the country has seen a sharp increase in PAD cases after the mid-1960s.

In addition, technological innovation has played a pivotal role in the market's expansion. Chinese companies such as MicroPort have been developing and manufacturing embolization devices tailored to local needs. MicroPort, headquartered in Shanghai, is recognized for its significant investment in research and development, contributing to the advancement of medical technologies in China. Market players are engaged in strategic activities to expand their footprint in the market. Grand Pharmaceutical and Healthcare Holdings Limited acquired Shenming Medical Technology Co., Ltd in May 2021. The company has obtained all rights to an innovative thermosensitive embolic agent that is used for liver cancer treatment, further expanding its tumor intervention treatment product pipeline. In January 2024, Zylox-Tonbridge's ZYLOX Phoenix Peripheral Detachable Fibered Coil Embolization System was granted marketing approval by the National Medical Products Administration (NMPA).

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 659.10 Million |

| Market Size by 2031 | US$ 1,302.34 Million |

| CAGR (2025 - 2031) | 10.3% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered |

Asia Pacific

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Medtronic Plc; Cook Medical Holdings LLC; Stryker Corp; Boston Scientific Corp; Terumo Corp; Johnson & Johnson; Abbott Laboratories; NeuroSafe Medical Co. Ltd; Wallaby Medical; Sirtex Medical Ltd; GEM srl; Penumbra Inc.; Balt; Lepu Medical Technology Beijing Co Ltd; INVAMED; Meril Life Sciences Pvt Ltd; Merit Medical Systems Inc; and Lifetech Scientific Corp, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insights Partners conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Embolization Devices Market is valued at US$ 659.10 Million in 2024, it is projected to reach US$ 1,302.34 Million by 2031.

As per our report Asia Pacific Embolization Devices Market, the market size is valued at US$ 659.10 Million in 2024, projecting it to reach US$ 1,302.34 Million by 2031. This translates to a CAGR of approximately 10.3% during the forecast period.

The Asia Pacific Embolization Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Embolization Devices Market report:

The Asia Pacific Embolization Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Embolization Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Embolization Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)