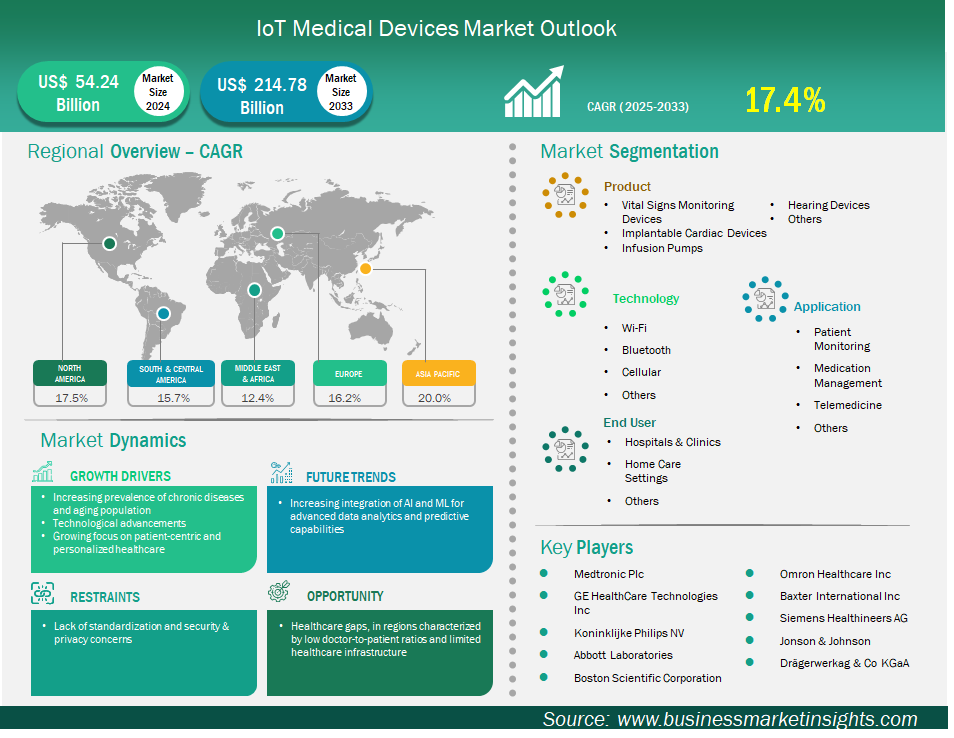

The IoT medical devices market size is expected to reach US$ 214,775.0 million by 2033 from US$ 54,238.3 million in 2024. The market is estimated to record a CAGR of 17.4% from 2025 to 2033.

Executive Summary and Global Market Analysis:

The global IoT medical devices market is experiencing significant growth driven by increasing prevalence of chronic diseases and aging population, growing focus on patient-centric and personalized healthcare, and technological advancements. However, the lack of standardization and associated security and privacy concerns are slowing market evolution. Geographically, North America currently holds the largest total share of the global market, due to advanced health care infrastructure and the early adoption of digital health technologies along with significant regulatory support for health innovation.

Asia Pacific is rapidly emerging as the fastest growing market driven by a rapidly evolving digital transformation, increasing chronic disease levels, and more rapidly evolving health care infrastructure. Medtronic, GE Healthcare, and Koninklijke Philips N.V. are major companies in the market actively pursuing product innovation, partnerships, and developing markets. As demand for IoT medical devices grows, manufacturers are developing advanced IoT devices, so significant and evident growth in global IoT medical devices is anticipated, leading to reduced costs for personal IoT medical devices, enhanced efficiency, and improved patient outcomes worldwide.

Key segments that contributed to the derivation of the IoT Medical Devices market analysis are product, technology, application, and end user.

IoT Medical Devices Market Drivers and Opportunities:

Increasing Prevalence of Chronic Diseases and Aging Population Driving IoT Medical Devices Market

Growing prevalence of chronic diseases, including diabetes, heart disease, and lung disease, inherently requires concurrent monitoring, timely action, and individualized care. The US National Council on Aging (NCOA) estimates that nearly all adults over 65 (approximately 80%) have at least one chronic disease and are typically managing two or more. This adult cohort not only has a higher rate of chronic disease than any other age group, but they also have a higher share of healthcare spending. Per NCOA estimates, in 2024, adults aged 55 and older represented just 31% of the population but were responsible for more than 50% of total healthcare spending.

IoT medical devices, particularly those designed for Remote Patient Monitoring (RPM), provide an exceptionally effective and efficient way to manage chronic disease outside of a healthcare facility. By continuously gathering vital sign data, such as glucose levels from Continuous Glucose Monitors (CGMs) or heart rates and blood pressures through wearable sensors, IoT medical devices provide real-time data to patients or providers. This data can be shared instantly with qualifying healthcare professionals, allowing them to observe and react immediately to variances they may identify and escalate the clients' treatment plan on demand. As a result, the devices significantly reduce the need for frequent in-person follow-ups and fewer visits to the hospitals, hence alleviating the significant cost incurred for managing chronic conditions and improving patient outcomes overall. The trajectory of the market reflects this intense impact. Market growth is largely the result of an increase in the adoption of remote patient monitoring solutions as a necessary overlap of chronic disease management and consideration for an aging population. In the long term, there will be an increasing need for scalable, efficient, and patient-centered solutions to manage chronic diseases in an aging population. This demand will ensure that IoT medical devices remain at the forefront of future healthcare innovation and investment.

Healthcare Gaps and Limited Healthcare Infrastructure to Provide Significant Opportunity

One of the key opportunities for the IoT medical devices market is its capacity to connect existing gaps in healthcare, especially in areas with low doctor-patient ratios and limited healthcare infrastructure. This has the potential to improve access to care for underserved populations. Many areas around the world, especially in developing, rural, and remote regions, have fewer qualified healthcare professionals available to practice medicine. For example, India has an overall doctor-to-population ratio of approximately 1:834. In rural areas—where about 70% of the population resides—this ratio can worsen to as high as 1:2500, according to reports by the Deccan Chronicle (September 2024) and PMC (August 2024). These sources also highlight a severe lack of physical healthcare infrastructure, making it unlikely for medical professionals to practice in rural and remote regions. This means that millions of people are unable to access basic medical consultations, diagnoses, and ongoing healthcare in a timely manner, and often these patients are required to travel long distances over long periods time to access the nearest healthcare provider. In contrast, IoT medical devices can enable Remote Patient Monitoring (RPM) and telehealth. Wearable sensors, smart diagnostic devices (e.g., connected blood pressure monitors, pulse oximeters, glucose meters), and sometimes ingestible sensors can wirelessly capture and send real-time health and medical data wirelessly from a patient's home or a local community health.

IoT Medical Devices Market Size and Share Analysis

The IoT medical devices market is classified by products into vital signs monitoring devices, implantable cardiac devices, infusion pumps, hearing devices, and others. The vital signs monitoring devices segment led the market in 2024 and beyond. The segment's leading position is strengthened by their fundamental and universal importance in healthcare. These devices, including IoT-enabled blood pressure monitors, glucometers, cardiac monitors and pulse oximeters, constantly monitor important physiological parameters. The global prevalence of chronic diseases, such as hypertension, diabetes and respiratory diseases, is on the rise. An increasing number of patients will require ongoing monitoring with IoT devices. In addition, the COVID-19 pandemic has accelerated the deployment and adoption of vital sign monitors, especially for remotely managed patients. The pandemic amplified the importance of monitoring vital signs as it relates to earlier detection, ongoing disease management, and reducing visits to the hospital. Continuing and actionable data is critical to deliver clinical care, improve patient health, and enable interventions.

By technology, the market is segmented into Wi-Fi, Bluetooth, cellular, and others. The Wi-Fi segment held the largest share of the market in 2024. This is owing to its universal availability, low-cost implementation, and capability for real-time data transmission. Almost all healthcare infrastructures already have Wi-Fi networks and the ability to add new IoT devices would require minimal investment. Wi-Fi is a good choice for clinical and home-based applications due to its versatility and the variety of medical devices that support Wi-Fi, such as bedside devices, wearable sensors, etc. Other technologies, such as Bluetooth and cellular, have some advantages, but Wi-Fi is likely the selected connectivity option for many connected medical device applications as it is widely available and provides additional, ongoing enhancements in speed, reliability, and security. In addition, Wi-Fi allows for high-bandwidth data transmission in local areas, making it ideal for many IoT medical applications.

In terms of applications, the market is segmented into patient monitoring, medication management, telemedicine, and others. The patient monitoring segment had the largest market share in 2024. This is because of the growing demand for continuous and real-time health tracking, whether in a clinic or at home. This application includes devices that monitor vital signs, track movement, and provide data for managing chronic conditions. The increasing prevalence of chronic diseases and an aging population are arguably the two main factors contributing to the growth since continuous patient monitoring enabled the ability of providers to offer a more proactive level of care, detect health problems as they arise, and intervene as necessary to improve health outcomes for patients, while also preventing unnecessary readmissions. Additionally, the trend towards continuous, personalized, preventative, and value-based care models gives additional credibility to the need for continuous patient data to inform healthcare decisions, making IoT-enabled patient monitoring devices a critical component of the modern-day healthcare delivery system.

By end user, the market is segmented into hospitals & clinics, home care settings, and others. The hospitals & clinics segment held the largest share of the market in 2024. This is because they're the primary places of care where advanced medical technology and intermittent patient insurance are essential. These facilities can make the greatest use of IoT devices in order to improve operational efficiency to improve patient safety and clinical care workflows. IoT devices can actively monitor patients, track medical inventories, and handle repetitive tasks. This allows clinicians to focus on more meaningful work, manage a greater number of patients, and reduce time spent on manual documentation and memory-based recordkeeping. In addition, hospitals are using more and more "smart" technologies to forecast patient admissions to gain insight into managing critical care resources to improve treatment options. They have the most infrastructure and the greatest patient traffic though continuous care, making them the primary adopters of IoT medical devices.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 54,238.3 Million |

| Market Size by 2033 | US$ 214,775.0 Million |

| Global CAGR (2025 - 2033) | 17.4% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

IoT Medical Devices Market Report Coverage and Deliverables

The "IoT Medical Devices Market Size and Forecast (2022–2033)" report provides a detailed analysis of the market covering below areas:

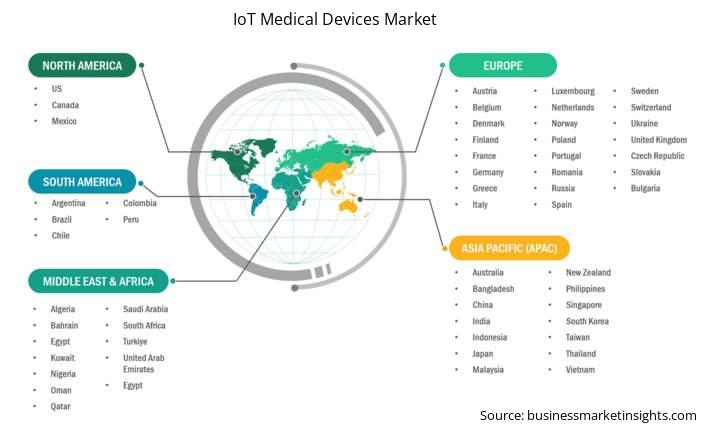

The geographical scope of the IoT medical devices market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The IoT Medical Devices market in Asia Pacific is expected to grow significantly during the forecast period.

Asia Pacific IoT medical devices market includes China, Japan, India, South Korea, Australia, Bangladesh, New Zealand, the Philippines, Singapore, Indonesia, Taiwan, Malaysia, Vietnam, and the Rest of Asia Pacific. This expansion can be attributed to a confluence of several factors. The healthcare infrastructure in the Asia Pacific region continues to develop a lot due to a combined increase in government spending and private funds meant to modernize healthcare delivery systems. There has been a rise in the awareness of people regarding the management of their own health and continuous monitoring, especially in chronic care. Additionally, the Asia Pacific region has one of the largest populations in the world, with a significant portion growing older which acts as a demographic driver contributing to a higher prevalence of chronic illnesses that require continued care and monitoring. There is also rapid adoption/usage of digital technologies which includes growing smartphone use and expanding high-speed internet networks in many countries, which can bolster the deployment and use of IoT medical devices. The growing demand for low-cost healthcare alternatives and rapid growth in medical tourism in some parts of the Asia Pacific region also fosters the uptake of IoT medical devices.

Among the countries in the Asia Pacific region, there are several countries leading the growth of the IoT medical devices market. China heads the charge with one of the largest patient bases, expanded and accelerated healthcare digitization, and a strong local manufacturing of low-cost and modern medical technology. The Chinese government is driving initiatives to roll out telemedicine and digital healthcare, especially in rural and remote areas, will also contribute to increases in the adoption rates of IoT medical devices. India has a strong projected growth rate due to rising healthcare spending, private hospital expansions, and government initiatives like "Make in India" which are pushing for medical devices produced domestically. Awareness of health issues, as well as improvements in diagnostic technology will also contribute to growth. Japan is technology advanced and has a rapidly aging population. Japan is a large player in the global market. The industrial IoT market in Japan is expected to see significant growth inthe coming years and is looking more specifically at IoT in healthcare with an emphasis on remote patient monitoring, smart homes, and eldercare robots as they look to assist their population. As these countries develop their health systems, IoT technologies are fueling growth across the entire region’s healthcare sector.

IoT Medical Devices Market Research Report Guidance

IoT Medical Devices Market News and Key Development:

The IoT medical devices market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the IoT Medical Devices market are:

Key Sources Referred:

The IoT Medical Devices Market is valued at US$ 54,238.3 Million in 2024, it is projected to reach US$ 214,775.0 Million by 2033.

As per our report IoT Medical Devices Market, the market size is valued at US$ 54,238.3 Million in 2024, projecting it to reach US$ 214,775.0 Million by 2033. This translates to a CAGR of approximately 17.4% during the forecast period.

The IoT Medical Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the IoT Medical Devices Market report:

The IoT Medical Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The IoT Medical Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the IoT Medical Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)