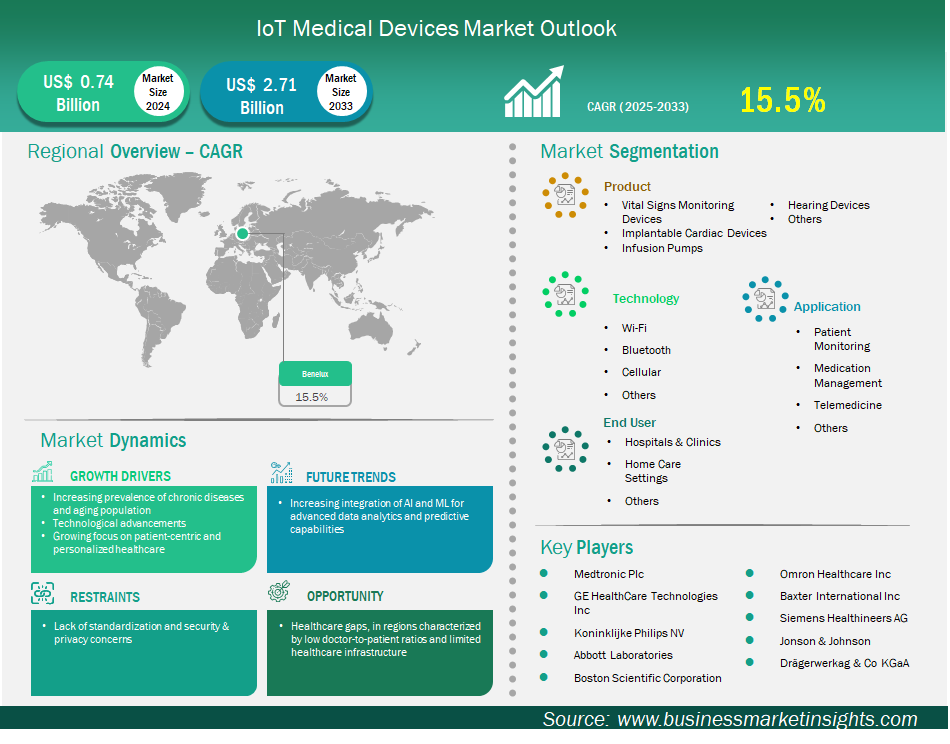

Benelux IoT medical devices market size is expected to reach US$ 2,711.9 million by 2033 from US$ 743.6 million in 2024. The market is estimated to record a CAGR of 15.5% from 2025 to 2033.

Executive Summary and Benelux IoT Medical Devices Market Analysis:

The IoT medical devices market in Benelux is experiencing significant growth driven by increasing prevalence of chronic diseases and aging population, growing focus on patient-centric and personalized healthcare, and technological advancements. The Benelux IoT medical devices market is part of a well-developed and progressive sector of the European digital health ecosystem and includes Belgium, the Netherlands, and Luxembourg. The region is characterized by advanced healthcare systems and strong digital infrastructure. Number of factors, such as an aging population, rising rates of chronic disease, a desire for continuous monitoring, and an interest in home-based care fueling market development. In addition, there is an active commitment to digital health transformation in these nations coming from governments, healthcare providers, and other stakeholders in the sector. There is a positive culture of R&D that enables the collaboration of universities, tech 'start-ups', and healthcare providers towards the creation and adoption of IoT medical devices in clinical settings, as well as in real life situations. Like many advanced markets, the Benelux region encounters challenges concerning data interoperability across incompatible systems and must effectively address issues related to data privacy, cybersecurity, and public trust in connected healthcare solutions.

Key segments that contributed to the derivation of the IoT medical devices market analysis are product, technology, application, and end user.

Benelux IoT Medical Devices Market Outlook

The Benelux IoT medical devices market is segmented into Belgium, Netherlands, and Luxembourg. The IoT medical devices market in the Benelux is showing growth. This is because of the region's strong health care systems and openness to digitalization. The governments and health care providers in the region will continue to push digital health. Investments into telemedicine and remote patient monitoring programs will enhance better managed care while also reducing expenses in health care and providing better outcomes for patients. The region also has strong and transparent regulatory frameworks in place. Benelux also has a strong R&D network. The diverse collaboration of universities, technology companies, and health care providers is ideal for the R&D phase of IoT medical device technology. Many of these advanced devices use artificial intelligence and analytics so that they can make early predictions of diseases.

Benelux IoT Medical Devices Market Country Insights

Based on country, the Benelux IoT medical devices market is segmented into the Belgium, Netherlands, and Luxembourg. The Netherlands held the largest share in 2024.

The Netherlands is a leader in remote patient monitoring and digital health innovation. This evolution is supported by a solid digital infrastructure. The country continues to invest in solutions that enable patients to monitor their health symptoms in their home environments. These strategies eliminate unnecessary clinical visits and improve the optimization of healthcare resources. Belgium is gaining traction as a healthcare innovation center. The government is focused on implementing digital health solutions across the healthcare system. A lot of initiatives focus on remote, personalized, and preventive healthcare. Belgium is also facilitating the integration of IoT technologies to support real-time monitoring of patients and improve the efficiency of its advanced healthcare framework. Although Luxembourg is a smaller country, it is very technologically ready. The country has a mature perspective regarding digital transformation within healthcare. Luxembourg takes advantage of a robust financial services ecosystem and its national ambition to innovate. HealthTech initiatives in Luxembourg include secure sharing of health data, AI-enabled decision support, and the Health 5.0 smart home conceptualization that facilitates the care of older adults. These developments at a country level illustrate how IoT health technology can help improve care pathways. They support remote patient monitoring, produce better clinical care methodologies, and allow for improved health outcomes.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 743.6 Million |

| Market Size by 2033 | US$ 2,711.9 Million |

| CAGR (2025 - 2033) | 15.5% |

| Historical Data | 2022-2023 |

| Forecast period | 2025-2033 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Benelux

|

| Market leaders and key company profiles |

|

Medtronic Plc, GE HealthCare Technologies Inc, Koninklijke Philips NV, Abbott Laboratories, Boston Scientific Corporation, Omron Healthcare Inc, Baxter International Inc, Siemens Healthineers AG, Jonson & Johnson, and Drägerwerkag & Co KGaA, are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

Benelux IoT Medical Devices Market Research Methodology:

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Benelux IoT Medical Devices Market is valued at US$ 743.6 Million in 2024, it is projected to reach US$ 2,711.9 Million by 2033.

As per our report Benelux IoT Medical Devices Market, the market size is valued at US$ 743.6 Million in 2024, projecting it to reach US$ 2,711.9 Million by 2033. This translates to a CAGR of approximately 15.5% during the forecast period.

The Benelux IoT Medical Devices Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Benelux IoT Medical Devices Market report:

The Benelux IoT Medical Devices Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Benelux IoT Medical Devices Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Benelux IoT Medical Devices Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)