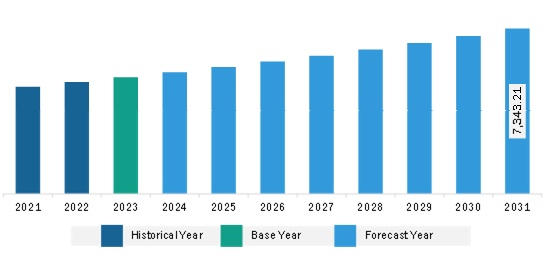

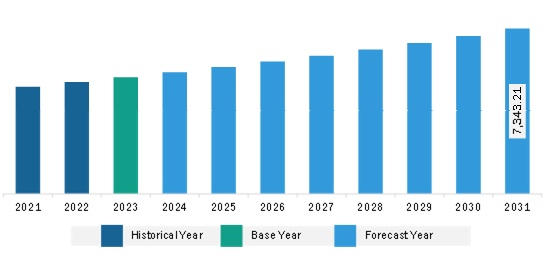

The Europe tortilla market was valued at US$ 5,166.17 million in 2023 and is expected to reach US$ 7,343.21 million by 2031; it is estimated to register a CAGR of 4.5% from 2023 to 2031.

The prevalence of Celiac disease is rising in different countries across the globe. According to the data published by Epidemiology, Presentation, and Diagnosis of Celiac Disease in 2021, cases of celiac disease are found across the globe, contrary to earlier beliefs that it affects people in Western and Northern Europe. Celiac disease can cause thyroid/Type 1 diabetes or damage the intestine lining in some patients. The gluten-free diet can help reduce celiac disease's effect by promoting intestinal healing. Therefore, consumers are tremendously preferring gluten-free diets. As per the Leisure Food & Beverages EXPO in 2021, people aged 20–39 are the primary consumers of a gluten-free diet in the UK. Also, 41% of athletes in the country have said they followed a gluten-free diet. This has propelled the demand for gluten-free products in the UK in recent years. Increasing consumption of healthy food products to prevent health issues such as chronic pulmonary disease, diabetes, heart disease, obesity, and metabolic syndrome is expected to boost the demand for gluten-free food items such as tortillas. Gluten-free tortillas are manufactured from rice flour, corn flour, or tapioca flour. Many people try new diets such as keto or paleo diets. In addition, individuals adopt a gluten-free diet due to their existing medical conditions. Further, manufacturers are focusing on developing and launching gluten-free products in response to their increasing demand among consumers. For instance, in 2021, Mission Foods unveiled its better-for-you tortilla offerings with two new varieties—almond flour tortillas and cauliflower tortillas. Both are certified gluten-free and vegan-friendly. Thus, the increasing preference for gluten-free products is expected to create a huge opportunity for the tortilla market during the forecast period.

Constant changes in consumer preferences and a rise in diverse culinary experiences led to the popularity of Mexican cuisine, which boosted the demand for tortilla products in Europe. Tortillas are often considered a healthier alternative to bread owing to the presence of lower fat and fiber content. Hence, the population of health-conscious consumers opt for tortilla-based meals as part of a balanced diet. Consumers are also seeking convenient and versatile options that can be used in various dishes, such as tacos, wraps, quesadillas, and burritos, which contributes to the growing sales of tortillas.

A rise in the working population and dual-income families are major factors promoting the consumption of processed foods such as packaged flour tortillas in Europe. For instance, Eurostat reported that approximately 73.1% of the population in the region, amounting to 250 million people, were working professionals in 2021. In the same year, the Department of Public Health of Belgium estimated that the consumption of ultra-processed food and drinks increased to 44% in the UK and 14% in countries such as Italy and Romania. Further, the National Research Council of Italy revealed that approximately 50% of the average daily energy intake in European countries emerged from the consumption of processed foods in 2021.

The presence of a robust retail sector and the growing preference for online shopping are boosting the demand for tortillas in Europe. Retailers provide a wide range of tortilla products from different brands and adopt various other promotional strategies to boost sales. For example, they offer huge discounts and deals to attract a large number of customers who prefer tortillas.

The Europe tortilla market is categorized into source, product type, category, distribution channel, and country.

Based on source, the Europe tortilla market is segmented into wheat, corn, and others. The corn segment held the largest market share in 2023.

By product type, the Europe tortilla market is segmented into tortilla chips/tostada chips taco shells, tortilla wraps, others. The tortilla chips/tostada chips segment held the largest market share in 2023. The tortilla chips/tostada chips segment is further sub segmented into corn chips and other chips.

Based on category, the Europe tortilla market is bifurcated into organic and conventional. The conventional segment held a larger market share in 2023.

Based on distribution channel, the Europe tortilla market is segmented into supermarkets and hypermarkets, convenience stores, online retail, others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the Europe tortilla market is segmented into Germany, France, Italy, the UK, Spain, and the Rest of Europe. The Rest of Europe dominated the Europe tortilla market share in 2023.

GRUMA SAB de CV; PepsiCo Inc; La Tortilla Factory Inc; Aranda’s Tortilla Co Inc; Paulig Ltd; General Mills Inc; Goya Foods Inc; Moctezuma Foods SRO; Komali Tortillas GmbH; Greendot Health Foods Pvt. Ltd.; Paul’s Organics; Delibreads Europe S.L.; Leighton Foods AS; and The Hain Celestial Group Inc are some of the leading companies operating in the Europe tortilla market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5,166.17 Million |

| Market Size by 2031 | US$ 7,343.21 Million |

| CAGR (2023 - 2031) | 4.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Source

|

| Regions and Countries Covered |

Europe

|

| Market leaders and key company profiles |

|

The Europe Tortilla Market is valued at US$ 5,166.17 Million in 2023, it is projected to reach US$ 7,343.21 Million by 2031.

As per our report Europe Tortilla Market, the market size is valued at US$ 5,166.17 Million in 2023, projecting it to reach US$ 7,343.21 Million by 2031. This translates to a CAGR of approximately 4.5% during the forecast period.

The Europe Tortilla Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Tortilla Market report:

The Europe Tortilla Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Tortilla Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Tortilla Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)