Growing LNG Liquefaction Capacity

In 2021, China, was a major contributor in the trading as its net import of LNG volume increased by 10.4 million metric ton per year, while the countries in Asia Pacific increased the trading volume of LNG which climbed from 68. million metric ton per year in 2020 to 79.3 million metric ton per year in 2021. Also, as per the data from Global Trade Tracker and China’s General Administration of Customs, in 2021, China imported LNG in a large amount of averaged 10.5 billion cubic feet per day (Bcf/d), an increase of 19% compared with 2020. Thus, the increase in LNG import is augmenting the need for LNG liquefaction which is further strengthening the demand for LNG carrier for transportation purpose, which is helping the C-type LNG carrier market to grow.

As per the IGU-World-LNG-Report-2022, as of April 2022, LNG liquefaction of 136.2 million Tonnes Per Annum (MTPA) capacity was under construction or approved for development. However, only 7.7 MTPA of overall capacity is expected to come online in the second half of 2022, and the rest is anticipated to come between 2023 and 2027. Also, according to the same report, global liquefaction capacity reached 459.9 MTPA in 2021, and the utilization rate was 80.4% on average, compared to 74.6% in 2020.

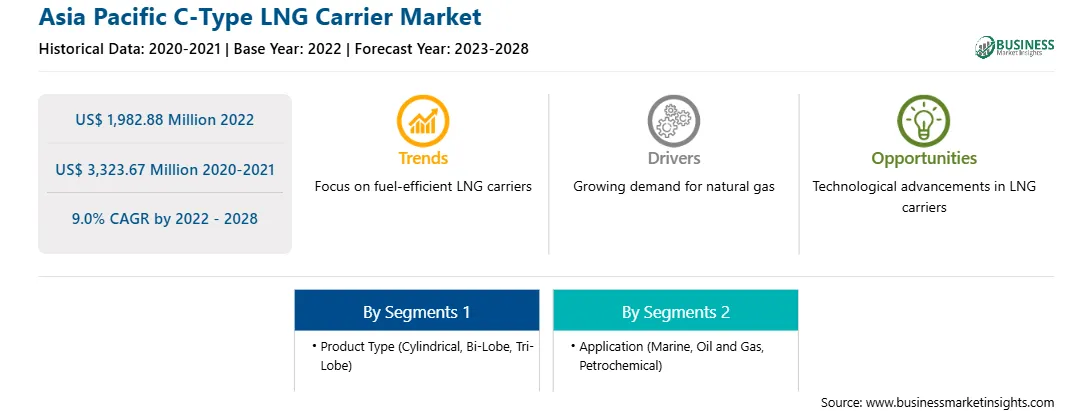

Market Overview

Asia Pacific accounted for the largest share of the LNG market in 2021. This can be attributed to the increasing demand for natural gas due to high industrial growth and the adoption of clean energy sources. The region is expected to dominate the C-Type LNG carrier market during the forecast period. Most of the demand in the region comes from China. For instance, in 2020, the Chinese government announced plans to build the country's largest LNG carrier with a capacity of 270,000 cubic meters to meet the country's growing demand for clean fuel. However, China's LNG imports are still highly dependent on foreign LNG carriers, with over 65% dependence on external capacity. Hence, the growing need for LNG is anticipated to fuel the market over the forecast period.

Furthermore, regional companies are partnering with storage tank manufacturers to ensure that LNG is installed and transported efficiently. For instance, McDermott International's CB&I Storage Solutions division has won a contract to build an LNG import plant in Batangas, the Philippines. Atlantic Gulf and Pacific Company were awarded the contract (AG&P). It is for designing, procuring, and building a liquefied natural gas (LNG) storage tank for AG&P's LNG import and regasification terminal in the Philippines. The facility will first have a capacity of up to 3 million tonnes per annum of re-gasified LNG. It will also have a scalable onshore regasification capability of 420 mmscfd and a storage capacity of about 200,000 cm.

In addition, the supply of ships in the Pacific is extremely limited, and with winter approaching, shippers who need LNG ships to cover their short positions need to pay heavily for it. For instance, the Asia Pacific barrel daily rate last hit a record high of around US$ 175,000 a day in mid-January 2021 and has ranged between US$ 50,000 and US$ 70,000 a day for most of 2021. Hence, the rising gas rate is fueling the demand for LNG carriers to minimize the rate, resulting in market expansion.

Strategic insights for the Asia Pacific C-Type LNG Carrier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Asia Pacific C-Type LNG Carrier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Asia Pacific C-Type LNG Carrier Strategic Insights

Asia Pacific C-Type LNG Carrier Report Scope

Report Attribute

Details

Market size in 2022

US$ 1,982.88 Million

Market Size by 2028

US$ 3,323.67 Million

CAGR (2022 - 2028) 9.0%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Application

Regions and Countries Covered

Asia-Pacific

Market leaders and key company profiles

Asia Pacific C-Type LNG Carrier Regional Insights

Asia Pacific C-Type LNG Carrier Market Segmentation

The Asia Pacific C-type LNG carrier market is segmented into product type, application, and country.

China Shipbuilding Trading Co., Ltd.; DSME Co., Ltd.; Gaslog Ltd.; GAS Entec; HYUNDAI SAMHO HEAVY INDUSTRIES CO., LTD.; Knutsen OAS Shipping; Komarine Co.; Mitsubishi Heavy Industries, Ltd.; and TGE Marine Gas Engineering GmbH; Torgy LNG AS are the leading companies operating in the c-type LNG carrier market in the region.

The Asia Pacific C-Type LNG Carrier Market is valued at US$ 1,982.88 Million in 2022, it is projected to reach US$ 3,323.67 Million by 2028.

As per our report Asia Pacific C-Type LNG Carrier Market, the market size is valued at US$ 1,982.88 Million in 2022, projecting it to reach US$ 3,323.67 Million by 2028. This translates to a CAGR of approximately 9.0% during the forecast period.

The Asia Pacific C-Type LNG Carrier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific C-Type LNG Carrier Market report:

The Asia Pacific C-Type LNG Carrier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific C-Type LNG Carrier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific C-Type LNG Carrier Market value chain can benefit from the information contained in a comprehensive market report.