Increasing Demand for Clean Energy

Natural gas is gaining momentum in many sectors as it is a cheap, environment-friendly, and efficient fossil fuel. It emits around 40% less carbon dioxide than coal and roughly 20% less carbon than oil. LNG is considered as a cleaner alternative to fuel oil and coal. It is widely adopted for generating the power. Thus, the rise in demand for clean gas is primarily attributed by the industrial and commercial applications which is further expected to drive the market growth. The surging demand for natural gases by residential, industrial, and commercial sectors, mainly from the developing economies, and the growing usage of LNG carriers for a wide range of end-use applications, such as defense and transport, are among the major factors holding potential opportunity for the growth of the C-type LNG carrier market. Thus, the increase in demand for clean energy sources across various applications is expected to provide lucrative opportunities for the market growth in the coming years.

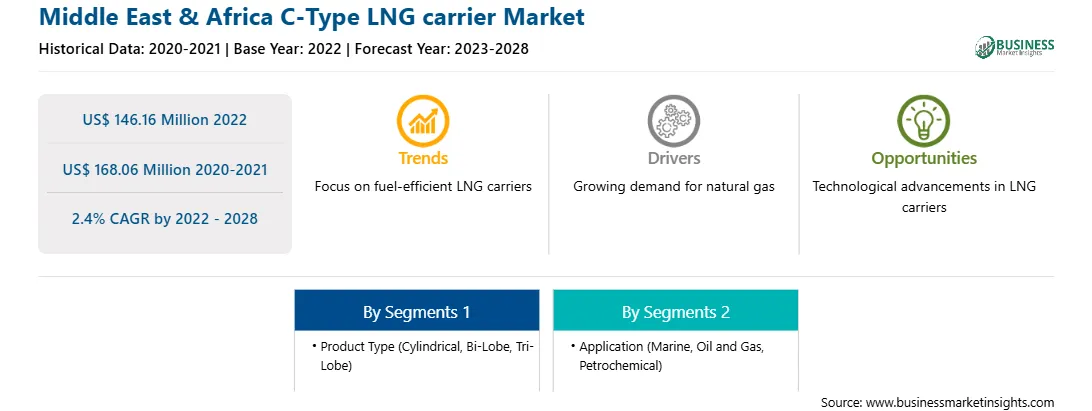

Market Overview

The Middle East's gas production is soaring, and the region surpassed Russia's output in 2019, making it the world's second-largest gas producer after North America. According to public energy estimates, the region produced about 730-billion-meter cube of LNG in 2020, which is expected to rise to almost 920 billion m3 by 2030. In 2018, the Middle East surpassed Asia in gas production, with 665 billion m3 produced, up from 465 billion m3 in 2010. In addition, Saudi Arabia and the UAE are predicted to increase their combined gas production from 115 billion m3 in 2010 to 225 billion m3 in 2030, with Saudi Arabia accounting for 70% of the total; however, Qatar continues to dominate global output. Hence, the growing LNG production in the region is set to create an immense opportunity for the C type LNG carrier market vendors. Furthermore, due to rising production and export rates, the region is one of the major procurers of LNG carriers. For instance, in 2018, Nakilat and Maran Ventures Inc. signed a four-vessel agreement with Daewoo Shipbuilding & Marine Engineering (DSME). The 174,000 cubic meter Global Sea Spirit was the first X-DF vessel to join the Nakilat fleet. The first two ME-GI devices were delivered in May 2020 and January 2021 and are now operational. The fourth carrier with X-DF engine technology is planned for 2022. Hence, the region provides the main customer base for the C Type LNG carrier market vendors.

Strategic insights for the Middle East & Africa C-Type LNG carrier provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa C-Type LNG carrier refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa C-Type LNG carrier Strategic Insights

Middle East & Africa C-Type LNG carrier Report Scope

Report Attribute

Details

Market size in 2022

US$ 146.16 Million

Market Size by 2028

US$ 168.06 Million

CAGR (2022 - 2028) 2.4%

Historical Data

2020-2021

Forecast period

2023-2028

Segments Covered

By Product Type

By Application

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa C-Type LNG carrier Regional Insights

Middle East & Africa C-Type LNG carrier Market Segmentation

The Middle East & Africa C-type LNG carrier market is segmented into product type, application, and country.

DSME Co., Ltd.; Knutsen OAS Shipping; Komarine Co. and Mitsubishi Heavy Industries, Ltd.; are the leading companies operating in the C-type LNG carrier market in the region.

The Middle East & Africa C-Type LNG carrier Market is valued at US$ 146.16 Million in 2022, it is projected to reach US$ 168.06 Million by 2028.

As per our report Middle East & Africa C-Type LNG carrier Market, the market size is valued at US$ 146.16 Million in 2022, projecting it to reach US$ 168.06 Million by 2028. This translates to a CAGR of approximately 2.4% during the forecast period.

The Middle East & Africa C-Type LNG carrier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa C-Type LNG carrier Market report:

The Middle East & Africa C-Type LNG carrier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa C-Type LNG carrier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa C-Type LNG carrier Market value chain can benefit from the information contained in a comprehensive market report.