亚太地区 C 型液化天然气运输船市场至 2028 年预测 – COVID-19 影响和区域分析 – 按产品类型(圆柱形、双叶和三叶)和应用(船舶、石油和天然气、石化、和其他)

No. of Pages: 117 | Report Code: BMIRE00027642 | Category: Automotive and Transportation

No. of Pages: 117 | Report Code: BMIRE00027642 | Category: Automotive and Transportation

液化天然气液化能力不断增长;

2021年,中国成为贸易的主要贡献者,其液化天然气净进口量每年增加1040万吨,而其他国家亚太地区的液化天然气贸易量增加,从 2020 年的每年 6800 万吨增至 2021 年的每年 7930 万吨。此外,根据全球贸易追踪和中国海关总署的数据, 2021年,中国大量进口LNG,平均每天105亿立方英尺(Bcf/d),较2020年增加19%。因此,LNG进口的增加增加了对LNG液化的需求,这进一步推动了LNG液化需求的增长。运输用途对液化天然气运输船的需求增加,这有助于 C 型液化天然气运输船市场的增长。

根据 IGU-World-LNG-Report-2022,截至2022年4月,正在建设或批准开发的液化天然气液化能力为1.362亿吨/年(MTPA)。然而,预计总产能中只有 7.7 MTPA 将在 2022 年下半年上线,其余产能预计将在 2023 年至 2027 年期间上线。此外,根据同一份报告,全球液化产能在 2021 年达到 459.9 MTPA,平均利用率为80.4%,而2020年为74.6%。

市场概况

亚太地区在 2021 年液化天然气市场中占据最大份额。这可归因于高工业化导致对天然气的需求不断增加增长和清洁能源的采用。预计该地区将在预测期内主导 C 型液化天然气运输船市场。该地区的大部分需求来自中国。例如,2020年,中国政府宣布计划建造中国最大的液化天然气运输船,运力达27万立方米,以满足中国对清洁燃料日益增长的需求。然而,中国液化天然气进口仍高度依赖国外液化天然气运输船,对外运力依存度超过65%。因此,预计在预测期内对液化天然气的需求不断增长将推动市场发展。

此外,区域公司正在与储罐合作制造商确保液化天然气的高效安装和运输。例如,McDermott International 的 CB&I Storage Solutions 部门赢得了在菲律宾八打雁建造液化天然气进口工厂的合同。大西洋海湾和太平洋公司获得了该合同(AG&P)。该项目旨在为 AG&P 位于菲律宾的液化天然气进口和再气化终端设计、采购和建造液化天然气 (LNG) 储罐。该设施首先将具有每年高达 300 万吨再气化液化天然气的产能。它还将具有 420 mmscfd 的可扩展陆上再气化能力和约 200,000 cm3 的存储容量。

此外,太平洋地区的船舶数量极其有限,随着冬季的临近,需要液化天然气船舶来弥补空头头寸的托运人需要为此付出高昂的代价。例如,亚太地区的桶日价格上一次创下历史新高是在 2021 年 1 月中旬,约为每天 175,000 美元,并且在 2021 年的大部分时间里一直在每天 50,000 美元至 70,000 美元之间波动。因此,天然气价格上涨正在刺激对液化天然气运输船的需求,以最大限度地降低费率,从而导致市场扩张。

亚太C型液化天然气运输船市场细分< /strong>

亚太地区 C 型液化天然气运输船市场按产品类型、应用和国家细分。

中国船舶重工贸易有限公司;大宇造船有限公司;加斯洛格有限公司;天然气恩泰克;现代三湖重工业有限公司;克努森 OAS 航运;科马林公司;三菱重工有限公司;和 TGE 海洋气体工程有限公司; Torgy LNG AS 是该地区 c 型液化天然气运输船市场的领先公司。

Strategic insights for Asia Pacific C-Type LNG Carrier involve closely monitoring industry trends, consumer behaviours, and competitor actions to identify opportunities for growth. By leveraging data analytics, businesses can anticipate market shifts and make informed decisions that align with evolving customer needs. Understanding these dynamics helps companies adjust their strategies proactively, enhance customer engagement, and strengthen their competitive edge. Building strong relationships with stakeholders and staying agile in response to changes ensures long-term success in any market.

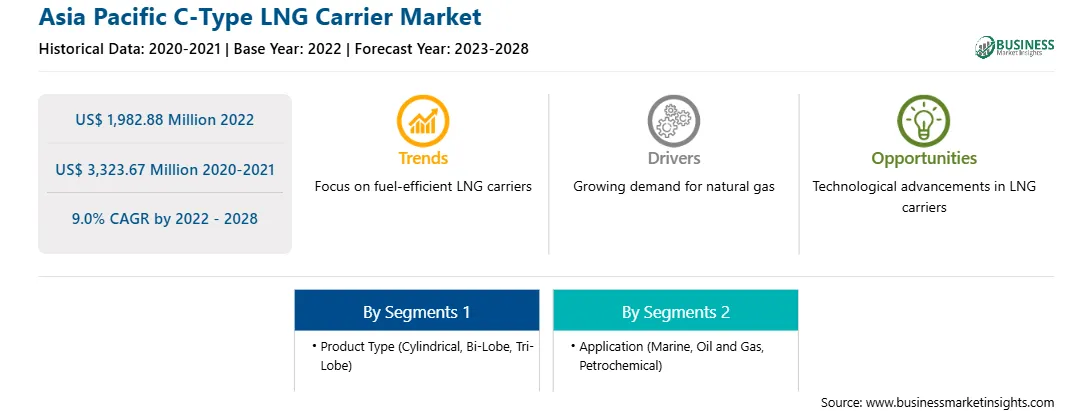

| Report Attribute | Details |

|---|---|

| Market size in 2022 | US$ 1,982.88 Million |

| Market Size by 2028 | US$ 3,323.67 Million |

| Global CAGR (2022 - 2028) | 9.0% |

| Historical Data | 2020-2021 |

| Forecast period | 2023-2028 |

| Segments Covered |

By 产品类型

|

| Regions and Countries Covered | 亚太地区

|

| Market leaders and key company profiles |

The regional scope of Asia Pacific C-Type LNG Carrier refers to the geographical area in which a business operates and competes. Understanding regional nuances, such as local consumer preferences, economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved regions or adapting their offerings to meet regional demands. A clear regional focus allows for more effective resource allocation, targeted marketing, and better positioning against local competitors, ultimately driving growth in those specific areas.

The Asia Pacific C-Type LNG Carrier Market is valued at US$ 1,982.88 Million in 2022, it is projected to reach US$ 3,323.67 Million by 2028.

As per our report Asia Pacific C-Type LNG Carrier Market, the market size is valued at US$ 1,982.88 Million in 2022, projecting it to reach US$ 3,323.67 Million by 2028. This translates to a CAGR of approximately 9.0% during the forecast period.

The Asia Pacific C-Type LNG Carrier Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific C-Type LNG Carrier Market report:

The Asia Pacific C-Type LNG Carrier Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific C-Type LNG Carrier Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific C-Type LNG Carrier Market value chain can benefit from the information contained in a comprehensive market report.