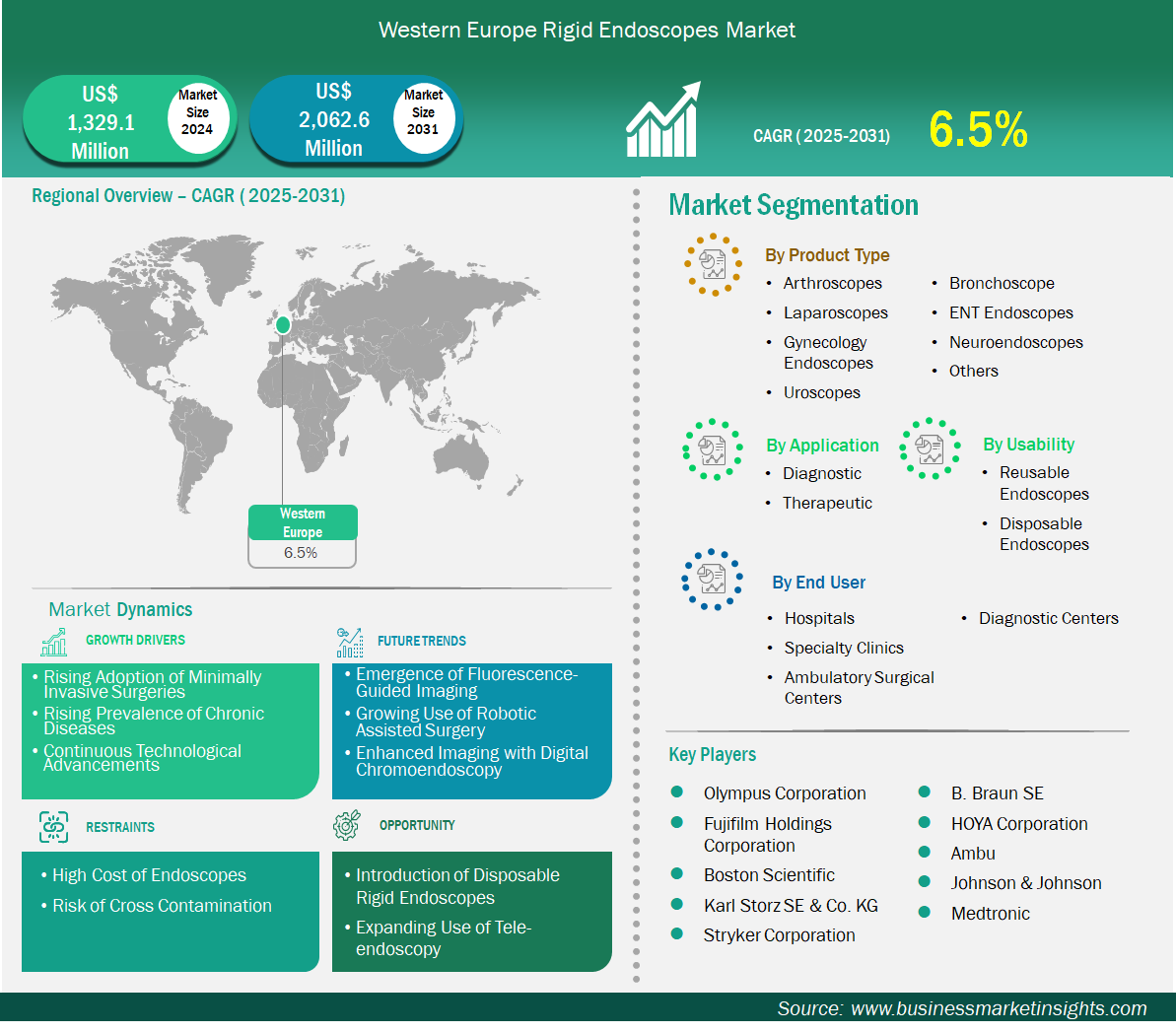

The Western Europe rigid endoscopes market size is expected to reach US$ 2,062.6 million by 2031 from US$ 1,329.1 million in 2024. The market is estimated to record a CAGR of 6.5% from 2025 to 2031.

The Western Europe rigid endoscopes market is mature, characterized by sophisticated surgical practices, strict regulatory process, and broad acceptance of minimally invasive technology. France, Italy, Spain and the UK are investing in modernization of surgery. Germany is the leading country in both clinical usage and manufacturing process. Rigid endoscopes are ubiquitous in applications associated with orthopedics, gynecology, and ENT, with high surgical volumr and medical personnel capacities. Hospitals are starting to incorporate digital platforms and AI-enhanced diagnostic protocols in public hospitals, while the private hospital sector is innovating with robotic-assisted systems. Cross-border research and EU supported investments continue the advancement of device innovation and the harmonization of clinical standards. As outpatient surgeries and personalized medicine become mainstream, the role of rigid endoscopy is becoming central to care delivery. Sustainability, infection control, and digital integration in all the categories of rigid endoscopy systems will continue to drive demand for modular, reusable systems.

Western Europe Rigid Endoscopes Market Strategic Insights

Key segments that contributed to the derivation of the rigid endoscopes market analysis are product type, usability, application, and end user.

Rigid endoscopes play a central role in surgical practice across Western Europe, prized for their durability, high-definition imaging, and compatibility with sterilizable systems. Rigid endoscopes are used extensively in orthopedic procedures, laparoscopic procedures, and ear, nose, and throat (ENT) procedures, which are sensitive in terms of accuracy and reliability. Growth in the region continues to be positive due to growing surgical innovation and quality assurance. Hospitals in France, Italy, and Spain are upgrading operating rooms, which include integrated endoscopic platforms, and increasingly implementing digital workflows, such as artificial intelligence (AI) assisted diagnosis. Germany is the leading country, with robotic-assisted endoscopes and imaging systems, and is setting a precedent for neighboring countries. Additionally, infection prevention and sustainability drive demand for modular and reusable systems. Further, there continues to be an embedded focus on endoscopy training in medical education, as Western Europe is building a cohort of trained professionals. At the same time, there is an overall movement towards outpatient and precision surgery that will keep the rigid endoscope an essential, digitally enabled tool to improve outcomes and efficient processes in surgical systems.

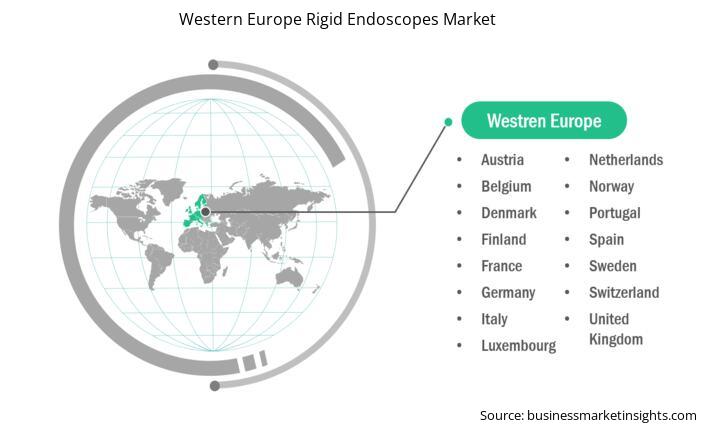

Based on country, the Western Europe rigid endoscopes market is segmented into Belgium, the Netherlands, Luxembourg, Germany, France, Italy, Spain, Switzerland, Sweden, Austria, the United Kingdom, Denmark, Portugal, Norway, and Finland. Germany held the largest share in 2024.

Germany leads the Western Europe rigid endoscopes market, driven by its advanced healthcare infrastructure, strong manufacturing base, and clinical leadership in minimally invasive surgery. German hospitals are the first to adopt rigid endoscopic platforms and integrate them into standard practice for use in orthopedic, gynecologic, and ENT procedures. Furthermore, its MedTech industry, including global leaders such as Karl Storz, is expanding the range of high-quality instruments and dissemination them to other countries. Public hospitals can leverage central procurement via national funding to remain innovative toward surgical innovation, while private clinics can adopt robotic-assisted platforms and AI-enhanced imaging. Medical universities and medical research centers in Germany are engaged in clinical trials and medical device development. Sustainability and infection control at the forefront of public funding in hospitals further facilitates the adoption of reusable and modular systems. Germany benefits from the skilled surgical workforce and regulatory oversight, which drive the future of the rigid endoscopy market in Western Europe.

Western Europe Rigid Endoscopes Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,329.1 Million |

| Market Size by 2031 | US$ 2,062.6 Million |

| CAGR (2025 - 2031) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Western Europe

|

| Market leaders and key company profiles |

|

Olympus Corporation, Fujifilm Holdings Corporation, Boston Scientific, Karl Storz SE & Co. KG, Stryker Corporation, B. Braun SE, HOYA Corporation, Ambu A/S, Johnson & Johnson, and Medtronic are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Western Europe Rigid Endoscopes Market is valued at US$ 1,329.1 Million in 2024, it is projected to reach US$ 2,062.6 Million by 2031.

As per our report Western Europe Rigid Endoscopes Market, the market size is valued at US$ 1,329.1 Million in 2024, projecting it to reach US$ 2,062.6 Million by 2031. This translates to a CAGR of approximately 6.5% during the forecast period.

The Western Europe Rigid Endoscopes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Western Europe Rigid Endoscopes Market report:

The Western Europe Rigid Endoscopes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Western Europe Rigid Endoscopes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Western Europe Rigid Endoscopes Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)