Rigid Endoscopes Market Outlook (2021-2031)

No. of Pages: 200 | Report Code: BMIPUB00031680 | Category: Life Sciences

No. of Pages: 200 | Report Code: BMIPUB00031680 | Category: Life Sciences

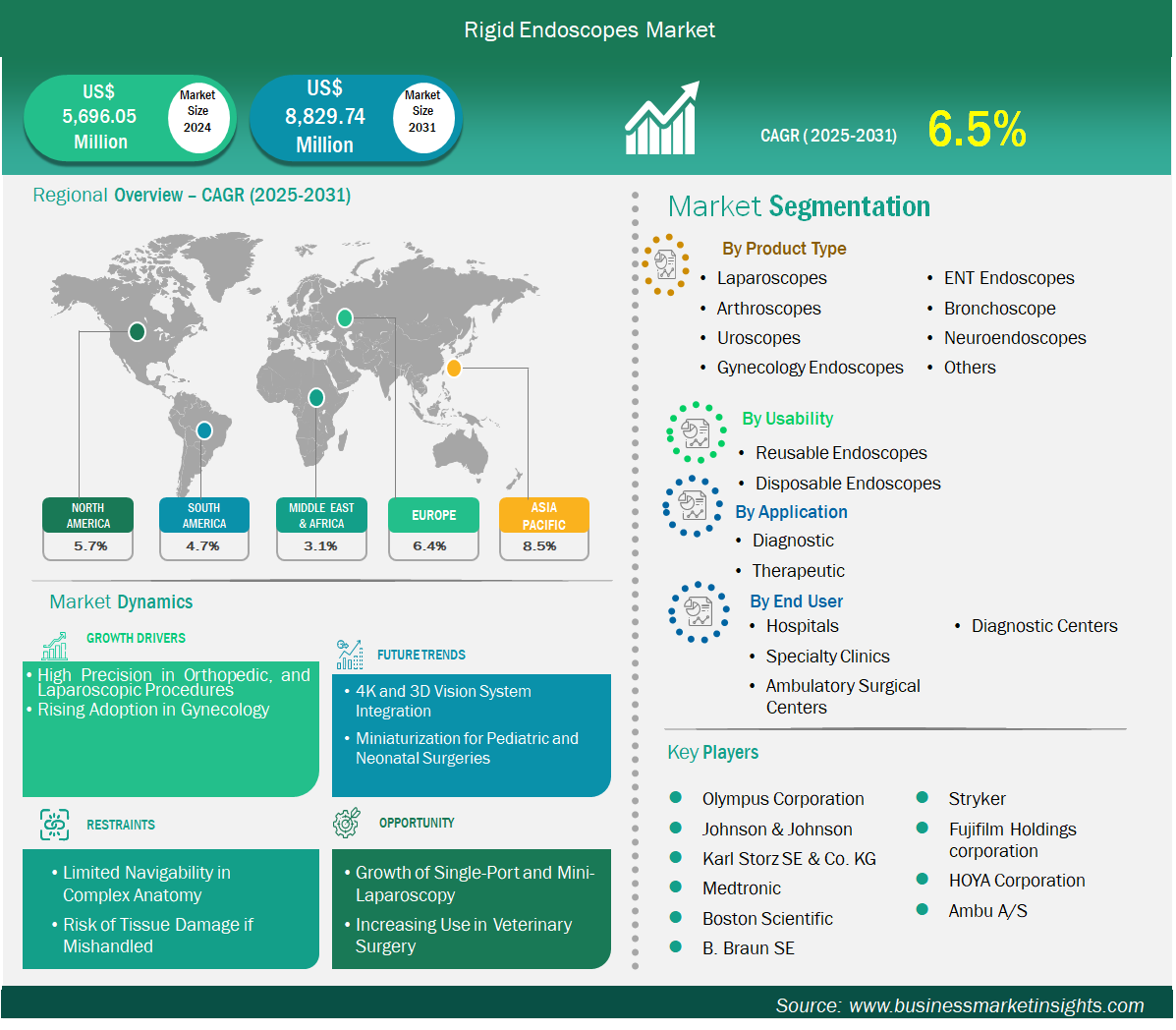

The rigid endoscopes market size is expected to reach US$ 8,829.74 million by 2031 from US$ 5,696.05 million in 2024. The market is estimated to record a CAGR of 6.5% from 2025 to 2031.

The rigid endoscopes market is growing due to rising demand for minimally invasive surgery. Rigid endoscopes are used in various surgical procedures such as laparoscopy, arthroscopy, urology, gynecology, and ear, nose, and throat (ENT) surgery. Rigid endoscopes with quality cameras and lighting can provide physicians with the clearest and most detailed images possible, improving their ability to perform operations with precision and detail. Patients can expect to benefit from faster recovery time after surgeries, shorter stays in the hospital, and reduced risks of complications. Technological advancement in rigid endoscopes including the latest high-definition (HD) options along with lighting advancements have made rigid endoscopes more effective and easier to use. In addition, with the rising number of surgeries performed, rising elderly population, and a growing awareness of minimally invasive treatment options are driving he growth of the rigid endoscope market.

In line with the adoption rate, the global rigid endoscopes market stood at US$ 5,696.05 million in 2024 and is expected to reach US$ 8,829.74 million by 2031. Rising healthcare infrastructure and investments on medical devices in emerging country is also supporting the growth curve. The costs of endoscopes and the need for healthcare professionals with the right skills, presents a challenge for the growth of the rigid endoscopes market. Despite the challenges, the rigid endoscopes market continues to be well positioned for growth.

Rigid Endoscopes Market Strategic Insights

Rigid Endoscopes Market Segmentation Analysis

Key segments that contributed to the derivation of the rigid endoscopes market analysis are product type, portability, technology, application, and end user.

Rigid endoscopes are popular instruments used in orthopedic, ENT (ear, nose, and throat), and laparoscopic surgeries involving the lower abdomen. These rigid devices provide better image stability and much more precision than flexible endoscopes. Rigid endoscopes find importance in orthopedic surgery, especially the arthroscopy procedure. During arthroscopy, the endoscope provides surgeons a preferred view of the joint under surgery, eliminating distortion for accurate diagnosis and treatment, especially with problems such as torn ligaments and damaged cartilage. Rigid endoscopes are used in ENT surgeries, especially sinus and middle ear cases, where surgeons have very limited space to establish any type of a stable view with minimal distortion. Rigid endoscopes also have a role in laparoscopic surgery, where the lower abdomen is accessed with a rigid scope providing steady views of abdominal organs. There is greater accuracy and control provided by rigid scopes over flexible scopes, which are limited in their scope of flexibility. The precision offered by rigid endoscopes minimizes the occurrence of surgical complications, improves patient outcomes, and helps to accelerate the trend toward minimally invasive surgery in orthopedic, ENT, and laparoscopic procedures.

Rigid endoscopes are being used more commonly in the field of gynecology, especially for hysteroscopy and laparoscopic procedures, thus enhancing market growth. Rigid scopes in hysteroscopy yield excellent image quality of the uterine cavity, thus diagnosing and/or treating fibroids, polyps, adhesions, and atypical bleeding can be done with less discomfort from the patient. The rigid nature of scopes with high-definition optics are great for both diagnostic and operative hysteroscopic procedures. While rigid scopes are well accepted by practitioners and patients in a hysteroscopic manner, rigid endoscopes are essential in laparoscopic gynecology as it relates to ovarian cyst excision, endometriosis excision, tubal ligation or sterilization, and many more. Rigid endoscopes provide accurate manipulation of the reproductive organs, as well as access to the reproductive organs via small incisions from the use of endoscopy as compared to traditional surgical techniques. Women who have surgery with rigid endoscopy use the hospital less time, have less postoperative pain, and recover sooner than those having traditional surgery. Since women are becoming more aware of their health across the world and looking for facilities that offer minimally invasive options, the markets for rigid endoscopes as it applies to gynecology is continuing to grow. As the clinical perspective of gynecologists advances to one that supports the recommendation of rigid endoscopes, this will further propel the growth of this market.

By product type, the rigid endoscopes market is segmented into laparoscopes, arthroscopes, uroscopes, gynecology endoscopes, ENT endoscopes, bronchoscope, neuroendoscopes and others. The laparoscopes segment dominated the market in 2024. Laparoscopes are heavily used in general and gynecologic surgeries, offering minimal invasiveness, faster recovery, and reduced hospital stays—making them the most commonly utilized rigid endoscope across healthcare settings.

By usability, the rigid endoscopes market is segmented into reusable endoscopes and disposable endoscopes. The reusable endoscopes segment dominated the market in 2024. Reusable endoscopes are cost-effective for high-volume procedures, preferred by hospitals due to durability, sterilization capabilities, and long-term use, outweighing the short-term convenience of disposable options.

By application, the rigid endoscopes market is segmented into diagnostic and therapeutic. The therapeutic segment dominated the market in 2024. Therapeutic applications dominate as rigid endoscopes are primarily used for surgical interventions rather than simple diagnosis, driving greater usage in operative settings across specialties like laparoscopy and orthopedics.

By end user, the market is segmented into hospitals, specialty clinics, ambulatory surgical centers and diagnostic centers. The hospitals segment held the largest share of the market in 2024. Hospitals handle the highest procedure volumes, covering diverse specialties and equipped with advanced infrastructure, making them the top users of rigid endoscopes for both diagnostic and therapeutic purposes.

Rigid Endoscopes Market Report Highlights

Report Attribute

Details

Market size in 2024

US$ 5,696.05 Million

Market Size by 2031

US$ 8,829.74 Million

Global CAGR (2025 - 2031) 6.5%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Product Type

By Usability

By Application

By End User

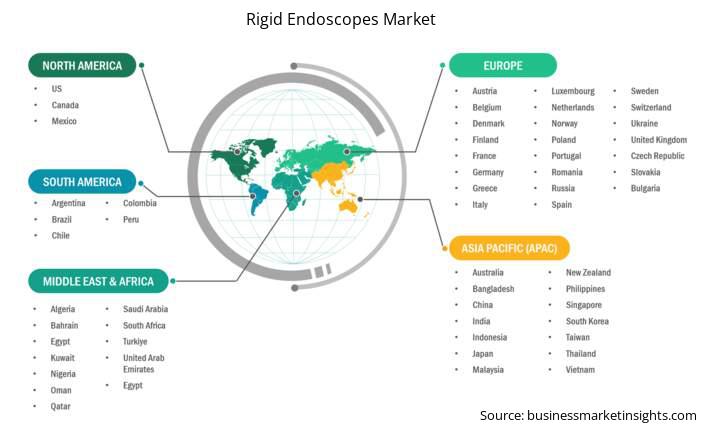

Regions and Countries Covered

North America

Europe

Asia-Pacific

South and Central America

Middle East and Africa

Market leaders and key company profiles

The "Rigid Endoscopes Market Size and Forecast (2021–2031)" report provides a detailed analysis of the market covering below areas:

The geographical scope of the rigid endoscopes market report is divided into five regions: North America, Asia Pacific, Europe, Middle East & Africa, and South & Central America. The rigid endoscopes market in Asia Pacific is expected to grow significantly during the forecast period.

The Asia Pacific rigid endoscopes market is segmented into China, Japan, South Korea, India, Australia, New Zealand, Indonesia, Malaysia, Philippines, Singapore, Thailand, Vietnam, Taiwan, Bangladesh and Rest of Asia. The Asia Pacific rigid endoscopes market is growing at a fast pace, fuelled by better healthcare infrastructure and increasing demand for minimally invasive procedures. China, India, Japan, and South Korea are observing increased investment in superior quality medical technology, including rigid endoscopes, to cater to rising surgical volumes. The region has highest population and has high healthcare demand. Moreover, growing government healthcare programs and health consciousness are promoting adoption in urban and rural areas alike. The expansion of private hospitals and ambulatory surgical centers are also driving market growth. Technological developments and collaborations between local and global producers are increasing product accessibility and price affordability. Still, issues like limited skilled professionals and cost sensitivities in low-income neighborhoods persist. Region-wide, the Asia Pacific offers a major growth potential with its growing healthcare industry and increasing patient demand for minimally invasive procedures.

The rigid endoscopes market is evaluated by gathering qualitative and quantitative data post primary and secondary research, which includes important corporate publications, association data, and databases. A few of the key developments in the rigid endoscopes market are:

The Rigid Endoscopes Market is valued at US$ 5,696.05 Million in 2024, it is projected to reach US$ 8,829.74 Million by 2031.

As per our report Rigid Endoscopes Market, the market size is valued at US$ 5,696.05 Million in 2024, projecting it to reach US$ 8,829.74 Million by 2031. This translates to a CAGR of approximately 6.5% during the forecast period.

The Rigid Endoscopes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Rigid Endoscopes Market report:

The Rigid Endoscopes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Rigid Endoscopes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Rigid Endoscopes Market value chain can benefit from the information contained in a comprehensive market report.