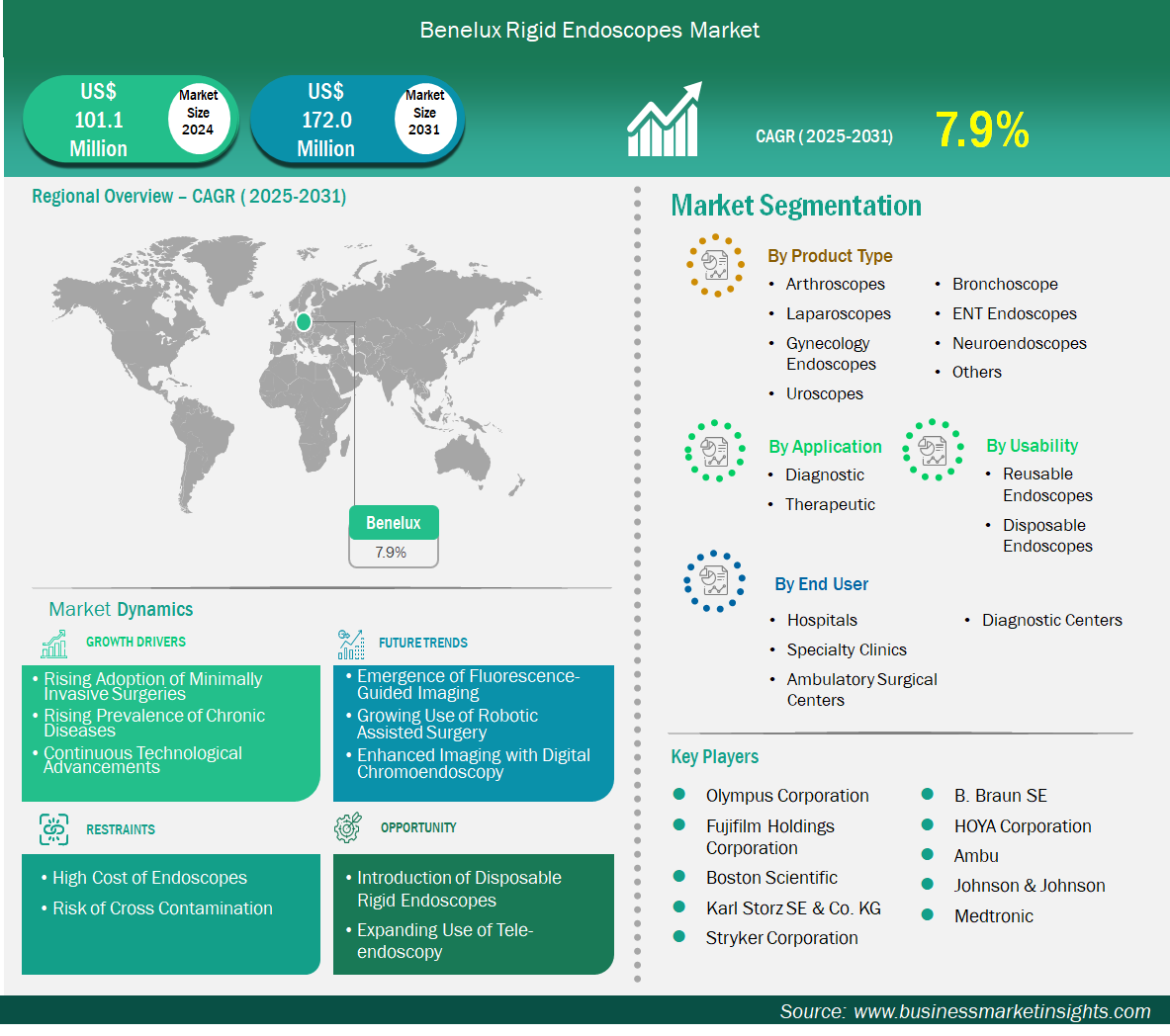

The Benelux rigid endoscopes market size is expected to reach US$ 172.0 million by 2031 from US$ 101.1 million in 2024. The market is estimated to record a CAGR of 7.9% from 2025 to 2031.

The Benelux rigid endoscopes market is characterized by high standards of clinical usage, strong regulations, and an increased emphasis on minimally invasive surgery. The Benelux region has well-established healthcare systems and a tradition of collaboration around medical innovation in practice and research. Rigid endoscopes are used across most surgical specialties, specifically for procedures in orthopedic, gynecological, and ENT specialties, where hospitals are focused on precision and durability. Public and private organizations are investing in innovative visualization platforms, enhancing digital pathways and providing AI-assisted diagnostic imaging. In addition, cross-border research opportunities and governmental funding programs coordinated by the EU are supporting clinical trials of advance medical devices. Hospitals within the Benelux region focused on sustainable, reusable, and infection regulating systems, are beginning to adopt modular rigid endoscope systems. The Benelux region is positioned to support personalized medicine and MVOS (Minimum Viable Outpatient Surgical Organizations), and it positions rigid endoscopy as part of the care delivery model led by a skilled workforce, organizational standards, and commitment to continuous improvement.

Benelux Rigid Endoscopes Market Strategic Insights

Key segments that contributed to the derivation of the rigid endoscopes market analysis are product type, usability, application, and end user.

Because of their reliability, image quality and compatibility with reusable systems, rigid endoscopes are deeply rooted in surgical practice all across the Benelux. They are more commonly used in orthopedic, laparoscopic, and ENT surgery involving areas that require structural rigidity and visualization consistency. Hospitals in Belgium and Luxembourg are working on upgrading their operating rooms to integrated endoscopic platforms, typically funded through European Union health infrastructure funds. The Netherlands is leading the way in developing AI-driven imaging techniques and robotic-assisted endoscopic procedures. Moreover, Benelux’s emphasis on infection control and sustainability promotes the use of reusable and modular rigid endoscope systems. As the emphasis on digital health and outpatient operations continues to grow, rigid endoscopy will remain a vital component of high-quality healthcare in the region.

Based on country, the Benelux rigid endoscopes market is segmented into Belgium, the Netherlands, and Luxembourg. The Netherlands held the largest share in 2024.

The Netherlands is the leader of the Benelux rigid endoscopes market, which has an advanced healthcare system and a significant focus on diagnostics innovation. In the Netherlands, high-definition rigid endoscopes are increasingly being adopted in hospitals and ambulatory surgical facilities for gastroenterology, urology, and orthopedics in connection with government initiatives promoting precision medicine and digital health. The Netherlands benefits from an array of academic medical centers and collaboration with industry sectors promoting innovation and development in endoscopic imaging, AI-assisted diagnostics, and robotic-assisted surgery. In addition, the emphasis in the Netherlands on outpatient care and efficiency has helped support growing demand for portable and single-use rigid endoscope systems. Coupled with favorable reimbursement, supply chain availability, commitment to medical professional education, and attitudes of progression in technology, the Netherlands continues to be a leader in growth within the region, setting standards for innovation, and quality and improvement across the Benelux region.

Benelux Rigid Endoscopes Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 101.1 Million |

| Market Size by 2031 | US$ 172.0 Million |

| CAGR (2025 - 2031) | 7.9% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

Benelux

|

| Market leaders and key company profiles |

|

Olympus Corporation, Fujifilm Holdings Corporation, Boston Scientific, Karl Storz SE & Co. KG, Stryker Corporation, B. Braun SE, HOYA Corporation, Ambu A/S, Johnson & Johnson, and Medtronic are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The Benelux Rigid Endoscopes Market is valued at US$ 101.1 Million in 2024, it is projected to reach US$ 172.0 Million by 2031.

As per our report Benelux Rigid Endoscopes Market, the market size is valued at US$ 101.1 Million in 2024, projecting it to reach US$ 172.0 Million by 2031. This translates to a CAGR of approximately 7.9% during the forecast period.

The Benelux Rigid Endoscopes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Benelux Rigid Endoscopes Market report:

The Benelux Rigid Endoscopes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Benelux Rigid Endoscopes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Benelux Rigid Endoscopes Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)