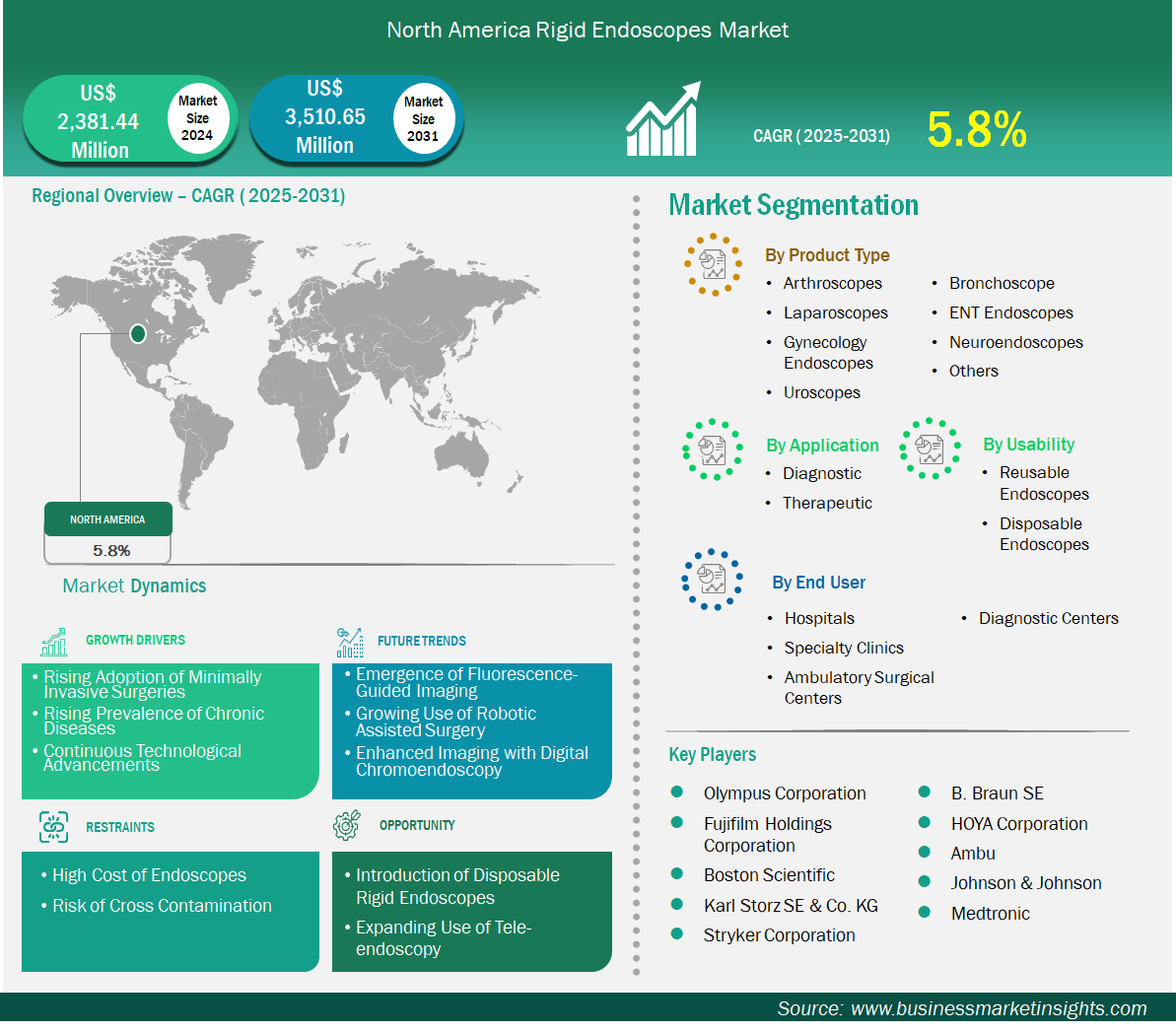

The North America rigid endoscopes market size is expected to reach US$ 3,510.65 million by 2031 from US$ 2,381.44 million in 2024. The market is estimated to record a CAGR of 5.8% from 2025 to 2031.

North America is the dominant region in the rigid endoscopes market, fueled by sophisticated healthcare infrastructure, high emphasis on minimally invasive procedures, and pervasiveness of innovative medical technologies. As rigid endoscopes offer benefits such as accuracy, reliability, and economic viability, they are regularly utilized in hospitals and specialty clinics in the US and Canada for gynecology, urology, ENT, and orthopedic interventions. The market is aided by an established healthcare infrastructure, high patient knowledge, and demanding quality and safety standards that drive the adoption of advanced surgical devices. Growth enablers include continued investment in surgical suites, surgeons' training programs, and partnerships with international device makers. Challenges of high device prices, regulatory compliance, and rising competition continue but are mitigated by healthcare funding and mature supply chains. The United States, as the leading nation, establishes regional standards in stringent endoscope use, adoption of technology, and best procedure practices, shaping trends throughout North America and retaining the status as the leading market in the region.

North America Rigid Endoscopes Market Strategic Insights

Key segments that contributed to the derivation of the rigid endoscopes market analysis are product type, usability, application, and end user.

Rigid endoscopes are extensively utilized in North America for minimally invasive procedures that require high reliability and precision, such as laparoscopy, arthroscopy, cystoscopy, and ENT surgery. A major growth factor is rising investment in hospital infrastructure, especially in the US, where both public and private healthcare institutions are renovating operating rooms and implementing superior surgical equipment. Increase in the incidence of chronic and lifestyle diseases, including gastrointestinal, urology, and orthopedic diseases, also drives demand for rigid endoscopes. Increasing preference for minimally invasive procedures by surgeons, which decrease postoperative complications and recovery time, also remains supportive for long-term adoption. Although cost and regulatory demands are still factors, the region's very sophisticated healthcare environment, combined with high procedural volumes and robust reimbursement policies, assures that stiff endoscopes are a regular part of surgical practice in North America.

Based on country, the North America rigid endoscopes Market is segmented into the United States, Canada and Mexico. The United States held the largest share in 2024.

The United States represents the largest market for rigid endoscopes in North America, fueled by advanced health care infrastructure, high patient demand, and a shift to more minimally invasive surgeries. Hospitals and outpatient surgery centers in major urban areas have state-of-the-art operating rooms that routinely use a rigid endoscope in urology, gynecology, ENT, and orthopedic support procedures. Private hospital networks and academic medical center systems work together with top global device companies to procure the latest generation endoscopic equipment, maintenance, and training support. Government-funded and privately funded insurance payments are also encouraging adoption of minimally invasive surgery, which increases the demand for high-quality rigid endoscope devices. The US also has established professional training programs for surgeons and technicians to properly use devices. Although cost and regulations continue to be limiting factors, the country's advanced health care system, surgical capabilities, and willingness to invest in new technologies create a strong growth driver for rigid endoscopes in North America.

North America Rigid Endoscopes Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 2,381.44 Million |

| Market Size by 2031 | US$ 3,510.65 Million |

| CAGR (2025 - 2031) | 5.8% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

Olympus Corporation, Fujifilm Holdings Corporation, Boston Scientific, Karl Storz SE & Co. KG, Stryker Corporation, B. Braun SE, HOYA Corporation, Ambu A/S, Johnson & Johnson, and Medtronic are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The North America Rigid Endoscopes Market is valued at US$ 2,381.44 Million in 2024, it is projected to reach US$ 3,510.65 Million by 2031.

As per our report North America Rigid Endoscopes Market, the market size is valued at US$ 2,381.44 Million in 2024, projecting it to reach US$ 3,510.65 Million by 2031. This translates to a CAGR of approximately 5.8% during the forecast period.

The North America Rigid Endoscopes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Rigid Endoscopes Market report:

The North America Rigid Endoscopes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Rigid Endoscopes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Rigid Endoscopes Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)