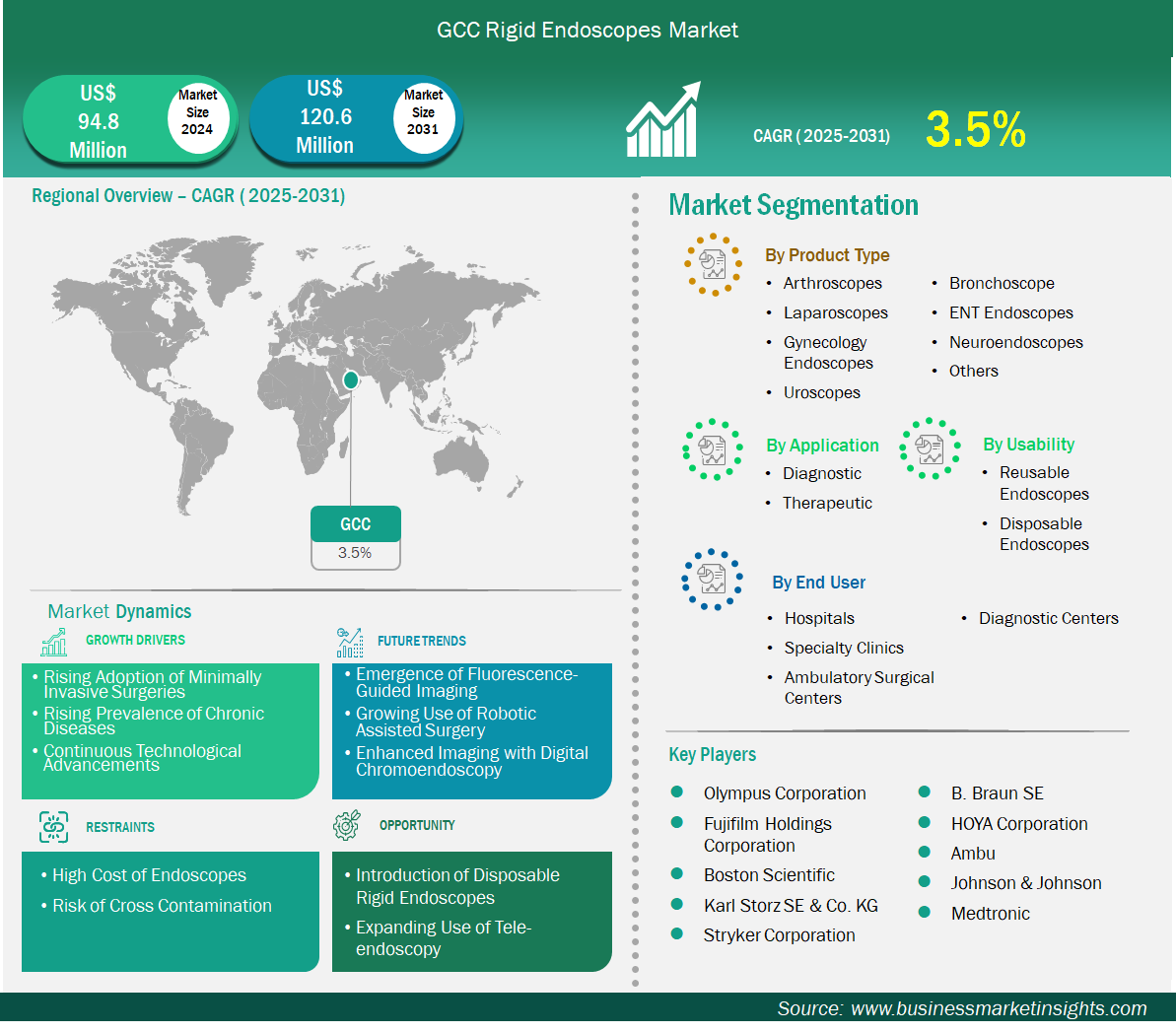

The GCC rigid endoscopes market size is expected to reach US$ 120.6 million by 2031 from US$ 94.8 million in 2024. The market is estimated to record a CAGR of 3.5% from 2025 to 2031.

The rigid endoscopes market in the GCC is developing steadily, mainly attributed to an increased surgical demand and modernization of their healthcare systems, and an increased push in the region towards minimally invasive procedures. GCC consists of Saudi Arabia, UAE, Qatar, Kuwait, Bahrain and Oman, which have high per capita healthcare spend and large investments into medical infrastructure. Rigid endoscopes are becoming increasingly common in orthopedic, gynecology, and ENT practice as hospitals look to purchase precision instruments that improve outcome and recovery time. Private healthcare organizations are leading the adoption of rigid endoscopies in practice, while public hospitals are beginning phased upgrades, as mandated by national health strategies. Saudi Arabia is clearly the leader, utilizing its Vision 2030 strategic reforms to innovate models of surgery and attract global MedTech partners. The region’s focus on digital health, medical education, and clinical excellence is creating fertile ground for endoscopic innovation. As outpatient surgery and personalized medicine become broadly adopted, rigid endoscopy market is expected to grow in this region.

GCC Rigid Endoscopes Market Strategic Insights

Key segments that contributed to the derivation of the rigid endoscopes market analysis are product type, usability, application, and end user.

Across the GCC, rigid endoscopes are becoming popular because they are reliable and produce sharp images, fitting well with systems designed for reuse. Within the medical specialities, such as orthopedics, urology, and ENT, where clear views and long-lasting tools are needed, these endoscopes are key for accurate work. A key growth factors is increasing investment into building new hospital and upgrading medical instruments across region. Also, GCC countries are teaming up with global medical tech companies to make products locally and improve training, which makes these tools more accessible and easier to use.

There's also a move toward endoscopes that are reusable and can be sterilized, which helps with infection control and supports environmental goals. Many medical universities provide endoscopic training program within their surgical education, which has increased the skilled workforce across the region. With digital tools and AI playing a bigger role in diagnosis, rigid endoscopy is turning into a platform for precise surgery, helping to improve patient results and operational efficiency in healthcare facilities that are operating in the region.

Based on country, the GCC rigid endoscopes market is segmented into Saudi Arabia, the United Arab Emirates (UAE), Qatar, Kuwait, Bahrain, and Oman. Saudi Arabia held the largest share in 2024.

Saudi Arabia is the largest country in the GCC for rigid endoscopes, driven by the educational healthcare agendas of Vision 2030 and investment in surgical modernization. The country is building new medical cities and updating hospitals with better rigid endoscopic platforms. These new updates are primarily expanding across Riyadh, Jeddah, and Dammam. The public hospitals have become familiar with the use of rigid endoscopes, such as the orthopedic rigid endoscope, to complete high-volume hip and knee procedures in surgery, funded by the government and other centralized purchases. Strong private institutions are applying more creativity, with robotic-assisted surgical systems and incorporating AI into their imaging and tools. Medical universities and research centers are actively involved in clinical trials and device evaluative processes. The surgical workforce in Saudi Arabia is talented and well educated. This factor has placed Saudi Arabia as a dominant country for rigid endoscopes market in GCC.

GCC Rigid Endoscopes Market Report Highlights| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 94.8 Million |

| Market Size by 2031 | US$ 120.6 Million |

| CAGR (2025 - 2031) | 3.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product Type

|

| Regions and Countries Covered |

GCC

|

| Market leaders and key company profiles |

|

Olympus Corporation, Fujifilm Holdings Corporation, Boston Scientific, Karl Storz SE & Co. KG, Stryker Corporation, B. Braun SE, HOYA Corporation, Ambu A/S, Johnson & Johnson, and Medtronic are among the key players operating in the market. These players adopt strategies such as expansion, product innovation, and mergers and acquisitions to stay competitive in the market and offer innovative products to their consumers.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to US$. For companies reporting in other currencies, figures have been converted to US$ using the relevant exchange rates for the corresponding year.

Business Market Insights conducts a significant number of primary interviews each year with industry stakeholders and experts to validate and analyze the data and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews with industry experts across various markets, categories, segments, and sub-segments in different regions. Participants typically include:

The GCC Rigid Endoscopes Market is valued at US$ 94.8 Million in 2024, it is projected to reach US$ 120.6 Million by 2031.

As per our report GCC Rigid Endoscopes Market, the market size is valued at US$ 94.8 Million in 2024, projecting it to reach US$ 120.6 Million by 2031. This translates to a CAGR of approximately 3.5% during the forecast period.

The GCC Rigid Endoscopes Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the GCC Rigid Endoscopes Market report:

The GCC Rigid Endoscopes Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The GCC Rigid Endoscopes Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the GCC Rigid Endoscopes Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)