Sub-Saharan Africa Aquafeed Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 202 | Report Code: BMIRE00031884 | Category: Food and Beverages

No. of Pages: 202 | Report Code: BMIRE00031884 | Category: Food and Beverages

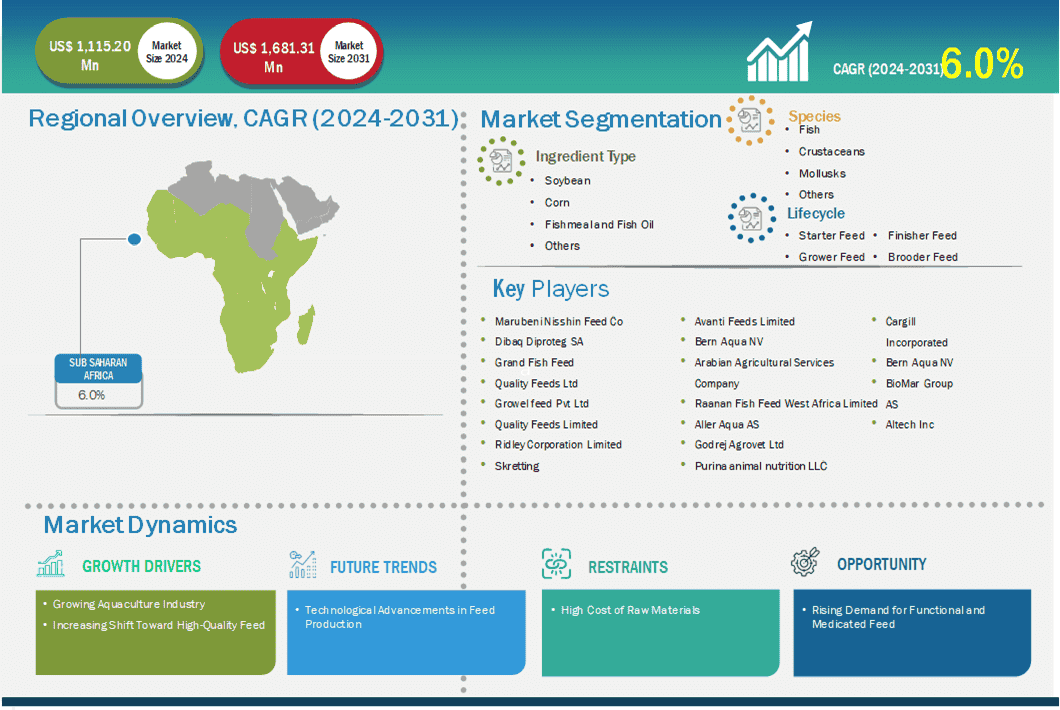

The Sub-Saharan Africa aquafeed market size is expected to reach US$ 1,681.31 million by 2031 from US$ 1,115.20 million in 2024. The market is estimated to record a CAGR of 6.0% from 2024 to 2031.

The aquafeed market in Sub-Saharan Africa is experiencing steady growth, underpinned by the expanding aquaculture industry across the region. As traditional fishing struggles to meet the rising demand for fish due to overfishing and environmental challenges, aquaculture has emerged as a viable solution to ensure food security and provide a source of livelihood for millions. Countries such as Nigeria, Kenya, Uganda, and Zambia are leading the way in aquaculture production, creating a growing demand for high-quality aquafeed to support the sustainable growth of farmed fish species such as tilapia, catfish, and carp. According to the FAO, the adoption of new technologies is bringing changes to the sector. In sub-Saharan Africa, aquaculture production has evolved from extensive and semi-intensive systems, primarily in ponds and lagoons with minimal management, to the utilization of more intensive systems, cages with recirculating systems, and aquaponic systems. Tilapia, catfish, trout, and marine finfish are widely cultured in Ghana, Nigeria, and South Africa. Aquafeed manufacturers in the region are focusing on delivering cost-effective, nutritionally balanced feed formulations, including the use of locally sourced ingredients such as soybean meal, cassava, and fish processing by-products, which are helping reduce reliance on expensive imported raw materials. Furthermore, the increasing awareness of feed efficiency and its impact on fish health, growth rates, and water quality is driving the adoption of specialized feed products in commercial aquaculture operations.

Key segments that contributed to the derivation of the aquafeed market analysis are ingredient type, species, and lifecycle.

Global fish consumption is steadily rising due to population growth and a shift toward healthier, protein-rich diets. As a result, aquaculture has become the primary means of meeting this demand. Unlike traditional fisheries, which face challenges such as overfishing and environmental constraints, aquaculture offers a sustainable and scalable solution, producing over half of the seafood consumed worldwide today. As aquaculture expands, the need for efficient, nutritionally balanced feed has become critical to maintaining the health, growth, and productivity of farmed aquatic species. According to FAO, in 2022, the global fisheries and aquaculture production reached 223.2 million tons, representing ~4% increase from 2020. This production consisted of 185.4 million tons of aquatic animals and 37.8 million tons of algae. The global aquaculture production reached an unmatched 130.9 million tons. Aquafeed, formulated with essential nutrients such as proteins, fats, vitamins, and minerals, plays a pivotal role in modern aquaculture by ensuring optimal growth rates, improved immunity, and higher yield quality. Advancements in feed technology, including the use of probiotics, enzymes, and alternative protein sources, have further enhanced feed efficiency, making aquafeed indispensable for intensive farming systems. Additionally, the diversification of aquaculture species, from shrimp and tilapia to salmon and carp, has spurred the demand for species-specific feeds tailored to their unique nutritional needs. Global aquaculture continues to scale up, driven by increasing seafood consumption and the push for sustainable food production.

Based on country, the Sub-Saharan Africa aquafeed market comprises Nigeria, South Africa, Kenya, and the Rest of Sub-Saharan Africa. The Rest of Sub-Saharan Africa held the largest share in 2024.

Ghana, Zambia, Zimbabwe, Uganda, Senegal, Mauritius, Ethiopia, and Cameroon are among the key countries in the Rest of Sub-Saharan Africa aquafeed market. The need for high-quality, cost-effective aquafeed is increasing as governments and private stakeholders invest in expanding aquaculture to meet the growing demand for fish. Sub-Saharan Africa faces a rising demand for seafood due to its rapidly growing population and changing dietary preferences, with fish considered an affordable and nutritious protein source. However, declining wild fish stocks have highlighted the importance of aquaculture, which is driving the demand for aquafeed to optimize the productivity and health of farmed fish. The use of nutritionally balanced feed enhances fish growth rates, improves survival, and ensures profitability for farmers, making it a vital component of the aquaculture value chain. In October 2024, Specialist agriculture investor AgDevCo announced the investment of US$ 10 million to finance the construction of a modern processing facility and other production equipment. This will increase the company's capacity to 30,000 tonnes within five years, contributing to improved nutrition and food security in Ghana. This increasing focus on investment in aquaculture is further driving the aquafeed market in the region.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 1,115.20 Million |

| Market Size by 2031 | US$ 1,681.31 Million |

| CAGR (2024 - 2031) | 6.0% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered | Sub-Saharan Africa

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Cargill, Incorporated; World Feeds Limited; Kemin Industries Inc; Archer-Daniels-Midland Co; Alltech Inc; BioMar Group AS; Purina Animal Nutrition LLC; Godrej Agrovet Ltd; Aller Aqua AS; Raanan Fish Feed West Africa Limited; Arabian Agricultural Services Company; Bern Aqua NV; Avanti Feeds Limited; Skretting; Ridley Corporation Limited; Growel Feeds Pvt Ltd; Quality Feeds Limited; Grand Fish Feed; Dibaq Diproteg SA; and Marubeni Nisshin Feed Co Ltd among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Sub-Saharan Africa Aquafeed Market is valued at US$ 1,115.20 Million in 2024, it is projected to reach US$ 1,681.31 Million by 2031.

As per our report Sub-Saharan Africa Aquafeed Market, the market size is valued at US$ 1,115.20 Million in 2024, projecting it to reach US$ 1,681.31 Million by 2031. This translates to a CAGR of approximately 6.0% during the forecast period.

The Sub-Saharan Africa Aquafeed Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Sub-Saharan Africa Aquafeed Market report:

The Sub-Saharan Africa Aquafeed Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Sub-Saharan Africa Aquafeed Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Sub-Saharan Africa Aquafeed Market value chain can benefit from the information contained in a comprehensive market report.