South & Central America Aquafeed Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 198 | Report Code: BMIRE00031883 | Category: Food and Beverages

No. of Pages: 198 | Report Code: BMIRE00031883 | Category: Food and Beverages

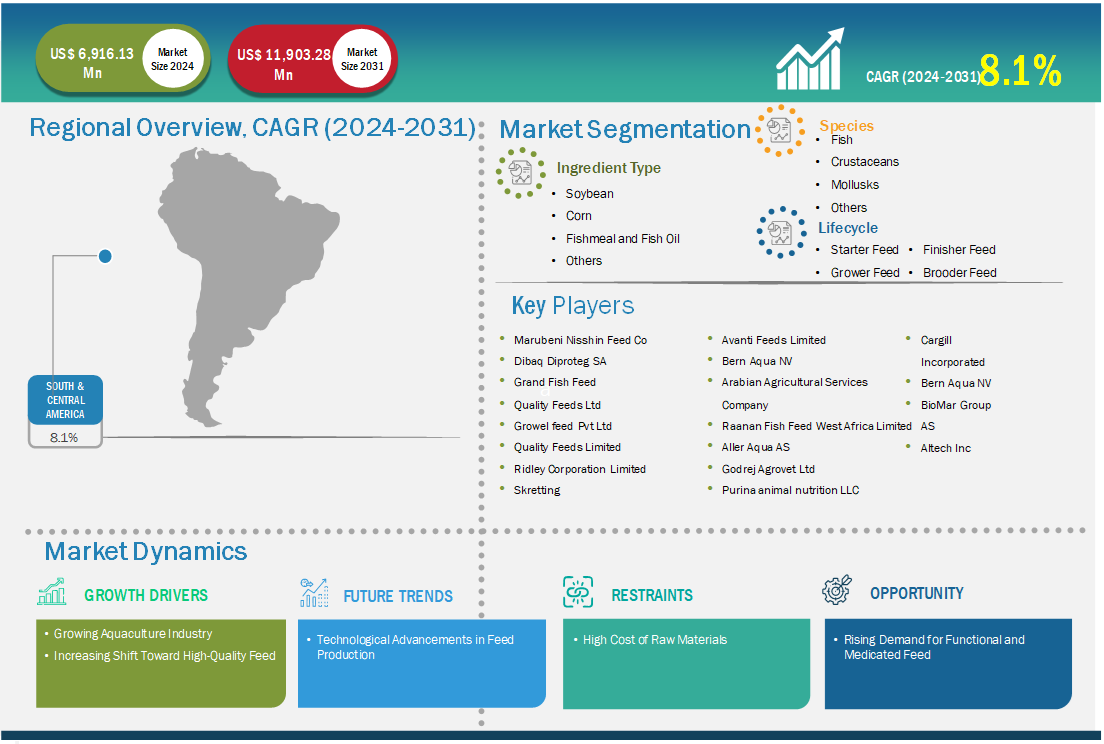

The South & Central America aquafeed market size is expected to reach US$ 11,903.28 million by 2031 from US$ 6,916.13 million in 2024. The market is estimated to record a CAGR of 8.1% from 2024 to 2031.

The aquafeed market in South and Central America is witnessing significant growth, driven by the increasing demand for high-quality seafood. Moreover, aquaculture activities in countries such as Brazil, Chile, Ecuador, and Peru have seen remarkable advancements in recent years, fueled by the rising global fish consumption, export opportunities, and government support. According to the FAO, Latin America and the Caribbean raised 4.3 million tonnes of aquatic animals in 2022, an increase of 448,300 tonnes (12.8%) from 3.8 million tonnes in 2020. This increase was primarily driven by Ecuador (348,400 tonnes, 71.4%) and Brazil (108,000 tonnes, 22.1%), followed by Colombia (25,600 tonnes, 5.2%), Chile (22,700 tonnes, 4.6%), and the Bolivarian Republic of Venezuela (12,600 tonnes, 2.6%), and most of the smaller producers in the region. As a result, the need for specialized aquafeed to ensure the optimal growth, health, and nutrition of farmed aquatic species has become a critical factor. Aquafeed manufacturers in the region are focusing on innovation to meet the dietary requirements of various species, including salmon, tilapia, shrimp, and trout. Sustainable aquafeed formulations incorporating plant-based proteins, insect meals, and other alternative ingredients are gaining prominence due to the growing awareness of environmental concerns and the increasing need to reduce dependency on fishmeal and fish oil. Moreover, the adoption of advanced feed technologies and the implementation of strict quality standards contribute to the market's expansion

Key segments that contributed to the derivation of the aquafeed market analysis are ingredient type, species, and lifecycle.

The rising incidence of disease outbreaks in aquaculture systems has highlighted the critical need for effective nutritional solutions, driving the demand for functional and medicated feeds. Functional feeds, enriched with probiotics, prebiotics, and immune-boosting additives, play a vital role in enhancing the health and resilience of farmed aquatic species. These feeds improve gut health, optimize nutrient absorption, and strengthen the immune system, reducing the risk of diseases and mortality in aquaculture operations.

In addition to functional feeds, medicated feeds designed to target specific diseases present a significant growth opportunity in the global aquafeed market. These feeds are formulated with therapeutic agents to treat or prevent diseases caused by bacterial, fungal, or parasitic infections, which are prevalent in intensive farming systems. With disease outbreaks posing a significant threat to aquaculture productivity and profitability, the adoption of such feeds has become increasingly essential.

Moreover, the growing focus on sustainable aquaculture practices has driven interest in natural additives and bioactive compounds as alternatives to antibiotics, aligning with regulatory restrictions and consumer preferences for antibiotic-free seafood. As aquaculture systems become more intensive and disease management becomes a priority, functional and medicated feeds are expected to play a crucial role in shaping the future of the aquafeed market.

Based on country, the South & Central America Aquafeed Market comprises Brazil, Argentina, and the Rest of South & Central America. The Rest of South & Central America held the largest share in 2024.

Chile, Peru, Colombia, and Venezuela are among the key countries in the Rest of South and Central America aquafeed market. The rising demand for seafood, both domestically and globally, has spurred aquaculture production, consequently increasing the need for high-quality aquafeed to support the growth, health, and sustainability of farmed species. Government support and international collaborations play a pivotal role in fostering the aquafeed market across the Rest of South and Central America. Policies promoting sustainable aquaculture practices, coupled with investments in research and infrastructure, have created a favorable environment for the industry. In November 2024, Peru's Ministry of Production (Produce) granted 106 environmental certifications to investment projects totaling ~US$ 105.26 million. Through these certifications, issued by the General Directorate of Fisheries and Aquaculture Environmental Affairs (DGAAMPA), the investments will comply with high environmental standards, promoting economic growth that respects the natural environment. These factors are driving demand for aquafeed in the Rest of South and Central America.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 6,916.13 Million |

| Market Size by 2031 | US$ 11,903.28 Million |

| CAGR (2024 - 2031) | 8.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered | South and Central America

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Cargill, Incorporated; World Feeds Limited; Kemin Industries Inc; Archer-Daniels-Midland Co; Alltech Inc; BioMar Group AS; Purina Animal Nutrition LLC; Godrej Agrovet Ltd; Aller Aqua AS; Raanan Fish Feed West Africa Limited; Arabian Agricultural Services Company; Bern Aqua NV; Avanti Feeds Limited; Skretting; Ridley Corporation Limited; Growel Feeds Pvt Ltd; Quality Feeds Limited; Grand Fish Feed; Dibaq Diproteg SA; and Marubeni Nisshin Feed Co Ltd among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The South & Central America Aquafeed Market is valued at US$ 6,916.13 Million in 2024, it is projected to reach US$ 11,903.28 Million by 2031.

As per our report South & Central America Aquafeed Market, the market size is valued at US$ 6,916.13 Million in 2024, projecting it to reach US$ 11,903.28 Million by 2031. This translates to a CAGR of approximately 8.1% during the forecast period.

The South & Central America Aquafeed Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Aquafeed Market report:

The South & Central America Aquafeed Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Aquafeed Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Aquafeed Market value chain can benefit from the information contained in a comprehensive market report.