Asia Pacific Aquafeed Market Report (2021-2031) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 214 | Report Code: BMIRE00031881 | Category: Food and Beverages

No. of Pages: 214 | Report Code: BMIRE00031881 | Category: Food and Beverages

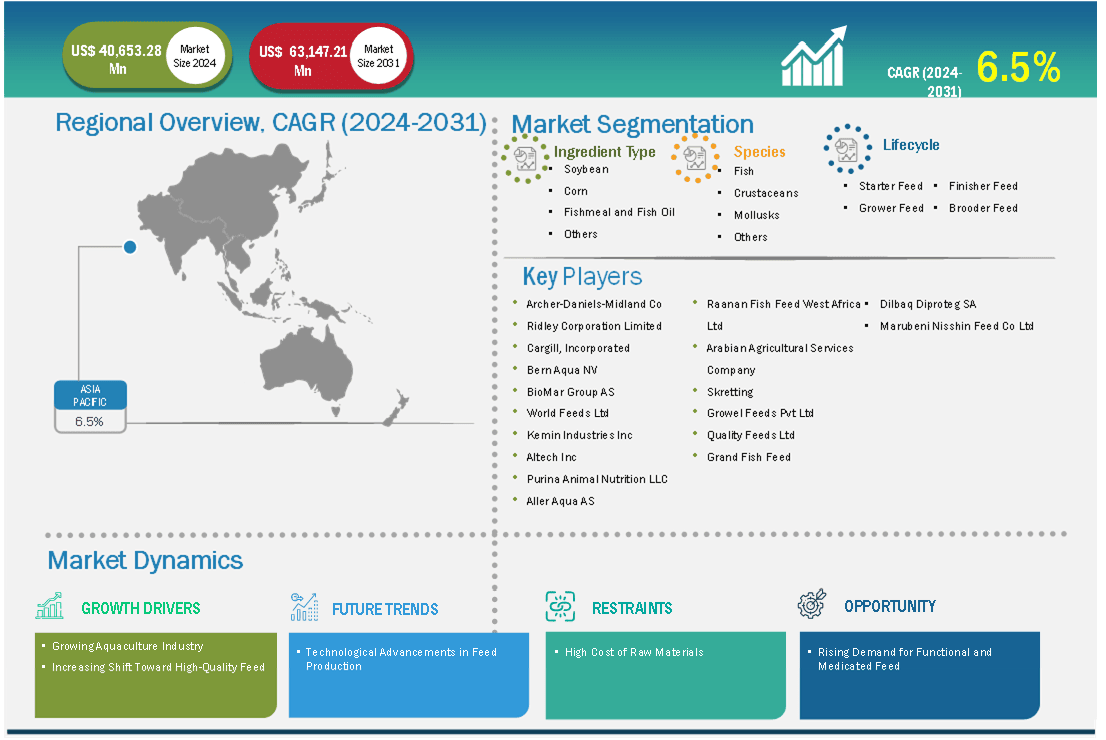

The Asia Pacific aquafeed market size is expected to reach US$ 63,147.21 million by 2031 from US$ 40,653.28 million in 2024. The market is estimated to record a CAGR of 6.5% from 2024 to 2031.

Asia Pacific is the world's largest producer and consumer of seafood, making it a significant market for aquafeed. The region's large and growing population has a high demand for protein-rich foods, including seafood. As income rises and diets diversify, seafood consumption is expected to increase further, driving the need for more aquafeed to support aquaculture production. Aquaculture is a major industry in Asia Pacific, contributing significantly to global seafood production. According to the Food and Agriculture Organization of the United Nations (FAO), in 2022, Asia contributed 91.4% of total aquaculture production. The increasing focus on intensive aquaculture practices to meet growing demand requires a steady supply of high-quality aquafeed to ensure optimal growth and the health of farmed aquatic animals. Furthermore, the region is witnessing a shift toward value-added aquaculture products, such as processed seafood and specialty species. These products often require specialized diets and formulated feeds to meet specific nutritional needs, further boosting the demand for aquafeed. Further, advancements in aquafeed technology and the development of more sustainable and efficient feed formulations are contributing to the growth of the aquafeed market in Asia Pacific.

Key segments that contributed to the derivation of the Aquafeed Market analysis are ingredient type, species, and lifecycle.

Technological advancements in feed production are shaping the future of the aquafeed industry by enhancing efficiency, sustainability, and customization. Innovations such as precision nutrition and advanced formulation techniques allow manufacturers to create feeds tailored to the specific dietary requirements of different aquatic species. This ensures optimal growth rates, better feed conversion ratios, and improved immunity in farmed species, addressing the growing demand for high-quality seafood. Technologies such as microencapsulation and nanotechnology enable the efficient delivery of essential nutrients, vitamins, and minerals, reducing nutrient loss and enhancing feed stability under varying aquaculture conditions.

The integration of alternative protein sources, such as insect meal, algae, and single-cell proteins, has also been made feasible through advancements in processing and formulation technologies. These sustainable ingredients reduce dependency on fishmeal and fish oil, addressing environmental concerns and raw material cost fluctuations. Additionally, smart feeding systems powered by data analytics, machine learning, and the Internet of Things (IoT) are revolutionizing feed management. These systems monitor fish behavior, water quality, and environmental parameters in real-time to optimize feeding schedules and reduce wastage. Furthermore, advancements in enzyme technology and probiotics are improving nutrient digestibility and gut health, enhancing overall feed performance.

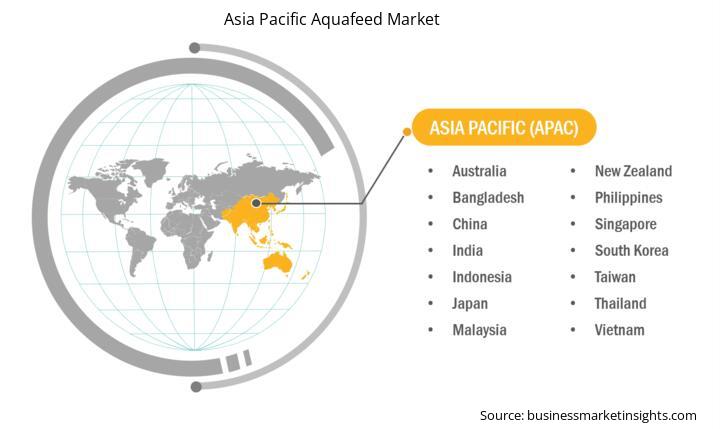

Based on country, the Asia Pacific aquafeed market comprises China, Japan, India, Australia, South Korea, and the Rest of Asia Pacific. China held the largest share in 2024.

The aquafeed market in China is one of the largest and most dynamic in the world, driven by the country's position as a global leader in aquaculture production. China accounts for a significant portion of global farmed seafood output, with species such as carp, tilapia, shrimp, and catfish dominating its aquaculture landscape. According to the FAO, China continues to be the main contributor, accounting for 55.4% (3.3 million tonnes) of the growth in Asian aquaculture. In addition to being by far the major producer of aquatic products, China has also been the leading exporter of aquatic products since 2002. According to the FAO, in 2022, China's contribution to world exports of aquatic animal products stood at 12%, comparable to—although slightly less than—the country's 14% share in total merchandise trade. This vast scale of production generates a high and consistent demand for aquaculture to support the nutritional needs and growth of these farmed aquatic species. The market's growth is underpinned by China's increasing domestic seafood consumption, driven by a growing population, rising incomes, and a shift toward healthier protein-rich diets. As seafood becomes an integral part of the Chinese diet, the aquaculture industry is scaling up to meet the demand, boosting the need for high-quality, nutritionally balanced aquafeed.

| Report Attribute | Details |

|---|---|

| Market size in 2024 | US$ 40,653.28 Million |

| Market Size by 2031 | US$ 63,147.21 Million |

| CAGR (2024 - 2031) | 6.5% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Ingredient Type

|

| Regions and Countries Covered | Asia Pacific

|

| Market leaders and key company profiles |

|

Some of the key players operating in the market include Cargill, Incorporated; World Feeds Limited; Kemin Industries Inc; Archer-Daniels-Midland Co; Alltech Inc; BioMar Group AS; Purina Animal Nutrition LLC; Godrej Agrovet Ltd; Aller Aqua AS; Raanan Fish Feed West Africa Limited; Arabian Agricultural Services Company; Bern Aqua NV; Avanti Feeds Limited; Skretting; Ridley Corporation Limited; Growel Feeds Pvt Ltd; Quality Feeds Limited; Grand Fish Feed; Dibaq Diproteg SA; and Marubeni Nisshin Feed Co Ltd, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Aquafeed Market is valued at US$ 40,653.28 Million in 2024, it is projected to reach US$ 63,147.21 Million by 2031.

As per our report Asia Pacific Aquafeed Market, the market size is valued at US$ 40,653.28 Million in 2024, projecting it to reach US$ 63,147.21 Million by 2031. This translates to a CAGR of approximately 6.5% during the forecast period.

The Asia Pacific Aquafeed Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Aquafeed Market report:

The Asia Pacific Aquafeed Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Aquafeed Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Aquafeed Market value chain can benefit from the information contained in a comprehensive market report.