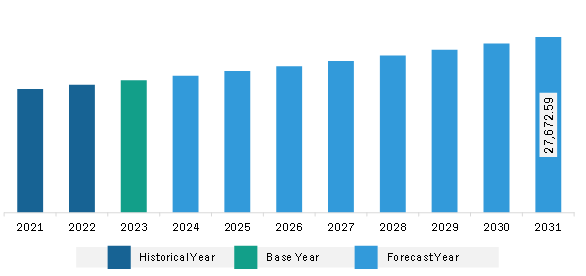

The North America tortilla market was valued at US$ 20,871.21 million in 2023 and is expected to reach US$ 27,672.59 million by 2031; it is estimated to register a CAGR of 3.6% from 2023 to 2031.

Consumers across the world pay attention to product labels and ingredients used in processed products such as tortillas, as they are highly concerned about their diet. Organic products are gaining significant popularity owing to their perceived health benefits. They are manufactured using ingredients harvested without genetically modified organisms (GMOs), chemical fertilizers, and pesticides, which increase their appeal among consumers, who are ready to pay higher prices. Moreover, consumers increasingly prefer products free of synthetic flavors, colors, and other food additives. Also, they focus on conscious and holistic consumption and prefer product items made with ethically sourced ingredients.

Consumers' interest in identifying the ingredients on the product packaging has triggered their inclinations toward clean-label products. They are becoming aware of the adverse health impacts associated with consuming various artificial food ingredients, such as colorants, flavors, texturizers, and emulsifiers. An understandable and clear label with thorough ingredient information attracts consumers. Using clean-label ingredients also assists manufacturers in their marketing and branding strategies.

Thus, the rising demand for natural, organic, and clean-label products is expected to introduce new trends into the tortilla market during the forecast period.

Tortilla is a highly versatile food item that can be used in various dishes such as fajitas, tacos, quesadillas, burritos, and wraps. It is considered a healthier option for bread due to its high starch and lower fat content, and it is typically made from corn flour and wheat flour. Health-conscious customers often prefer tortillas in their diet. Hence, a rise in health-conscious customers in North America propels the demand for tortillas.

The US has significant group of Hispanic/Latino population that are people of Latin American or Spanish origins, including Mexican, Central & South American, Dominican, Puerto Rican, Cuban, and other Indigenous groups. According to the Latino Policy & Politics Institute, in FY2021, the US Latino population reached 62.5 million, which is 19% of the US population. Tortillas are a key ingredient in Mexico's popular traditional dishes such as tacos, burritos, chilaquiles, barbacoa, and quesadillas, which drives its consumption among the Hispanic population. Thus, the rising Hispanic population influences the North American tortilla market growth.

The presence of major local tortilla producers in North America fuels the expansion of the tortilla market in the region. In March 2024, SnackCraft LLC, a subsidiary of Unismack SA, invested US$29.9 million in a facility expansion in Kentwood, Michigan. SnackCraft expanded its manufacturing, warehousing, and distribution space by adding 186,000 square feet to its 311,000-square-feet plant. SnackCraft offers a variety of baked snacks, including crackers, tortilla chips, pellet snacks, and baked extruded snacks.

Strategic insights for the North America Tortilla provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the North America Tortilla refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

North America Tortilla Strategic Insights

North America Tortilla Report Scope

Report Attribute

Details

Market size in 2023

US$ 20,871.21 Million

Market Size by 2031

US$ 27,672.59 Million

Global CAGR (2023 - 2031)

3.6%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Source

By Product Type

By Category

By Distribution Channel

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Tortilla Regional Insights

The North America tortilla Market is categorized into source, product type, category, distribution channel, and country.

Based on source, the North America tortilla market is segmented into wheat, corn, and others. The corn segment held the largest market share in 2023.

By product type, the North America tortilla market is segmented into tortilla chips/tostada chips

taco shells, tortilla wraps, and others. The tortilla chips/tostada chips segment held the largest market share in 2023. The tortilla chips/tostada chips segment is further sub segmented into corn chips and other chips.

Based on category, the North America tortilla market is bifurcated into organic and conventional. The conventional segment held a larger market share in 2023.

Based on distribution channel, the North America tortilla market is segmented into supermarkets and hypermarkets, convenience stores, online retail, and others. The supermarkets and hypermarkets segment held the largest market share in 2023.

By country, the North America tortilla market is segmented into the US, Canada, and Mexico. The US dominated the North America tortilla market share in 2023.

GRUMA SAB de CV; PepsiCo Inc; La Tortilla Factory Inc; Aranda’s Tortilla Co Inc; Paulig Ltd; Intersnack Group GmbH & Co KG; General Mills Inc; Conagra Brands Inc; Goya Foods Inc; Greendot Health Foods Pvt. Ltd.; Fresca Mexican Foods; Mi Rancho; Leighton Foods AS; and The Hain Celestial Group Inc are some of the leading companies operating in the North America tortilla market.

The North America Tortilla Market is valued at US$ 20,871.21 Million in 2023, it is projected to reach US$ 27,672.59 Million by 2031.

As per our report North America Tortilla Market, the market size is valued at US$ 20,871.21 Million in 2023, projecting it to reach US$ 27,672.59 Million by 2031. This translates to a CAGR of approximately 3.6% during the forecast period.

The North America Tortilla Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Tortilla Market report:

The North America Tortilla Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Tortilla Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Tortilla Market value chain can benefit from the information contained in a comprehensive market report.