North America Hydrogen Compressor Market Report (2017-2035) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 145 | Report Code: TIPRE00023020 | Category: Manufacturing and Construction

No. of Pages: 145 | Report Code: TIPRE00023020 | Category: Manufacturing and Construction

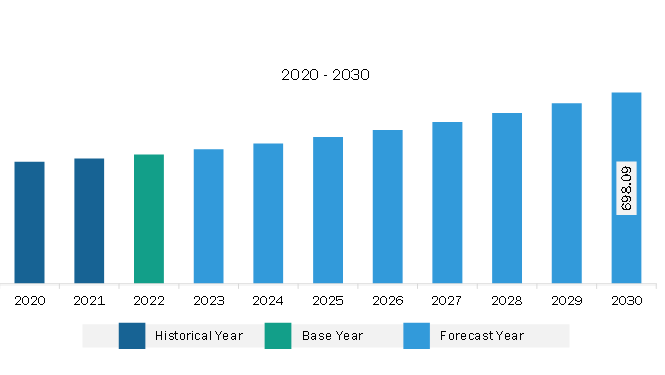

The North America hydrogen compressor market size is expected to reach US$ 755.58 million by 2035 from US$ 411.94 million in 2023. The market is estimated to record a CAGR of 5.4% from 2024-2035.

The North America hydrogen compressor is segmented into the US, Canada, and Mexico, which have a significant demand for hydrogen compressors owing to the growth in the oil & gas sector. Well-established infrastructure in developed countries, including the US and Canada, helps manufacturing firms explore the limits of science, technology, and commerce. Technological advancements have led to high competition in the manufacturing sector in the region. As per the National Institute of Standards and Technology (NIST), the manufacturing sector in the US was valued at US$ 2.9 trillion in 2023, accounting for a 10.0% share of its total GDP. Such prominent manufacturing and industrial sectors generate a vast demand for hydrogen as a clean fuel in North America, which in turn is projected to boost the hydrogen compressor market during the forecast period.

The US produces ~10 million metric tons of hydrogen per year, mainly used in petroleum refining and ammonia production. Hydrogen holds a significant potential to power zero-emission operations in chemical processes, clean energy systems, and transportation, among other applications. Hydrogen is also emerging as an attractive fuel in the functioning of data centers, ports, steel manufacturing facilities, and medium- to heavy-duty trucks. In January 2023, the Department of Energy (DOE) announced a US$ 8 billion investment in Regional Clean Hydrogen Hubs (H2Hubs) as part of the Infrastructure Investment and Jobs Act. These H2Hubs will showcase the entire clean hydrogen value chain, promoting production, processing, delivery, storage, and end-use applications. The DOE's efforts align with the Biden Administration's ambitious targets of achieving a carbon-free electric grid by 2035 and transitioning to a net-zero emissions economy by 2050. The funding aims to accelerate advancements in hydrogen technology and infrastructure, driving progress toward a more sustainable and environmentally friendly future in the US.

According to the World Economic Forum, Canada produces 3 MMT of hydrogen from fossil fuels and the oil & gas sector annually for industrial use. The country's commitment to a clean hydrogen economy was outlined in the Hydrogen Strategy for Canada, with the goal of supplying up to 30% of its energy in the form of clean hydrogen by 2050 and becoming one of the top 3 clean hydrogen producers worldwide.

According to the Energy Information Administration in the US, crude oil production in 2022 reached a 0.6 million per day increase of 5.6% compared to 2021. Hydrogen compressor is used in petroleum refineries to ensure leakage-free compression of the oil and gas. In October 2023, Pemex Mexican oil and gas company announced its plan to invest ~US$ 9.2 billion for the expansion of its petroleum refineries.

In North America, the US has the largest market share in 2023, owing to the rapid growth in the oil & gas sector, and is also expected to witness growth in drilling activities in the coming years. The government's growing investment in oil and gas projects in the region is likely to increase the demand for hydrogen compressors. Various oil & gas projects in North America are expected to boost the hydrogen compressor market growth. For instance, the US Department of Energy planned to invest US$ 7 billion in launching the seven clean hydrogen hubs across the nation, and the government planned to accelerate the commercial-scale deployment of clean hydrogen. North America is witnessing significant growth in the renewable energy & power sector owing to growing demand for power transmission projects. Hydrogen compressors are used to compress and store energy efficiently. For instance, in November 2021, the US government passed the Bipartisan Infrastructure Law and invested US$ 9.5 billion in the clean hydrogen project initiatives. This funding will help promote clean hydrogen production over the next five years.

North America Hydrogen Compressor Market Strategic Insights

North America Hydrogen Compressor Market Segmentation Analysis

Key segments that contributed to the derivation of the hydrogen compressor market analysis are type, technology, and end-user.

Governments of various countries across the globe are continuously focusing on the development of eco-friendly solutions for various industries, including automotive, due to rising concerns associated with the depletion of natural resources and environmental degradation. In addition, a shift in consumer preferences owing to a surge in awareness related to the effects of air pollution and boosting levels of traffic and greenhouse gas emissions has driven the need for hydrogen fuel cell vehicles. The rise in government investments in hydrogen fuel infrastructure and incentives offered to the buyers are allowing the original equipment manufacturers (OEMs) to expand their revenue stream as well as their geographical presence. For instance, the US and Canada are promoting hydrogen fuel cell vehicles by investing in hydrogen infrastructure, offering tax credits, and providing funding for clean energy initiatives. Key efforts in the US include the Department of Energy's Hydrogen Program and California's Hydrogen Highway. Meanwhile, Canada has implemented a Hydrogen Strategy with the goal of achieving net-zero emissions by 2050. Further, there is a rise in research and development activities by vehicle manufacturers players across the globe. For instance, in December 2020, Toyota launched its redesigned Mirai. The company updated a variety of internal and external functions, including its hydrogen fuel cell system.

There are a variety of benefits of hydrogen fuel cell vehicles over conventional ICE vehicles. Fuel cell electric vehicles (FCEVs) provide improved fuel economy to internal combustion engine (ICE) vehicles. The FCEV has a fuel economy of ~63 miles per gallon gasoline equivalent (MPGge), and an ICE vehicle records 29 MPGge on roads. Hybridization enhances the fuel economy of an FCEV by approximately 3.2%. Moreover, the FCEVs can travel almost 300 miles without refueling. Honda Clarity has the highest EPA driving rating for any zero-emission vehicle in the US. It has a driving range of up to 366 miles. Owing to these benefits, the demand for hydrogen fuel cell vehicles has increased. Government incentives and product development activities by key players for hydrogen vehicles is leading to increased demand for hydrogen infrastructure market ultimately driving the market.

Based on country, the North America Hydrogen Compressor Market comprises the US, Canada, and Mexico. The US held the largest share in 2023.

In 2023, the US was the second-largest hub for manufacturing and industrial production after China. The manufacturing sector contributed nearly US$ 2,900 billion and accounted for more than 12% of the total US GDP. There is a continuous need to boost investments in hydrogen infrastructure development and expansion to raise the industrial output at the same pace in the future, which, in turn, is expected to create a demand for hydrogen compressors in the coming years. The current infrastructure in the US is aging and needs upgrades and capacity expansion, especially in sectors such as oil and gas, energy, refinery, petrochemicals, and aviation. With an upsurge in investments toward upgrading the infrastructure of these industries, there will be a rise in demand for hydrogen as a transition fuel in the US. Further, the growing upstream and downstream activities, and rising power generation and transmission projects by the government are propelling the market toward growth. Hydrogen compressors are extensively used in electricity storage networks in nuclear power plants and industrial manufacturing. The growing oil and gas exploration activities with the US government support and initiatives drive the hydrogen compressors market growth. The US government planned to invest US$ 50 billion to promote a Clean Hydrogen Economy. The government planned to build seven clean hydrogen hubs in the country. The growth in the power generation capacity is the most substantial factor driving the market growth in the country. The hydrogen compressor is extensively used in the electricity storage network in nuclear power plants and industrial manufacturing; thus, it is likely to boost the market growth in the coming years. In addition, companies in the US are investing in clean energy projects. In March 2022, the US Department of Energy planned to invest US$ 750 million in research and development in hydrogen production for making clean hydrogen. The investment was increased to US$ 1.5 billion in 2022 to reduce the additional costs of clean energy hydrogen production. The total funding from the federal government is supported by Plug Power Inc's research and development activities.

North America Hydrogen Compressor Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 411.94 Million

Market Size by 2035

US$ 755.58 Million

CAGR (2024 - 2035) 5.4%

Historical Data

2017-2022

Forecast period

2024-2035

Segments Covered

By Type

By Technology

By End User

Regions and Countries Covered

North America

Market leaders and key company profiles

North America Hydrogen Compressor Market Company Profiles

Some of the key players operating in the market include Atlas Copco AB; Burckhardt Compression AG; Fluitron, Inc; Gardner Denver Nash, LLC; Howden Group; HAUG Sauer Kompressoren AG; NEUMAN & ESSER GROUP; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; PDC Machines Inc.; Sundyne; and Ariel Corporation, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The North America Hydrogen Compressor Market is valued at US$ 411.94 Million in 2023, it is projected to reach US$ 755.58 Million by 2035.

As per our report North America Hydrogen Compressor Market, the market size is valued at US$ 411.94 Million in 2023, projecting it to reach US$ 755.58 Million by 2035. This translates to a CAGR of approximately 5.4% during the forecast period.

The North America Hydrogen Compressor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Hydrogen Compressor Market report:

The North America Hydrogen Compressor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Hydrogen Compressor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Hydrogen Compressor Market value chain can benefit from the information contained in a comprehensive market report.