Middle East & Africa Hydrogen Compressor Market Report (2017-2035) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 170 | Report Code: TIPRE00023019 | Category: Manufacturing and Construction

No. of Pages: 170 | Report Code: TIPRE00023019 | Category: Manufacturing and Construction

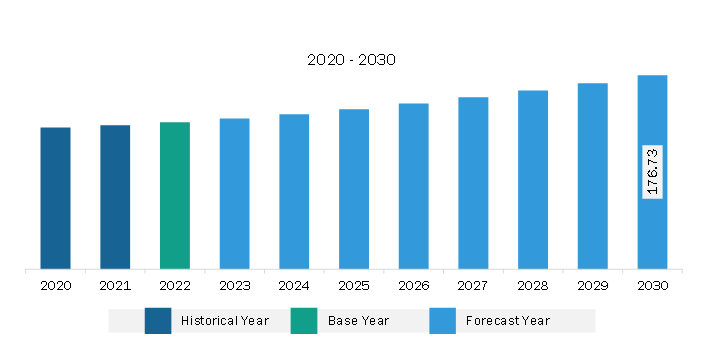

The Middle East & Africa hydrogen compressor market size is expected to reach US$ 179.54 million by 2035 from US$ 84.17 million in 2023. The market is estimated to record a CAGR of 6.7% from 2024-2035.

The Middle East & Africa is home to a few of the world's most significant hydrogen production plants, such as NEOM Helios and Oman Acme Group. Countries in the region receive high solar irradiation levels. With abundant renewables, geographic convenience, and vast ongoing logistical infrastructure investments, the Middle East & Africa flairs the potential for scalable green hydrogen generation and exports to meet rising global demand. Governments of these economies are significantly investing in hydrogen production capacity to diversify their economies, generate jobs, and become leaders in the energy transition. Most green hydrogen projects are still in the planning stages, while two projects—the NEOM Helios and the Ain Sokhna Complex (Egypt)—are under construction. In line with their ambitious renewable energy targets, governments of nations in the Middle East & Africa have been developing large-scale solar and wind projects to harness their natural resources for hydrogen production. They announced more than 45 new hydrogen projects with a total value of more than US$ 100 billion and a total capacity of more than 10 metric tons of hydrogen per year during 2020–2022. In 2023, the Middle East Economic Digest (MEED) calculated that more than 50 projects in the region added up to over US$ 150 billion in investments. Further, Saudi Arabia and the UAE had projects worth US$ 10.5 billion and US$ 10.28 billion, respectively, while Egypt has staked more than these countries by investing US$ 63.8 billion. Oman has invested US$ 48.9 billion in various projects; these projects include a green hydrogen hub (Oman) by Oman Acme Group; OQ, ACWA Power, Air Products—a green hydrogen and ammonia complex (Oman) by Salalah; POSCO—a hydrogen export plant (Saudi Arabia) by PIF; A.D. Ports—a green ammonia complex (UAE) by TAQA Group; and Hyphen—a green hydrogen complex (Namibia). Hence, with ongoing investments, the region is poised to play a critical role in shaping the future of the green hydrogen sector on a global scale, which is expected to boost the hydrogen compressor market growth in the future.

Middle East & Africa Hydrogen Compressor Market Strategic Insights

Middle East & Africa Hydrogen Compressor Market Segmentation Analysis

Key segments that contributed to the derivation of the hydrogen compressor market analysis are type, technology, and end-user.

The electromechanical hydrogen compressors are presently in the research and development stage and electrochemical reactions, ionic liquids, and metal hydrides. The electrochemical compressors have the application of proton exchange membranes lined by electrodes and a peripheral power source to lead the recombination at higher pressures at the cathode and dissociation of hydrogen at the anode. The development of an electrochemical hydrogen compressor (EHC) is necessary to tackle the critical requirements of higher efficiency, lower cost, and improved durability. For instance, HyET Group offers electrochemical hydrogen compression technology, which is exclusively designed to operate the compression and purification step utilizing one piece of equipment. This results in a compact, energy-efficient, and cost-effective electromechanical hydrogen compressor. This technology minimizes downtime, as electrochemical compression stacks are static equipment, and hence, they do not have the wear and tear issue.

Furthermore, the modular design of EHC systems facilitates concurrent operation in case one of the compressor stacks requires maintenance or inspection after some period. Also, in September 2023, Atlas Copco launched an H2P hydrogen compressor that is capable of electrochemical electrolysis production. The company introduced speed-controlled technologies to compensate for fluctuations in hydrogen production and ensure optimal efficiency by reducing energy losses. These unique technologies launched by the key players are contributing to future growth in the hydrogen compressor market.

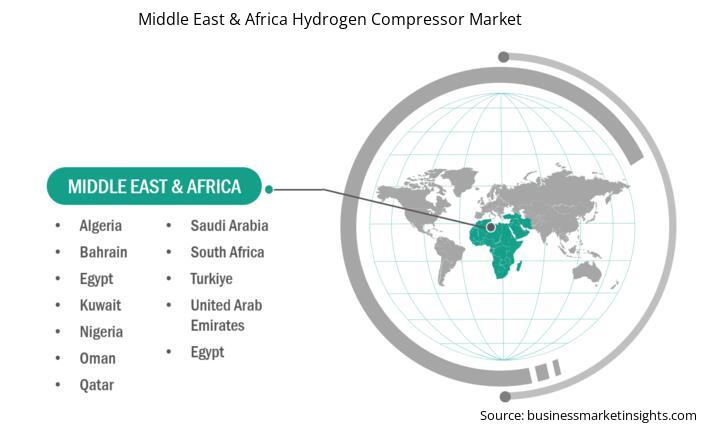

Based on Geography, the Middle East & Africa Hydrogen Compressor Market comprises South Africa, Saudi Arabia, the UAE, Turkey, Namibia, Oman, Nigeria, Egypt, and the Rest of Middle East & Africa. Saudi Arabia held the largest share in 2023.

Hydrogen compressor market growth in Saudi Arabia is attributed to the rise in demand for hydrogen in the manufacturing, energy, petrochemical refinery, chemicals, aviation, and heavy machinery industries, among others. As per the data from the US Energy Information Administration (EIA), Saudi Arabia produced ~13.4 million barrels/day of crude oil in 2023 as compared to 12.2 million barrels per day in 2022. Hence, such rise in production increases the need for machinery in petroleum refineries and increases the demand for hydrogen which in turn is expected to drive the market growth in the coming years.

Saudi Arabia has a suitable climate for large-scale solar panel installations, which can help produce hydrogen. The government had plans to add approximately 27 GW of primarily solar capacity by the end of 2023 and over 58 GW by 2030. The Saudi government's commitment to green hydrogen is evident through various initiatives and investments. It has launched several large-scale green hydrogen projects, attracting significant attention from domestic and international investors. NEOM, ACWA Power (Saudi Arabia), and Air Products (Pennsylvania) have established a joint venture named NEOM Green Hydrogen Complex with a valuation of US$ 8.4 billion. With 4 GW of renewable capacity, the project would be the world's largest renewable hydrogen-to-ammonia facility, with an estimated capacity of producing 1.2 metric tons of green hydrogen per year, approximately equivalent to 5 million barrels of oil per year in energy. It is likely to become the world's largest renewable hydrogen-to-ammonia facility by 2026. Such a rise in investment toward renewable energy projects, increasing industrialization, and hydrogen fueling stations is expected to drive the hydrogen compressor market in Saudi Arabia from 2024 to 2031.

Middle East & Africa Hydrogen Compressor Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 84.17 Million

Market Size by 2035

US$ 179.54 Million

CAGR (2024 - 2035) 6.7%

Historical Data

2017-2022

Forecast period

2024-2035

Segments Covered

By Type

By Technology

By End User

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Hydrogen Compressor Market Company Profiles

Some of the key players operating in the market include Atlas Copco AB; Burckhardt Compression AG; Fluitron, Inc; Gardner Denver Nash, LLC; Howden Group; HAUG Sauer Kompressoren AG; NEUMAN & ESSER GROUP; Hydro-Pac, Inc.; Lenhardt & Wagner GmbH; PDC Machines Inc.; Sundyne; and Ariel Corporation, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Middle East & Africa Hydrogen Compressor Market is valued at US$ 84.17 Million in 2023, it is projected to reach US$ 179.54 Million by 2035.

As per our report Middle East & Africa Hydrogen Compressor Market, the market size is valued at US$ 84.17 Million in 2023, projecting it to reach US$ 179.54 Million by 2035. This translates to a CAGR of approximately 6.7% during the forecast period.

The Middle East & Africa Hydrogen Compressor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Hydrogen Compressor Market report:

The Middle East & Africa Hydrogen Compressor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Hydrogen Compressor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Hydrogen Compressor Market value chain can benefit from the information contained in a comprehensive market report.