Asia Pacific Hydrogen Compressor Market Report (2017-2035) by Scope, Segmentation, Dynamics, and Competitive Analysis

No. of Pages: 185 | Report Code: TIPRE00023021 | Category: Manufacturing and Construction

No. of Pages: 185 | Report Code: TIPRE00023021 | Category: Manufacturing and Construction

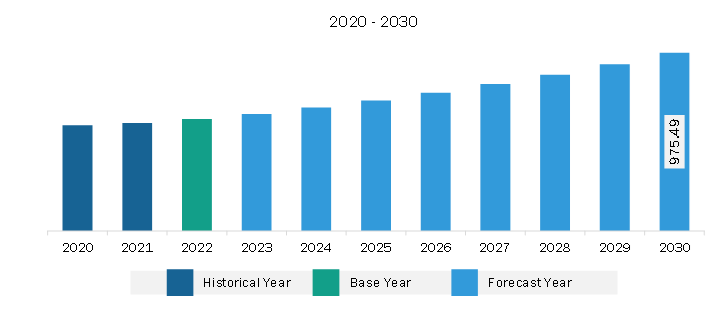

The Asia Pacific hydrogen compressor market size is expected to reach US$ 1,690.71 million by 2031 from US$ 843.27 million in 2023. The market is estimated to record a CAGR of 6.2% from 2024-2035.

The Asia Pacific hydrogen compressor market is segmented into Australia, South Korea, India, China, Japan, Indonesia, Singapore, Taiwan, New Zealand, Southeast Asia, and the Rest of Asia Pacific. The region consists of various growing economies such as India, China, Thailand, Vietnam, Singapore, Taiwan and New Zealand. The availability of low labor costs, low taxes and tariffs, and a gradual increase in the adoption of advanced technologies indicate a robust business ecosystem in these countries, attracting global manufacturing players to expand their production facilities in this region.

Asia Pacific is witnessing intense competition among companies aiming to establish green hydrogen production bases, recognizing its potential as a next-generation power source. The domestic players are teaming up with companies from Western countries for massive projects. Orsted, a Danish offshore wind power company exploring entry into the green hydrogen sector, partnered with POSCO, a South Korean steelmaker, for an offshore wind power project in May 2021. It is also studying the feasibility of green hydrogen production. Moreover, Western oil companies are making significant investments in Asia Pacific. In June 2022, BP became the largest shareholder in the Asian Renewable Energy Hub (AREH) project in Australia, aiming to produce up to 1.6 metric tons of green hydrogen annually and secure a 10% share of the global market. Such investments by companies are expected to drive the hydrogen compressor market growth in Asia Pacific during the forecast period. A report from the Hydrogen Council, which includes over 150 multinational companies, predicts that the combined hydrogen demand from China, India, Japan, and South Korea is expected to reach 285 million tonnes by 2050, accounting for 43% of the global total. China, being the world's largest hydrogen consumer, is actively striving to gain the lead in green hydrogen production. As the demand for green hydrogen surges, companies are engaging in strategic partnerships and investing heavily to position themselves in the emerging green hydrogen industry in Asia Pacific, which propels the hydrogen compressor market growth in the region.

The growth in the oil and gas sector can boost the upstream and downstream activities. The rise in of oil and gas exploration activities boosts the demand to integrate hydrogen compressors in both downstream and upstream oil and natural gas industries, as well as operate under harsh environmental conditions. In APAC's oil and gas production, India, China, and Indonesia have the largest contribution. Also, gas production is highest among Australia, China, Indonesia, and Malaysia. In 2023, governments of Southeast Asian countries invested US$ 16 billion in oil and gas greenfield projects.

Further, APAC's demand for hydrogen compressors is largest in 2022 owing to rapid investments in the energy and power sector with several government projects in the region. The region is expected to dominate owing to ample investment by the government in the renewable energy sector. Renewable energy investment in Asia Pacific is expected to reach US$ 1.3 trillion by 2030. The fossil fuel expenditures were recorded to be US$ 54 billion annually in Asia Pacific. Further, India and China are the leading contributors to the hydrogen compressors market growth. The installation of large-scale solar power projects across India is likely to promote the adoption of hydrogen compressors. Besides, due to rising power demand in other developing countries of APAC, coupled with the growing investment in RandD activities, it is expected to boost the growth of the hydrogen compressor market. Additionally, the APAC hydrogen compressor market is led by China and Japan and further anticipates significant growth with growing fuel cell stack shipments for the transport industry.

Asia Pacific Hydrogen Compressor Market Strategic Insights

Asia Pacific Hydrogen Compressor Market Segmentation Analysis

Key segments that contributed to the derivation of the hydrogen compressor market analysis are type, technology, and end-user.

Energy consumption has risen significantly with rapid urbanization and industrial growth. To meet the growing demand for power, the development of sub-transmission and intrastate transmission networks is expanding. With the rise in new power transmission projects, the deployment of hydrogen compressors is also increasing. Renewable energy plays a significant role in generating electricity to cater to increasing demand for energy. As per the International Energy Agency (IEA), the demand for electricity is projected to expand at 2.1% per year by 2040 worldwide. The rising requirement for electricity in Southeast Asia is among the fastest in the globe; it has the potential for the renewable energy sector. Moreover, in APAC, India is the third largest producer of electricity, and the generating capacity is exponentially expanding due to favorable government support and the initiation of numerous power generation projects. For instance, the Khargone Transmission Project was initiated to connect NTPC's 1,320 MW thermal power project at Khandwa in Madhya Pradesh with a transmission system to serve Maharashtra and southern states in India. Therefore, the rising investments in the energy and power industry are expected to create huge opportunities for the hydrogen compressor market growth during the forecast period.

With rising urbanization and rapid industrial growth, energy consumption across the globe has proliferated. Thus, to meet this huge demand for power, there is a rapid increase in the launch of hydrogen-generated power projects. According to the Ember Climate Organization, total global energy demand reached ~13,393 TWh in the first quarter of 2022, an increase from 13,004 TWh compared to 2021. Such an increase in demand for energy and power, owing to rising residential and industrial manufacturing requirements, is driving the demand for hydrogen compressors. Renewable energy plays a significant role in making electricity. Per the International Energy Agency (IEA), the global demand for electricity is anticipated to increase by 2.1% annually by 2040.

Further, the growth in electricity demand is higher in Asia Pacific countries such as China, Japan, and India. In APAC, India is the third largest producer of electricity, generating higher capacity with favorable government support and the initiation of numerous power generation projects. For instance, the Khargone Transmission Project was initiated to connect NTPC's 1,320 MW thermal power project at Khandwa in Madhya Pradesh with a transmission system to serve Maharashtra and southern states. Along with the new power transmission projects, the deployment of hydrogen compressors is also increasing. Therefore, development in the renewable energy & power sector is surging the demand for power generation projects worldwide, thereby boosting the demand for hydrogen compressors.

There is a rise in investments in the renewable energy sector due to increased government initiatives and funding, which promotes the adoption of hydrogen compressors. Per the IEA, global investments in the renewable energy sector reached US$ 358.0 billion in the first six months of 2023, an increase of 22% rise compared to the start of last year and an all-time high for any six months. Renewable energy companies compared to last year, 2022. The venture capital firms and private equity companies are expanding their operations in the renewable energy sector, reaching US$ 10.4 billion in the first quarter of 2023. China accounted for the largest market share in the first quarter of 2023, with investment reaching US$ 177 billion, increased by 16% compared to the first quarter of 2022.

Further, many hydrogen production projects are being launched due to government support and funding. According to the International Energy Agency Organization and McKinsey Report, globally, more than 680 large-scale investment projects announced with investments of US$ 240 billion by 2022. The report estimates that investment is expected to reach US$ 700 billion by 2030 to achieve the net-zero target. Also, investment in building hydrogen fuel stations across the globe is rising, owing to a surge in investments in fuel cell technology by private equity firms and venture capital.

Thus, rising investments in renewable energy and hydrogen generation projects owing to government support and funding are anticipated to create ample opportunity for the market growth in the coming years.

Based on country, the Asia Pacific Hydrogen Compressor Market comprises China, Japan, India, Australia, Indonesia, Singapore, Taiwan, New Zealand, Southeast Asia, South Korea, and the Rest of Asia Pacific. China held the largest share in 2023.

China has become a manufacturing hub in the world with the largest manufacturing output. As per the World Steel Association – AISBL, China was the largest steel-producing country in the world, with 1,032.8 million tonnes of production volume in 2021. Jianglong Group, China Baowu Group, ShaGang Group, and Shougang Group are among the key players in the metal production industry in China, which creates a vast demand for hydrogen fuel. The country is taking initiatives growing initiatives to promote the adoption of green hydrogen in the production of green steel, which is, in turn, bolstering the demand for hydrogen compressors. According to the China Hydrogen Alliance (CHA), China is the world's largest hydrogen producer, with a yearly production of 33 million tons of hydrogen. As per forecasts by the CHA, the country's hydrogen demand is expected to increase significantly in the coming decades. By 2030, China's hydrogen demand is projected to reach 35 million tons, accounting for ~5% of the total energy demand in the country. The burgeoning focus on clean and sustainable energy sources is likely to drive the demand for hydrogen in China in the future. By 2050, China's hydrogen demand is forecasted to reach 90 million tons, supporting ~10% of the country's total energy demand. Such a rise in demand for hydrogen, followed by government initiatives toward hydrogen infrastructure expansion, is anticipated to drive the hydrogen compressor market growth in China in the coming years.

China is house for several industries, including chemicals, automotive, manufacturing, and energy and power, among others. There is a rise in investment in the manufacturing units in the country. According to the Ministry of Commerce in China, the Foreign direct investment (FDI) for the manufacturing sector in China increased by 6.8%, reaching US$ 32.97 billion in the first six months of 2023. Also, the high-tech manufacturing investment in China increased by 19.7% annually. The manufacturing sector requires hydrogen compressors for operating various automatic industrial machines.

The country ranks first in electricity generation, and the government is taking several necessary measures in order to meet all electricity requirements by cities and the industrial sector of China. For instance, in 2022, the State Grid Corporation of China (SGCC) planned to construct 12 electricity transmission lines connecting the hydropower centers and coal production in inland areas. Further, China also plans to build the world's biggest super grid. Such initiatives are promoting the usage of hydrogen compressors among electricians. This factor will boost the hydrogen compressor market growth in the country in the coming years.

Asia Pacific Hydrogen Compressor Market Report Highlights

Report Attribute

Details

Market size in 2023

US$ 843.27 Million

Market Size by 2031

US$ 1,690.71 Million

CAGR (2024 - 2035) 6.2%

Historical Data

2017-2022

Forecast period

2024-2035

Segments Covered

By Type

By Technology

By End User

Regions and Countries Covered

Asia Pacific

Market leaders and key company profiles

Asia Pacific Hydrogen Compressor Market Company Profiles

Some of the key players operating in the market include Atlas Copco AB; Burckhardt Compression AG; Fluitron, Inc; Gardner Denver Nash, LLC; Howden Group; HAUG Sauer Kompressoren AG; NEUMAN & ESSER GsROUP; Hydro-Pac, Inc; Lenhardt & Wagner GmbH; PDC Machines Inc; Sundyne; and Ariel Corporation, among others. These players are adopting various strategies such as expansion, product innovation, and mergers and acquisitions to provide innovative products to their consumers and increase their market share.

The following methodology has been followed for the collection and analysis of data presented in this report:

The research process begins with comprehensive secondary research, utilizing both internal and external sources to gather qualitative and quantitative data for each market. Commonly referenced secondary research sources include, but are not limited to:

Note: All financial data included in the Company Profiles section has been standardized to USD. For companies reporting in other currencies, figures have been converted to USD using the relevant exchange rates for the corresponding year.

The Insight Partners’ conducts a significant number of primary interviews each year with industry stakeholders and experts to validate its data analysis, and gain valuable insights. These research interviews are designed to:

Primary research is conducted via email interactions and telephone interviews, encompassing various markets, categories, segments, and sub-segments across different regions. Participants typically include:

The Asia Pacific Hydrogen Compressor Market is valued at US$ 843.27 Million in 2023, it is projected to reach US$ 1,690.71 Million by 2031.

As per our report Asia Pacific Hydrogen Compressor Market, the market size is valued at US$ 843.27 Million in 2023, projecting it to reach US$ 1,690.71 Million by 2031. This translates to a CAGR of approximately 6.2% during the forecast period.

The Asia Pacific Hydrogen Compressor Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Asia Pacific Hydrogen Compressor Market report:

The Asia Pacific Hydrogen Compressor Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Asia Pacific Hydrogen Compressor Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Asia Pacific Hydrogen Compressor Market value chain can benefit from the information contained in a comprehensive market report.