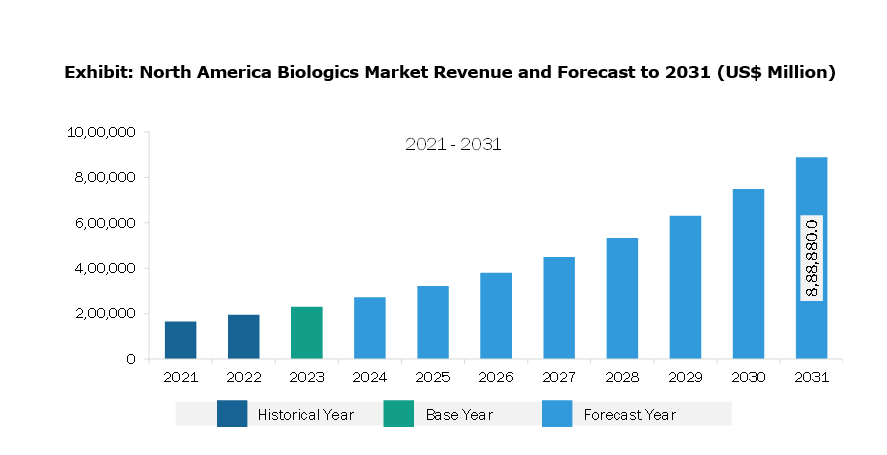

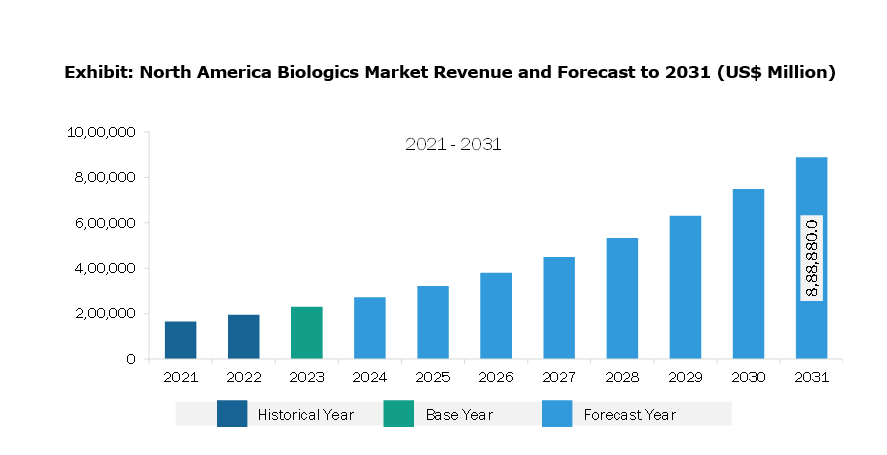

The North America biologics market was valued at US$ 230,256.1 million in 2023 and is expected to reach US$ 888,880.0 million by 2031; it is estimated to register a CAGR of 18.4% from 2023 to 2031.

Increasing Prevalence of Chronic Diseases Fuels North America Biologics Market

According to a study titled "Chronic Disease: A Bio-Logical Approach," published in Ellerston Capital Limited, 41 million people worldwide die from chronic diseases every year, accounting for 74% of all deaths worldwide. Cancer was responsible for almost 10 million deaths in 2020, i.e., 1 in every 6 deaths. According to GLOBOCAN, 19.3 million cancer cases were registered worldwide in 2020, and the number is estimated to rise to 24.6 million by 2030. In addition, the prevalence of autoimmune diseases increases annually by 3-9%. The number of Alzheimer's disease cases is expected to reach 78 million by 2030 and 139 million by 2050. According to the World Health Organization (WHO), every year, ~17 million people across the world succumb to death due to noncommunicable diseases before the age of 70.

Biologics such as antibodies and vaccines offer more targeted treatment because they are designed to interact with the immune system in specific ways to deliver a therapeutic or prophylactic effect. Biological drugs have the promising potential to treat a few chronic autoimmune diseases by blocking the overactive components (proteins in many cases) of the immune system, which damage joints, skin, and other body parts. The treatment of cancer with biologics involves using the body's immune cells to kill cancerous cells; cytokines such as interferons, interleukins, and monoclonal antibodies (mAbs) are the most commonly used biologic therapies employed to treat cancer. Anti-amyloid mAbs have also shown promising therapeutic effects in clinical studies conducted on Alzheimer's disease patients. Chronic diseases such as ulcerative colitis and Crohn's disease include recurring episodes of inflammation of the mucosal layer of the colon. The US Food and Drug Administration has approved a few biological drugs for the treatment of Crohn's disease; these include infliximab, adalimumab, and natalizumab. Further, biological disease-modifying antirheumatic drugs are one of the major approaches to treating rheumatoid arthritis. With the shift in doctors' and patients' preference from conventional to aggressive approaches, the demand for biologics in the treatment of rheumatoid arthritis is also on the rise. Therapeutics use are partially or fully humanized proteins targeting different immune response pathways. Therefore, the increasing prevalence of chronic diseases drives the growth of the biologics market.

North America Biologics Market Overview

North America holds the largest share of the biologics market in terms of revenue. Market growth in this region is attributed to the presence of key biologics manufacturing players and the increasing spending on R and D. According to an article published in the JAMA Network, biologics R and D spending accounted for 37% of total R and D spending in the US. The number of prescriptions written for biologics and investments in the development of targeted drugs are on the rise in the country. Additionally, the approval of several novel biological drugs such as antisense, gene therapy, and RNAi therapeutics is expected to further drive the market growth. As per an article published by the National Center for Biotechnology Information (NCBI), the country recorded historically the highest percentage of biologics approvals in 2022, i.e., 40%, which indicates the stability of biologics in pharmaceutical applications. Moreover, this category of drugs accounts for 30% of the total drug approvals. In May 2024, Biocon Biologics Ltd (BBL) received FDA approval for YESAFILI (aflibercept) as the first biological alternative to Eylea. YESAFILI is a vascular endothelial growth factor (VEGF) inhibitor used to treat several different types of ophthalmology conditions.

North America Biologics Market Revenue and Forecast to 2031 (US$ Million)

North America Biologics Market Segmentation

The North America biologics market is categorized into product, application, source, manufacturing, and country.

Based on product, the North America biologics market is segmented into monoclonal antibodies, vaccine, recombinant hormones/proteins, cell and gene therapy, and others. The monoclonal antibodies segment held the largest market share in 2023.

In terms of application, the North America biologics market is categorized into cancer, infectious diseases, autoimmune diseases, and others. The cancer segment held the largest market share in 2023.

By source, the North America biologics market is bifurcated into mammalian and microbial. The mammalian segment held a larger market share in 2023.

Based on manufacturing, the North America biologics market is bifurcated into outsourced and in-house. The outsourced segment held a larger market share in 2023.

In terms of country, the North America biologics market is segmented into the US, Canada, and Mexico. The US dominated the North America biologics market share in 2023.

AbbVie Inc, Pfizer Inc, Samsung Biologics Co Ltd, ADMA Biologics, Inc., Wuxi Biologics Inc, Catalent Inc, AGC Biologics AS, AstraZeneca Plc, Amgen Inc, Nitto Avecia, and Quality Assistance s.a. are some of the leading companies operating in the North America biologics market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 230,256.1 Million |

| Market Size by 2031 | US$ 888,880.0 Million |

| CAGR (2023 - 2031) | 18.4% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

North America

|

| Market leaders and key company profiles |

|

The North America Biologics Market is valued at US$ 230,256.1 Million in 2023, it is projected to reach US$ 888,880.0 Million by 2031.

As per our report North America Biologics Market, the market size is valued at US$ 230,256.1 Million in 2023, projecting it to reach US$ 888,880.0 Million by 2031. This translates to a CAGR of approximately 18.4% during the forecast period.

The North America Biologics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the North America Biologics Market report:

The North America Biologics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The North America Biologics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the North America Biologics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)