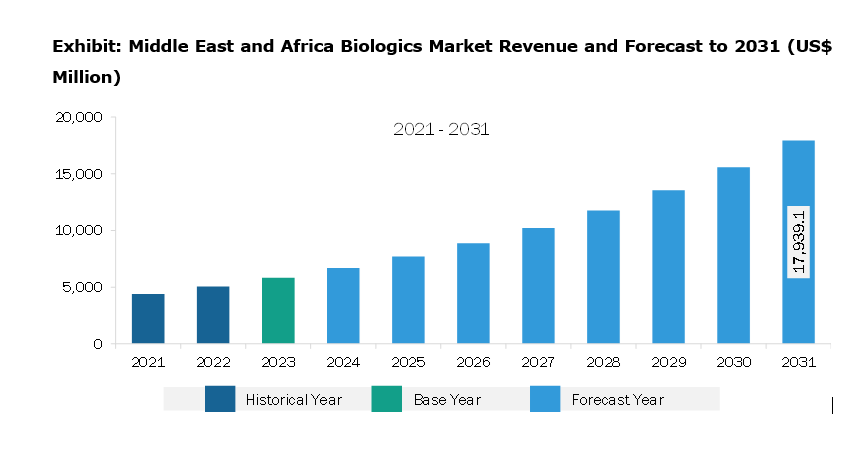

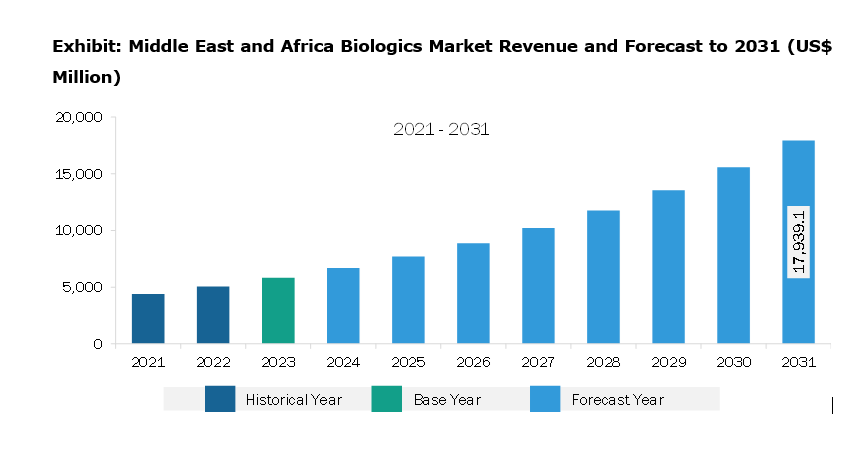

The Middle East & Africa biologics market was valued at US$ 5,818.6 million in 2023 and is expected to reach US$ 17,939.1 million by 2031; it is estimated to register a CAGR of 15.1% from 2023 to 2031.

Strategic Initiatives by Companies Bolster Middle East & Africa Biologics Market

Companies operating in the biologics market focus on strategic developments such as expansions, partnerships, agreements, collaborations, and new product launches, which help them improve their sales, expand their geographic reach, and enhance their capacities to cater to a larger than existing customer base. A few of the noteworthy developments in the biologics market are mentioned below.

Middle East & Africa Biologics Market Overview

The biologics market in the Middle East & Africa is segmented into the UAE, Saudi Arabia, South Africa, and the Rest of the Middle East & Africa. The market is driven by research projects undertaken by several research institutes and the availability of infrastructure as well as facilities to support high-tech work in healthcare in the UAE and Saudi Arabia. Support by governments in these countries owing to the increasing incidence of genetic disorders and cancer also boosts the growth of the market. Healthcare facilities and infrastructure in South Africa are undergoing significant developments, which is likely to fuel the adoption of advanced technologies for the diagnosis of various conditions in a large patient population, facilitating the early commencement of effective treatment. Pharmaceutical companies from other countries are forming strategic partnerships and collaborations with local healthcare providers and research institutions to expand their presence in South Africa, which further favors the growth of the biologics market in the country.

Middle East & Africa Biologics Market Revenue and Forecast to 2031 (US$ Million)

Middle East & Africa Biologics Market Segmentation

The Middle East & Africa biologics market is categorized into product, application, source, manufacturing, and country.

Based on product, the Middle East & Africa biologics market is segmented into monoclonal antibodies, vaccine, recombinant hormones/proteins, cell and gene therapy, and others. The monoclonal antibodies segment held the largest market share in 2023.

In terms of application, the Middle East & Africa biologics market is categorized into cancer, infectious diseases, autoimmune diseases, and others. The cancer segment held the largest market share in 2023.

By source, the Middle East & Africa biologics market is bifurcated into mammalian and microbial. The mammalian segment held a larger market share in 2023.

Based on manufacturing, the Middle East & Africa biologics market is bifurcated into outsourced and in-house. The outsourced segment held a larger market share in 2023.

In terms of country, the Middle East & Africa biologics market is segmented into South Africa, Saudi Arabia, the UAE, and the Rest of Middle East & Africa. South Africa dominated the Middle East & Africa biologics market share in 2023.

AbbVie Inc; Pfizer Inc; Samsung Biologics Co Ltd; ADMA Biologics, Inc.; Wuxi Biologics Inc; Catalent Inc; AGC Biologics AS; AstraZeneca Plc; Amgen Inc; Nitto Avecia; and Quality Assistance s.a. are some of the leading companies operating in the Middle East & Africa biologics market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 5,818.6 Million |

| Market Size by 2031 | US$ 17,939.1 Million |

| CAGR (2023 - 2031) | 15.1% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Product

|

| Regions and Countries Covered |

Middle East & Africa

|

| Market leaders and key company profiles |

|

The Middle East & Africa Biologics Market is valued at US$ 5,818.6 Million in 2023, it is projected to reach US$ 17,939.1 Million by 2031.

As per our report Middle East & Africa Biologics Market, the market size is valued at US$ 5,818.6 Million in 2023, projecting it to reach US$ 17,939.1 Million by 2031. This translates to a CAGR of approximately 15.1% during the forecast period.

The Middle East & Africa Biologics Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Biologics Market report:

The Middle East & Africa Biologics Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Biologics Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Biologics Market value chain can benefit from the information contained in a comprehensive market report.

Please tell us your area of interest

(Market Segments/ Regions and Countries/ Companies)