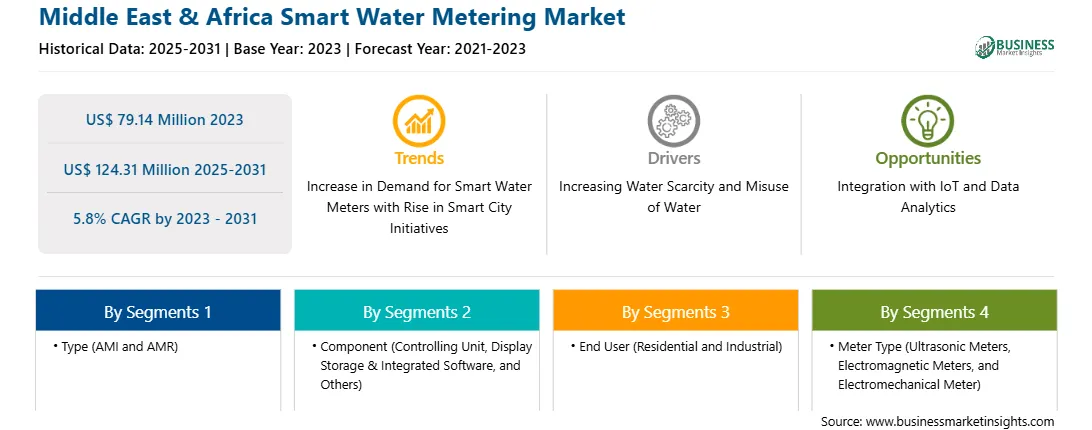

The Middle East & Africa smart water metering market was valued at US$ 79.14 million in 2023 and is expected to reach US$ 124.31 million by 2031; it is estimated to register a CAGR of 5.8% from 2023 to 2031.

Water supply systems are one of the most crucial systems. With the increasing population, it is inevitably anticipated that the demand for water consumption will increase exponentially. A city's water distribution channel and management systems are required to be viable over a longer period to maintain consistent growth. They should be integrated with technologies that can monitor and check water loss issues. Various developed and developing nations across the world are witnessing a paradigm shift to smart cities. The governments of various countries are adopting the momentum of smart cities, thereby investing in the development of internet infrastructure in the countries with an aim to bring robust urbanization. The demand for smart water meters is anticipated to witness exponential growth in these smart cities as the smart city initiatives majorly focus on the energy sector. The water utilities in all countries cater to energy sectors as the energy generation sector is one of the prominent consumers of water. Thus, the rising number of smart city projects is expected to create new trends in the smart water metering market during the forecast period.

The Middle East & Africa is known to be a region with two halves of economies. The Gulf countries are economically developed countries, whereas African countries are yet to match up to the economic conditions of the Gulf countries and lag far behind. Poor economy and access to poor internet connectivity are among the major reasons for low smart water meter technological trials and rollouts in the region. As developed nations in the Middle East, Saudi Arabia and the UAE move ahead with smart water meter implementation plans, while countries in Africa are eyeing to catch up with modern technologies. The Middle East & Africa are the most water-stressed regions in the world. The region receives scanty rainfall annually. Accelerated desertification, burgeoning population of the region, irrigation and climate change consequences add to the pressures on the already scanty water resources of the region. As per the statistics of the World Bank, the Middle East & Africa comprise 6% of the total world population, and the region has access to only 1.5% of the renewable freshwater supply through total rainfall across the world. A high percentage of water used for irrigation has resulted in extremely low volumes of water available for individual consumption.

Water scarcity issues have sent alarming signals to many Middle Eastern & African countries in the past, and a few of them are taking initiatives against those warnings. As far as the investments in smart water meters are concerned in the region, in May 2022 the Ministry of Ghana signed a deal with Danish smart water meter player Kamstrup. The Ministry of Water and Sanitation in Ghana signed a Memorandum of Understanding (MoU) with the company for provisioning 500,000 smart water meters along with a system that would enable remote meter reading to address the water scarcity issue in the country. Also, the Dubai Electricity and Water Authority (DEWA) has awarded a project for water supply monitoring to achieve better efficiencies as a part of the Smart Dubai Initiative. DEWA has logged a rise in the smart water meter numbers by 73.6% between 2018 and 2022. This increase in the number of smart meters has gone up from 566,214 meters in August 2018 to 983,185 meters in August 2022. Smart water meters are designed as the highest technical standards. As per an official of DEWA, smart meters are considered as a backbone of the smart grid, and an important pillar in the race of digital transformation. DEWA has over 2 million smart water and electricity meters in Dubai. In Bahrain, the Electricity and Water Authority has installed 53,000 new power and water meters and plans to deploy them across entire properties in the country over one and a half years. DIEHL Metering, Itron, and Kamstrup lead the deployment scenario for smart water meters in the Middle East & Africa. For smart water meter systems to prosper in any region, the laid-out internet infrastructure also needs to be fast and robust. In December 2021, Kamstrup received a Sharjah Electricity & Water Authority's (SEWA) project in Maysaloon. This contract states the demand for 2,519 connections to be fitted with a new metering system. The meters are equipped with an in-built wireless M-bus communication system. With the help of the automatic meter reading solution of Kamstrup, SEWA aims to enhance operational efficiency and boost service levels for its end users. Moreover, in Oman, the Public Authority for Water (Diam) connected smart water meters in Musandam and Muscat to its network through IoT technology in December 2020. The smart meters project is projected to help lower water losses in Muscat by a minimum of 20%, which will save nearly US$ 109 million. Approximately 184,400 meters were installed, of which 1,000 were prepaid meters, and the remaining were postpaid meters such steps for deploying smart water meters would contribute to reducing water scarcity issues in the Middle East & Africa, boosting the smart water metering market growth in the Middle East & Africa.

Strategic insights for the Middle East & Africa Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the Middle East & Africa Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.Middle East & Africa Smart Water Metering Strategic Insights

Middle East & Africa Smart Water Metering Report Scope

Report Attribute

Details

Market size in 2023

US$ 79.14 Million

Market Size by 2031

US$ 124.31 Million

CAGR (2023 - 2031) 5.8%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Component

By End User

By Meter Type

Regions and Countries Covered

Middle East and Africa

Market leaders and key company profiles

Middle East & Africa Smart Water Metering Regional Insights

The Middle East & Africa smart water metering market is categorized into type, component, end user, meter type, and country.

Based on type, the Middle East & Africa smart water metering market is bifurcated into AMI and AMR. The AMR segment held a larger market share in 2023.

In terms of component, the Middle East & Africa smart water metering market is categorized into controlling unit, display storage & integrated software, and others. The display storage & integrated software segment held the largest market share in 2023.

By end user, the Middle East & Africa smart water metering market is bifurcated into residential and industrial. The residential segment held a larger market share in 2023.

Based on meter type, the Middle East & Africa smart water metering market is categorized into ultrasonic meters, electromagnetic meters, and electromechanical meter. The ultrasonic meters segment held the largest market share in 2023.

By country, the Middle East & Africa smart water metering market is segmented into South Africa, Saudi Arabia, Egypt, the UAE, West Africa, and the Rest of Middle East & Africa. Saudi Arabia dominated the Middle East & Africa smart water metering market share in 2023.

Kamstrup AS, Mueller Water Products Inc, Badger Meter Inc, Itron Inc, Arad Ltd, Sensus USA Inc, WAVIoT Integrated Systems LLC, and Diehl Stiftung & Co KG., are among the leading companies operating in the Middle East & Africa smart water metering market.

The Middle East & Africa Smart Water Metering Market is valued at US$ 79.14 Million in 2023, it is projected to reach US$ 124.31 Million by 2031.

As per our report Middle East & Africa Smart Water Metering Market, the market size is valued at US$ 79.14 Million in 2023, projecting it to reach US$ 124.31 Million by 2031. This translates to a CAGR of approximately 5.8% during the forecast period.

The Middle East & Africa Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Middle East & Africa Smart Water Metering Market report:

The Middle East & Africa Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Middle East & Africa Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Middle East & Africa Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.