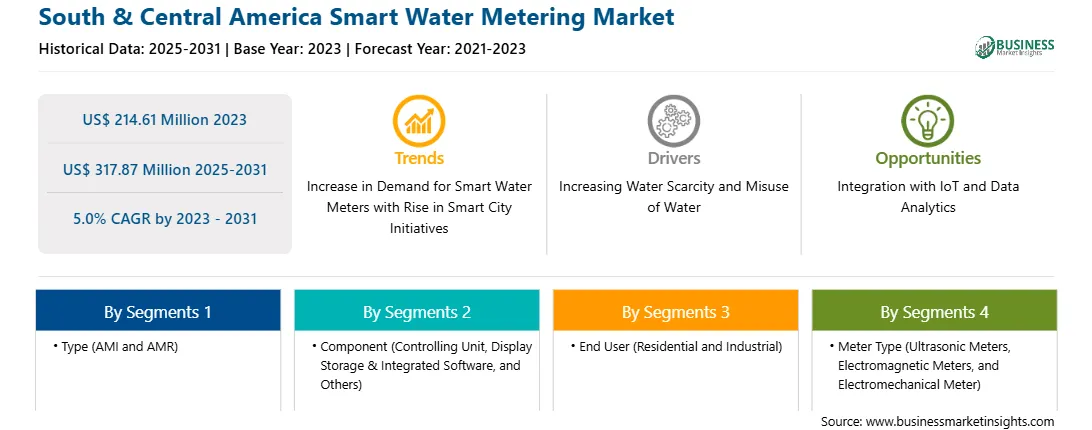

The South & Central America smart water metering market was valued at US$ 214.61 million in 2023 and is expected to reach US$ 317.87 million by 2031; it is estimated to register a CAGR of 5.0% from 2023 to 2031.

The integration of smart water meters with the Internet of Things (IoT) and advanced data analytics platforms presents a significant opportunity for the growth of the smart water metering market. IoT-enabled smart meters collect real-time data on water usage, providing utilities with immediate insights into consumption patterns, system performance, and potential issues such as leaks or irregular usage. This seamless connectivity allows for remote monitoring, eliminating the need for manual meter readings and enabling more efficient management of water resources. Data analytics platforms enhance the value of this integration by processing the vast amounts of data generated by smart meters. These platforms can identify trends, forecast demand, detect anomalies, and optimize water distribution in real-time. For example, utilities can use predictive analytics to proactively address maintenance needs, reducing downtime and preventing costly repairs. Additionally, consumers can access personalized usage data through apps or online portals, empowering them to make informed decisions about water conservation and potentially lower their utility bills. This integration not only improves the operational efficiency of utilities but also promotes transparency and accountability. It offers a more sustainable approach to water management by reducing waste, enhancing resource allocation, and increasing customer satisfaction. As IoT and data analytics technologies continue to evolve, their role in optimizing smart water metering systems will become increasingly crucial in modern water management strategies.

The recent technological developments have had a direct impact on the economy of Brazil. A recent study says that due to the changing economic condition in South America, government enterprises, businesses, and consumers in the region are keen to implement and incorporate the upcoming technologies. The cost-savings advantage and higher work efficiency achieved are cited as the major attractive points in the region. Large infrastructural developments in South America have resulted in the growth of commercial complexes, shopping malls, hospitals, educational institutions, universities, and government offices. Universal supply of water is one of the most daunting challenges faced by the cities in South America, especially rural cities. Water basins, infrastructure, supply networks, and hydrology are among the critical aspects of proper water supply management. Almost 60% of the water is lost every year due to various reasons in the region. Less than half of the South American cities have proper water infrastructure to meet the demand for water in urban areas. The nonrevenue water in the region amounts to 40% of the total water supplied, which is another major issue faced by the water utilities. The growth in demand for water exposes the weakness of countries in the region in managing their water resources. In some countries, the immediate need to increase the water supply leaves no other option for political and industrial leaders but to invest in seawater desalination treatment plants.

The recent internet revolution in South America has accelerated growth in internet technologies. Several initiatives are being taken in South American countries for the rollout of smart water meter systems. Major public–private partnerships are being established by water utilities and municipal corporations operating in the region. Smart water meter is expected to be the enabling connectivity architecture between the consumers and water utility bodies. Telefonica, Huawei, and Kamstrup have successfully deployed smart water pilot project in Chile. It is the first instance in South America to combine real user data with NB-IoT. The project involves a telemetry solution for remote monitoring and management of domestic water meters. Itron, Zenner, Landis+Gyr, Kamstrup, and Sensus are among the leading players in the smart water metering market in South America. The players are contributing to market growth across the region.

Strategic insights for the South & Central America Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market. The geographic scope of the South & Central America Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.South & Central America Smart Water Metering Strategic Insights

South & Central America Smart Water Metering Report Scope

Report Attribute

Details

Market size in 2023

US$ 214.61 Million

Market Size by 2031

US$ 317.87 Million

CAGR (2023 - 2031) 5.0%

Historical Data

2021-2023

Forecast period

2025-2031

Segments Covered

By Type

By Component

By End User

By Meter Type

Regions and Countries Covered

South and Central America

Market leaders and key company profiles

South & Central America Smart Water Metering Regional Insights

The South & Central America smart water metering market is categorized into type, component, end user, meter type, and country.

Based on type, the South & Central America smart water metering market is bifurcated into AMI and AMR. The AMR segment held a larger market share in 2023.

In terms of component, the South & Central America smart water metering market is categorized into controlling unit, display storage & integrated software, and others. The display storage & integrated software segment held the largest market share in 2023.

By end user, the South & Central America smart water metering market is bifurcated into residential and industrial. The residential segment held a larger market share in 2023.

Based on meter type, the South & Central America smart water metering market is categorized into ultrasonic meters, electromagnetic meters, and electromechanical meter. The ultrasonic meters segment held the largest market share in 2023.

By country, the South & Central America smart water metering market is segmented into Brazil, Argentina, and the Rest of South & Central America. Brazil dominated the South & Central America smart water metering market share in 2023.

Kamstrup AS, Mueller Water Products Inc, Badger Meter Inc, Itron Inc, Arad Ltd, Sensus USA Inc, WAVIoT Integrated Systems LLC, and Diehl Stiftung & Co KG., are among the leading companies operating in the South & Central America smart water metering market.

The South & Central America Smart Water Metering Market is valued at US$ 214.61 Million in 2023, it is projected to reach US$ 317.87 Million by 2031.

As per our report South & Central America Smart Water Metering Market, the market size is valued at US$ 214.61 Million in 2023, projecting it to reach US$ 317.87 Million by 2031. This translates to a CAGR of approximately 5.0% during the forecast period.

The South & Central America Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the South & Central America Smart Water Metering Market report:

The South & Central America Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The South & Central America Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the South & Central America Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.