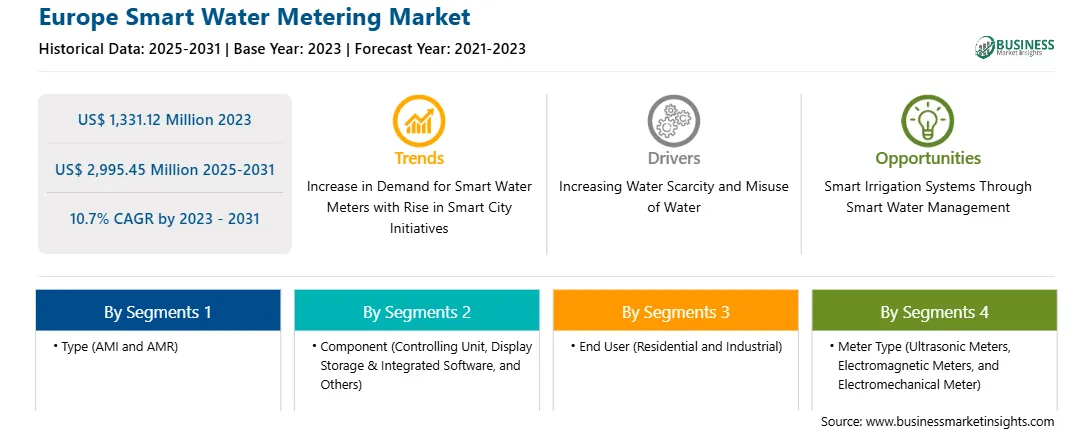

The Europe smart water metering market was valued at US$ 1,331.12 million in 2023 and is expected to reach US$ 2,995.45 million by 2031; it is estimated to register a CAGR of 10.7% from 2023 to 2031.

Nonrevenue water is the discrepancy between the amount of water produced and the amount of water billed to customers. Water loss from source to destination occurs due to various reasons, including leaks (physical loss) and metering mistakes, manipulation, and theft (apparent losses). The NRW is increasing at an exponential rate, resulting in water scarcity and other concerns. According to recent research by the International Water Association (IWA), global water waste is around 346 million cubic meters per day or 126 billion cubic meters per year in water distribution networks on their way to customers. The requirement to troubleshoot nonrevenue water has resulted in the need for the development of several technologies, such as smart water meters, which are generally approved by various governments. Smart water meter records hourly data on leaks or losses, as well as the time and date of occurrence. The system also enables the operator to review obtained data on-site or from any platform. Many smart water meters include alarms to reduce the likelihood of pipeline theft or manipulation. These warning systems help generate income from the end users' location. The increasing demand to monitor, control, and reduce nonrevenue water is driving companies in industry to innovate and design robust technologies, which is driving smart water metering market growth.

The Europe smart water metering market is segmented into France, Germany, Italy, Russia, the UK, and the Rest of Europe. Mega cities in the UK, Germany, and France are the nodes of smart water meter growth that encourage the adoption of this technology in the region. Nonrevenue water in Europe accounts for an average of 26% of total water across European utilities. Along with increasing measures toward nonrevenue water reduction, there is a growing demand for the efficient use of water resources. Therefore, a significant amount of nonrevenue water demands advanced metering systems to manage revenues across other water usages. Advanced water metering technology provides user-friendly command control systems, integrated billing technology, secure web-based payments, and online consumer applications, which boost customers toward adopting smart water meter products. The Landis+Gyr launched the latest addition of ultrasonic smart water meters—W270 and W370—based on IoT technologies in November 2021. In accordance with the Landis+Gyr Green Design principles, the new portfolio is 100% recyclable after its extensive lifetime of over 15 years. The latest software and hardware solutions for electricity, gas, heat, and water metering were also presented.

In August 2020, the German government planned to measure the number of smart metering systems in use in households and businesses by 2025. This new digital strategy is divided into fields of action such as "networked and digitally sovereign society" or "innovative economy, working world, science, and research." Furthermore, due to the introduction of the smart city concept in Spain, intelligent water meter infrastructure has been adopted to improve urban water supply planning and management in the country. In July 2021, Global Omnium, which engages in integral water cycle management, signed an agreement with Telefónica IoT & Big Data Tech for the installation of over 150,000 SIM cards embedded with NB-IoT technology and to enhance further the data communication power of 450,000 domestic and industrial smart water meters across Spain. Decreasing sensor costs and improving sensor technologies encourage governments to plan smart cities to achieve high operational efficiencies in using scarce resources such as water, electricity, and gas in Europe. Moreover, key players functioning across the Europe smart water metering market are Diehl Metering, Badger Meter, Apator SA, Siemens, Kampstrup, Itron, and Sontex SA. Moreover, various players across the region are partnering to bring smart water meters to the region. For example, in April 2024, SUEZ and Vodafone, a global provider of communication technologies and services, announced that they were joining forces to accelerate the global rollout of remote water meters reading via Narrowband IoT (NB-IoT1) communication networks. The aim is to bring over 2 million NB-IoT meters into service by 2030. Such instances drive the growth of the market across Europe.

Strategic insights for the Europe Smart Water Metering provides data-driven analysis of the industry landscape, including current trends, key players, and regional nuances. These insights offer actionable recommendations, enabling readers to differentiate themselves from competitors by identifying untapped segments or developing unique value propositions. Leveraging data analytics, these insights help industry players anticipate the market shifts, whether investors, manufacturers, or other stakeholders. A future-oriented perspective is essential, helping stakeholders anticipate market shifts and position themselves for long-term success in this dynamic region. Ultimately, effective strategic insights empower readers to make informed decisions that drive profitability and achieve their business objectives within the market.

| Report Attribute | Details |

|---|---|

| Market size in 2023 | US$ 1,331.12 Million |

| Market Size by 2031 | US$ 2,995.45 Million |

| CAGR (2023 - 2031) | 10.7% |

| Historical Data | 2021-2023 |

| Forecast period | 2025-2031 |

| Segments Covered |

By Type

|

| Regions and Countries Covered | Europe

|

| Market leaders and key company profiles |

|

The geographic scope of the Europe Smart Water Metering refers to the specific areas in which a business operates and competes. Understanding local distinctions, such as diverse consumer preferences (e.g., demand for specific plug types or battery backup durations), varying economic conditions, and regulatory environments, is crucial for tailoring strategies to specific markets. Businesses can expand their reach by identifying underserved areas or adapting their offerings to meet local demands. A clear market focus allows for more effective resource allocation, targeted marketing campaigns, and better positioning against local competitors, ultimately driving growth in those targeted areas.

The Europe smart water metering market is categorized into type, component, end user, meter type, and country.

Based on type, the Europe smart water metering market is bifurcated into AMI and AMR. The AMR segment held a larger market share in 2023.

In terms of component, the Europe smart water metering market is categorized into controlling unit, display storage & integrated software, and others. The display storage & integrated software segment held the largest market share in 2023.

By end user, the Europe smart water metering market is bifurcated into residential and industrial. The residential segment held a larger market share in 2023.

Based on meter type, the Europe smart water metering market is categorized into ultrasonic meters, electromagnetic meters, and electromechanical meter. The ultrasonic meters segment held the largest market share in 2023.

By country, the Europe smart water metering market is segmented into Germany, France, Italy, the UK, Russia, Spain, Greece, and the Rest of Europe. France dominated the Europe smart water metering market share in 2023.

Kamstrup AS, Mueller Water Products Inc, Badger Meter Inc, Itron Inc, Arad Ltd, Sensus USA Inc, WAVIoT Integrated Systems LLC, Bmeters SRL, and Diehl Stiftung & Co KG., are among the leading companies operating in the Europe smart water metering market.

The Europe Smart Water Metering Market is valued at US$ 1,331.12 Million in 2023, it is projected to reach US$ 2,995.45 Million by 2031.

As per our report Europe Smart Water Metering Market, the market size is valued at US$ 1,331.12 Million in 2023, projecting it to reach US$ 2,995.45 Million by 2031. This translates to a CAGR of approximately 10.7% during the forecast period.

The Europe Smart Water Metering Market report typically cover these key segments-

The historic period, base year, and forecast period can vary slightly depending on the specific market research report. However, for the Europe Smart Water Metering Market report:

The Europe Smart Water Metering Market is populated by several key players, each contributing to its growth and innovation. Some of the major players include:

The Europe Smart Water Metering Market report is valuable for diverse stakeholders, including:

Essentially, anyone involved in or considering involvement in the Europe Smart Water Metering Market value chain can benefit from the information contained in a comprehensive market report.